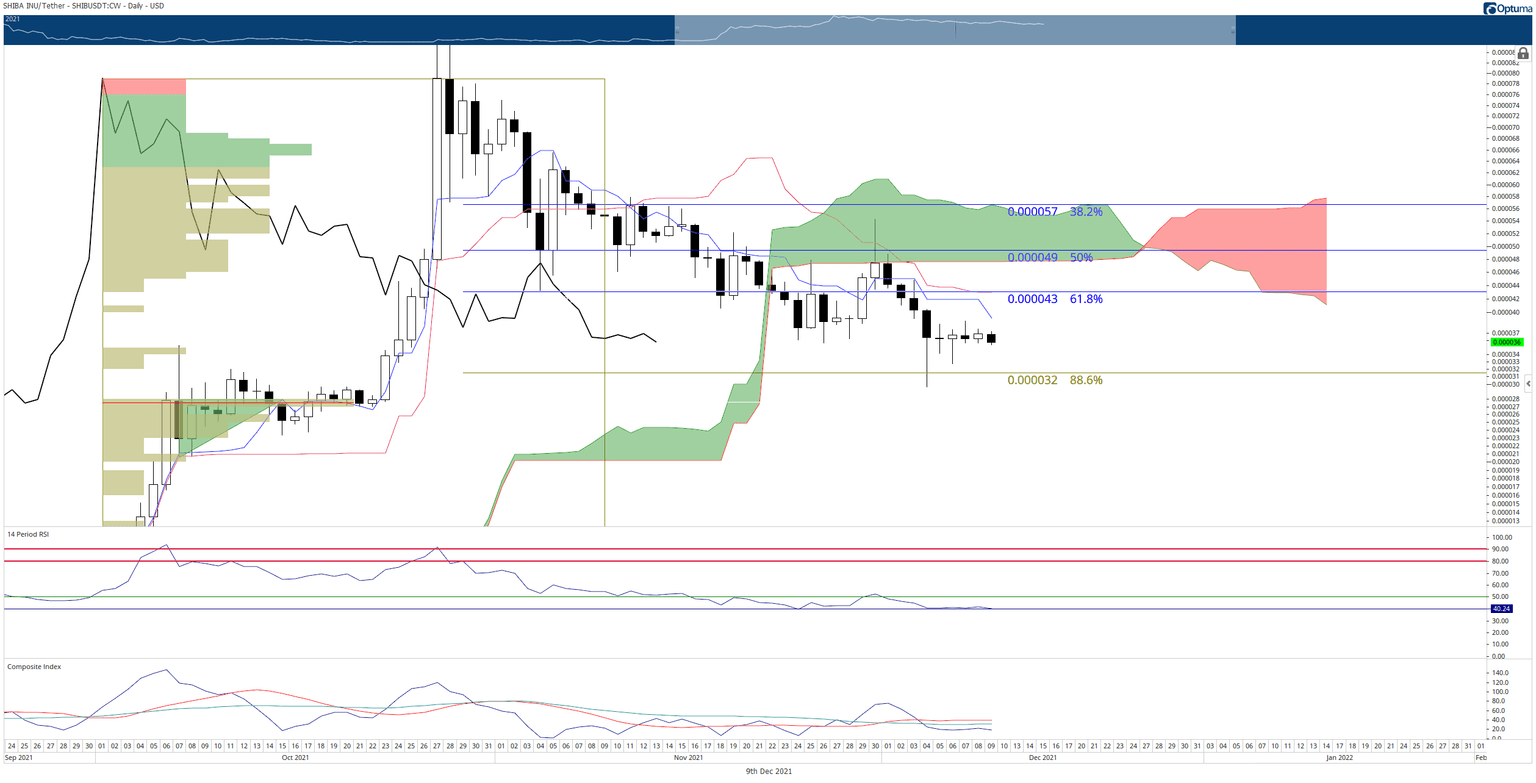

Shiba Inu buyers disappear as SHIB falls towards $0.00003

- Shiba Inu price consolidates after the initial rally from the flash-crash wanes.

- The final oversold level in the RSI continues to be tested.

- Volume begins to dry up, adding a likelihood that SHIBA pushes further south.

Shiba Inu price has been mostly unchanged since Sunday. The bodies of the past four daily candlesticks have been stuck between $0.000036 and $0.000037. SHIBA is in its fifth straight day of lower trade volume.

Shiba Inu price sees buying participation dry up

Shiba Inu price is in a dire state. The consecutive number of days of one trading day’s volume lower than the next is now five. Furthermore, the volume over the past two days has been the lowest since the week of October 20th.

Price action itself has been relatively muted, with minimal price movement. The combination of the flat trading conditions and drop in volume has positioned the Relative Strength Index barely above the final oversold level in a bear market (40). It has been trading against this level for six days, indicating a move below 40 could occur at any moment.

Pressure on Shiba Inu price will increase as the Tenkan-Sen and Kijun-Sen begin to trend lower. Bulls will need to push Shiba Inu above those levels; otherwise, they will act as a hand pushing SHIBA lower and lower.

Downside pressure should be limited to a support zone between the 2021 Volume Point Of Control at $0.000038 and the 88.6% Fibonacci retracement at $0.000032.

SHIBA/USDT Daily Ichimoku Chart

If bulls want to deny any further bearish price action, bulls will need to push Shiba Inu price to a close above the Kijun-Sen and 61.8% Fibonacci retracement at $0.000043. That would put SHIBA into the unique position of a close at an eight-day high, likely trapping any shorts or bringing in new buyers as FOMO begins.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.