SHIB Price Prediction: Shiba Inu remains stale as volatility dries up

- SHIB price is stuck trading around the $0.00000700 range for the past day.

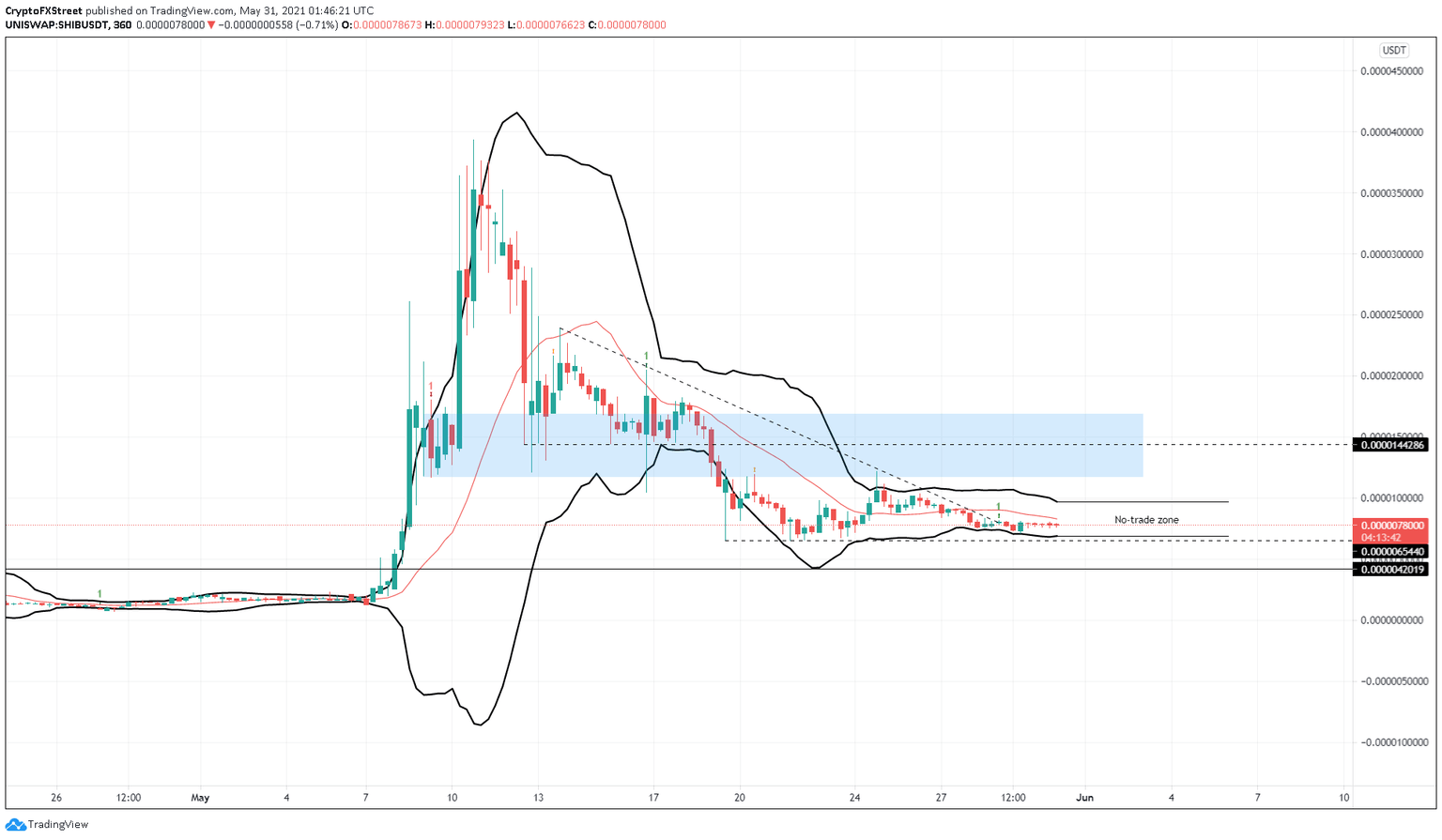

- The Bollinger Bands indicator shows Shiba Inu volatility has dried up.

- A large move is generally observed after breaking from the no-trade zone, ranging from $0.00000974 to $0.00000693.

Shiba Inu price is trading in a tight range under a crucial supply zone. A breakout from the volatility-nil phase would indicate massive moves for SHIB price.

SHIB price awaits a catalyst

SHIB price is currently experiencing a lack of volatility, keeping it around the $0.00000700 level for the past day. In fact, Shiba Inu has not traded above $0.0000100 for the past five days. Such a move indicates a lack of volatility and is affirmed by the Bollinger Bands indicator tightly squeezing the SHIB price action.

Shiba Inu is trading in a no-trade zone that ranges from $0.00000974 to $0.00000693. A breakout from either of the boundaries suggests an increase in volatility and that a violent move might follow.

Assuming a decisive 6-hour candlestick close above $0.00000974, then SHIB price could then rally 20% to tag the upper boundary of the supply zone at $0.0000117.

If the buying pressure persists, Shiba Inu will likely rise by another 20% to test the resistance level at $0.0000144.

SHIB/USDT 6-hour chart

On the other hand, if the dog-themed cryptocurrency produces a convincing close below $0.00000693, it will signal the start of a down move. However, a confirmation of this will arrive after SHIB price has sliced through the support level at $0.00000654.

In that case, Shiba Inu price might drop 36% to tag the support at $0.00000420.

Investors need to note that either scenario might occur, and an immediate confirmation for the same will arrive after SHIB price tears through the Bollinger Bands. However, until the dog-coin fails to do so, it does not have any inherent bias.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.