Shiba Inu price hits $0.000010 turning nearly 485,000 SHIB holders profitable

- Shiba Inu price climbed to $0.000010, eating a zero and crossing into a crucial demand zone for SHIB.

- SHIB price could zoom past the resistance at $0.000011 and climb to $0.000014.

- Shiba Inu supply on exchanges remains relatively low, supporting SHIB price gains.

Shiba Inu price climbed to $0.000010, dropping a zero in its price this week. The meme coin’s recent move has turned over 22% SHIB holders profitable. At the current price level, wallet addresses holding 134.63 trillion SHIB are profitable.

Shiba Inu’s on-chain metrics support the meme coin’s recent gains.

Also read: Bitcoin price rallies to $44,000 as Spot BTC ETF deadline looms

Shiba Inu on-chain metrics signal bullish outlook on SHIB

- On-chain data from crypto intelligence tracker Santiment reveals bullish signs for SHIB price.

- SHIB supply on exchanges is currently 7.84% of the asset’s total supply, according to Santiment data.

- The meme coin’s supply remains relatively low, ensuring that SHIB does not face intense selling pressure that pushes the asset’s price down.

- Shiba Inu price is $0.00001039 at the time of writing.

Shiba Inu supply on exchanges. Source: Santiment

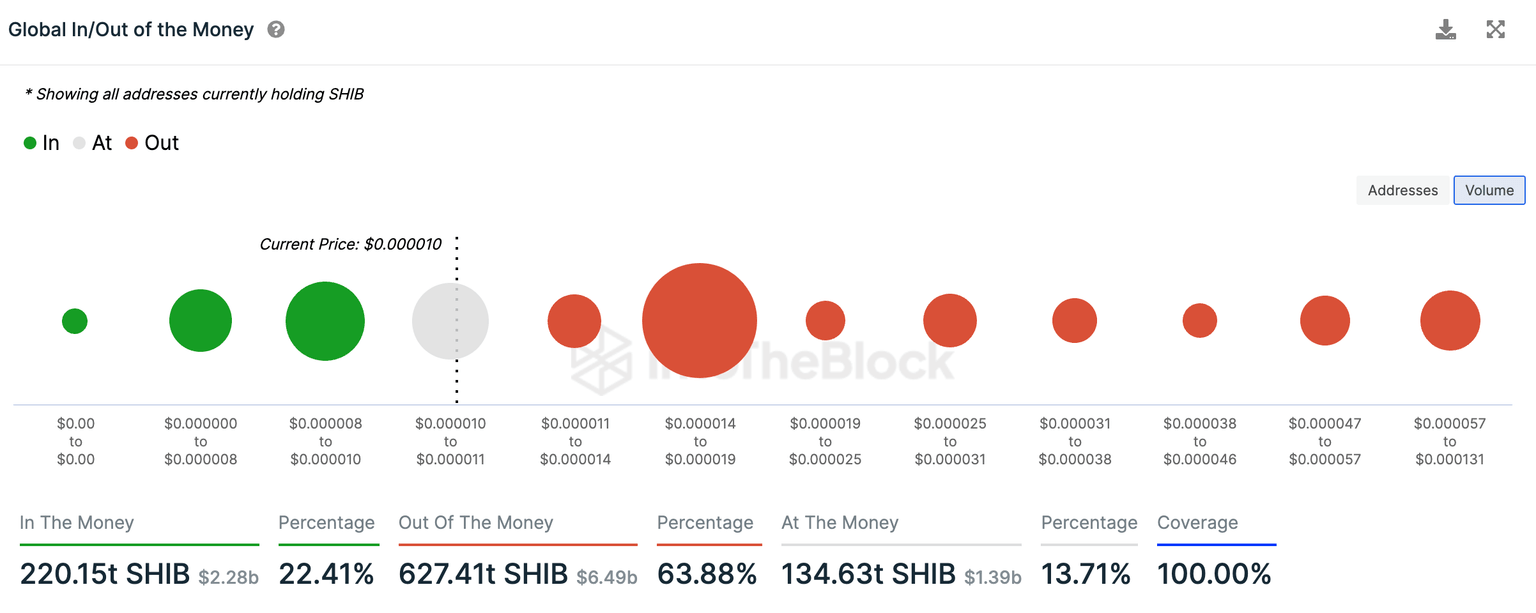

- Shiba Inu price is in a critical demand zone where 89,360 wallet addresses accumulated 134.63 trillion SHIB tokens. Once SHIB price crosses the upper boundary of the zone at $0.000011, the path to $0.000014 is likely clear for the meme coin, as seen in the Global In/Out of the Money chart below.

Global In/Out of the Money. Source: IntoTheBlock

Shiba Inu price outlook is bullish on high time frames

Crypto analyst behind the Twitter handle @Mangyek0, predicts a rally in Shiba Inu price. The analyst comments on Shiba Inu’s price rally compared to other meme coins in the crypto ecosystem.

One of these days, most probably during holidays, $SHIB is gonna pump so hard we might forget about other meme coins for a minute.

— MAXPAIN (@Mangyek0) December 21, 2023

Or it won't

- 483-day trend line breached on weekly, ready to shoot. #ShibaInu pic.twitter.com/5FmboqqTb6

At the time of writing, Shiba Inu price yielded nearly 2% daily and nearly 6% weekly gains for holders.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B16.19.02%2C%252021%2520Dec%2C%25202023%5D-638387545096168105.png&w=1536&q=95)