Shiba Inu price pumps and dumps after Robinhood listing; here’s where SHIB will go next

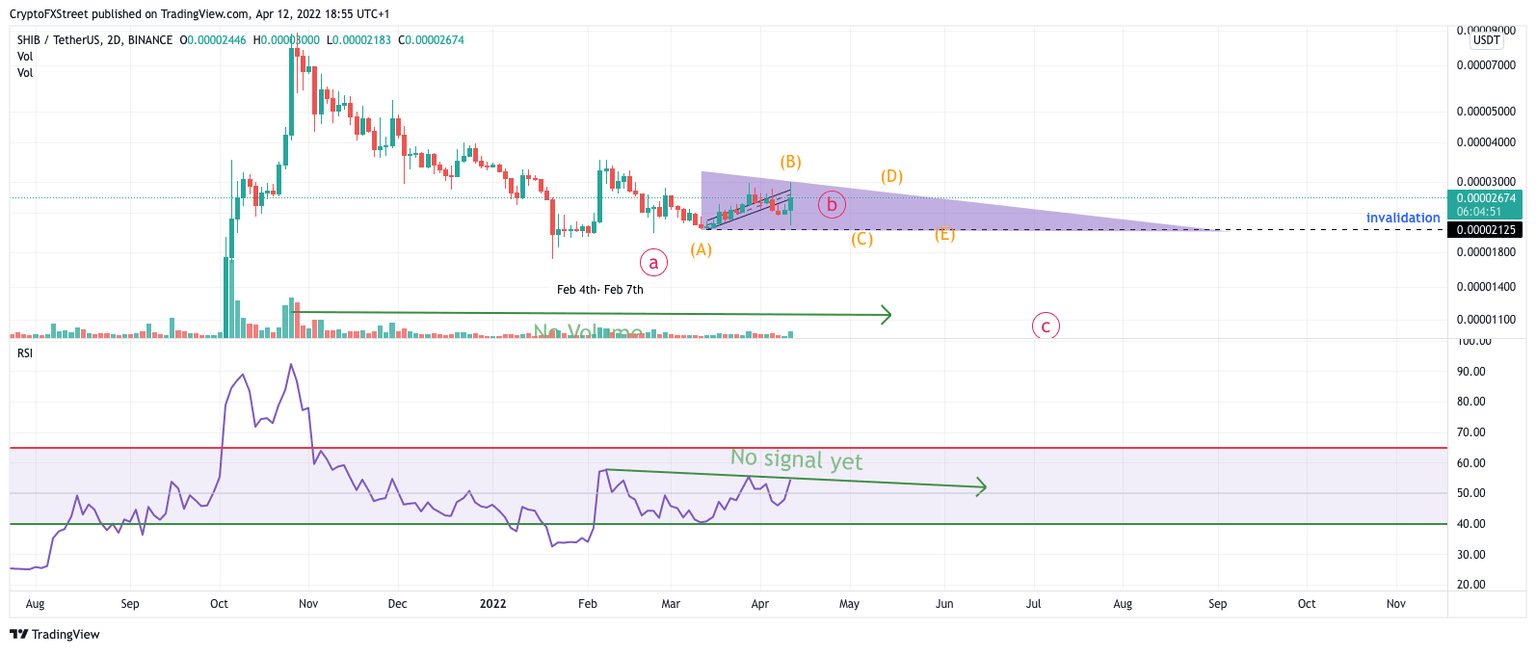

- Shiba Inu price erratic behavior spells for a range-bound triangle formation.

- SHIB price volume is still meager and unconvincing.

- Invalidation of the no-trade zone is a break below $0.000002125.

Shiba Inu price fools traders on both sides amidst Robinhood listing. SHIB price is likely to experience choppy range-bound price action in the coming weeks.

Shiba Inu price will continue to play choppy games

Shiba Inu price erratic behavior following the Robinhood listing has forced analysts to revise their outlook on the popular meme coin. The SHIB price invalidated last week’s bullish count today by tagging lows at $0.0002262 before running back up 30% to snag liquidity in the upper levels at $0.00002740. Such volatile behavior with a lack of distinguishable chart patterns spells for a long-term range being put in play.

From a macro perspective, Shiba Inu price is in a long-term consolidation following the massive $1,000% rally in 2021. The volatile price fluctuations could be market makers’ attempt to entice traders to open a position on the digital asset. However, the volume profile has insufficient evidence to project a directional bias. The Relative Strength Index also displays a lack of confluence for the trend in either direction.

Traders should wait for more evidence from the 2-day and weekly charts to depict when the B wave of the forming triangle is finished. Because C waves within triangles are generally complex and time-consuming, analysts have deemed the SHIB price as range bound and unfavorable until further notice.

SHIB/USDT 2-Day Chart

Invalidation of the no-trade zone will be a bearish engulfing candle closing under $0.00002125. If this were to occur, analysts would look to short Shiba Inu price to $0.00001250, resulting in a 60% dip from the current price.

Author

FXStreet Team

FXStreet