Shiba Inu price is due for a 30% recovery rally

- SHIB price has strong Fibonacci targets well above 30%.

- Shiba Inu price has moving averages coinciding with higher targets.

- Invalidation is a breach at the swing low at $0.00001704.

Shiba Inu price gives reason to believe in a 30% countertrend rally at a minimum. The invalidation level lies 15% below $0.00001704.

Shiba Inu price to rally soon

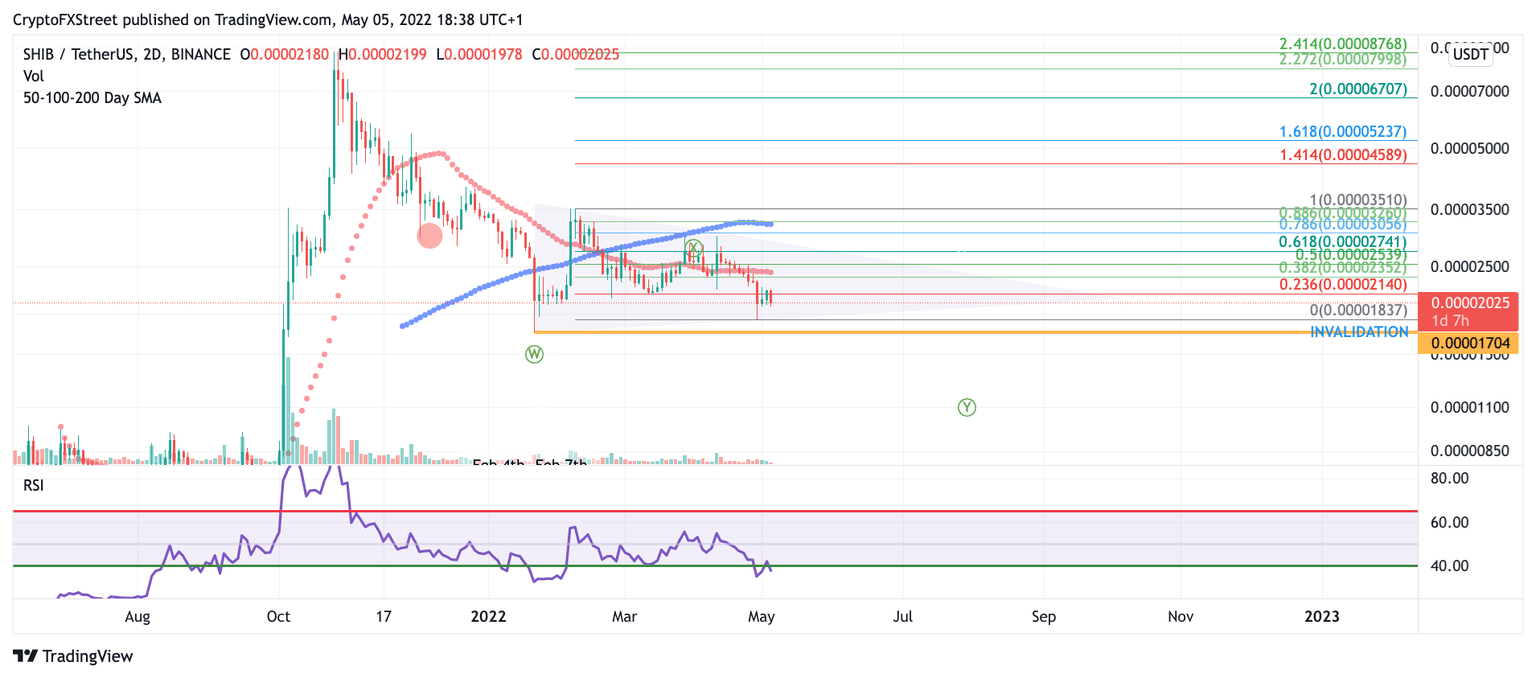

Shiba Inu price has produced choppy sideways price action for over one year. Erratic swings accompanied with puzzling price action spells for a triangle formation. A Fibonacci retracement level surrounding the prior swing high to swing low also has a strong 61.8% target marked at $0.00002741, which would result in a 36% increase from the current SHIB price of $0.00002020.

Shiba Inu price also has significant 50- and 100-day moving averages that coincide with the higher Fibonacci targets. Because of the bears' overall choppy price action and tapering volume, the current year-long downtrend is deemed a corrective structure due to an impulsive rally to balance out the wave structure.

SHIB/USDT 2-Day Chart

Invalidation of the uptrend scenario will be a breach of the swing low at $0.00001704. If the bears can reach this level, the SHIB price could continue falling to %$0.00001377, resulting in a 30% decrease from the current Shiba Inu price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.