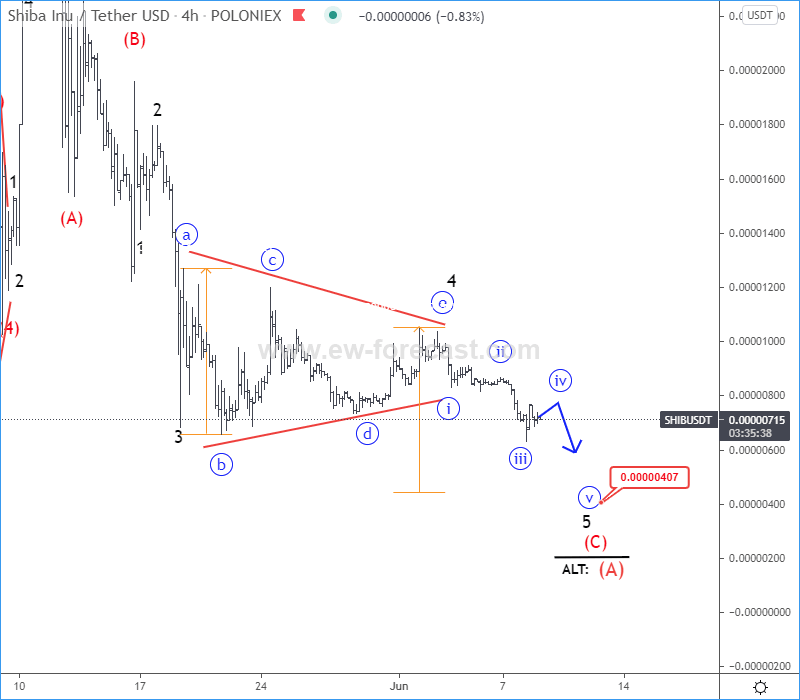

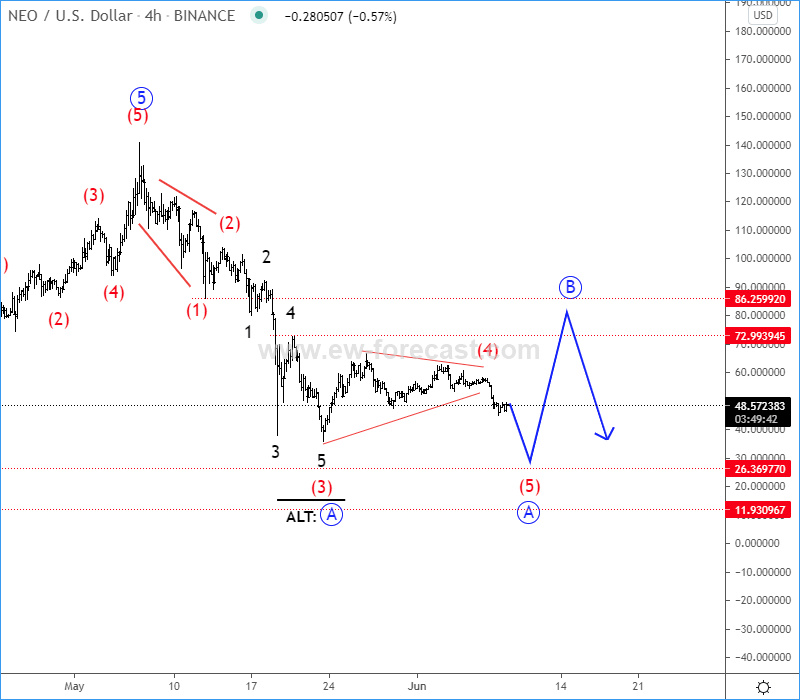

Shiba Inu and Neo Coin Elliott Wave analysis

- Shiba Inu has broken bearish traingle and looks lower towards 0.0000040 area

- Neo moves sideways with in wave (4) correction and can retest the lows for wave (5)

As expected, after we noticed a bearish triangle formation in Shiba Inu (SHIBUSD), it's already back to lows for wave 5, but wave 5 has to be completed with another five-wave cycle of a lower degree, so watch out for more weakness towards 0.0000040 projected triangle target area.

SHIBUSD 4h Elliott Wave Analysis Chart

Neo NEOUSD is slow and sideways and still looks like wave (4) correction which can retest the lows for wave (5) to complete a higher degree wave A before we will see a recovery in wave B. In case of an earlier recovery, then wave B correction would be already in play.

NEOUSD 4h Elliott Wave Analysis Chart

Finally, another ELLIOTT WAVE OPEN DOOR Event is here. See all of our charts FREE for 10 days. Join us at Elliot Wave Forecast!

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.