SHIB Price Prediction: Shiba Inu at crossroads, 23% move likely

- SHIB price is stuck trending lower since the all-time high on May 10.

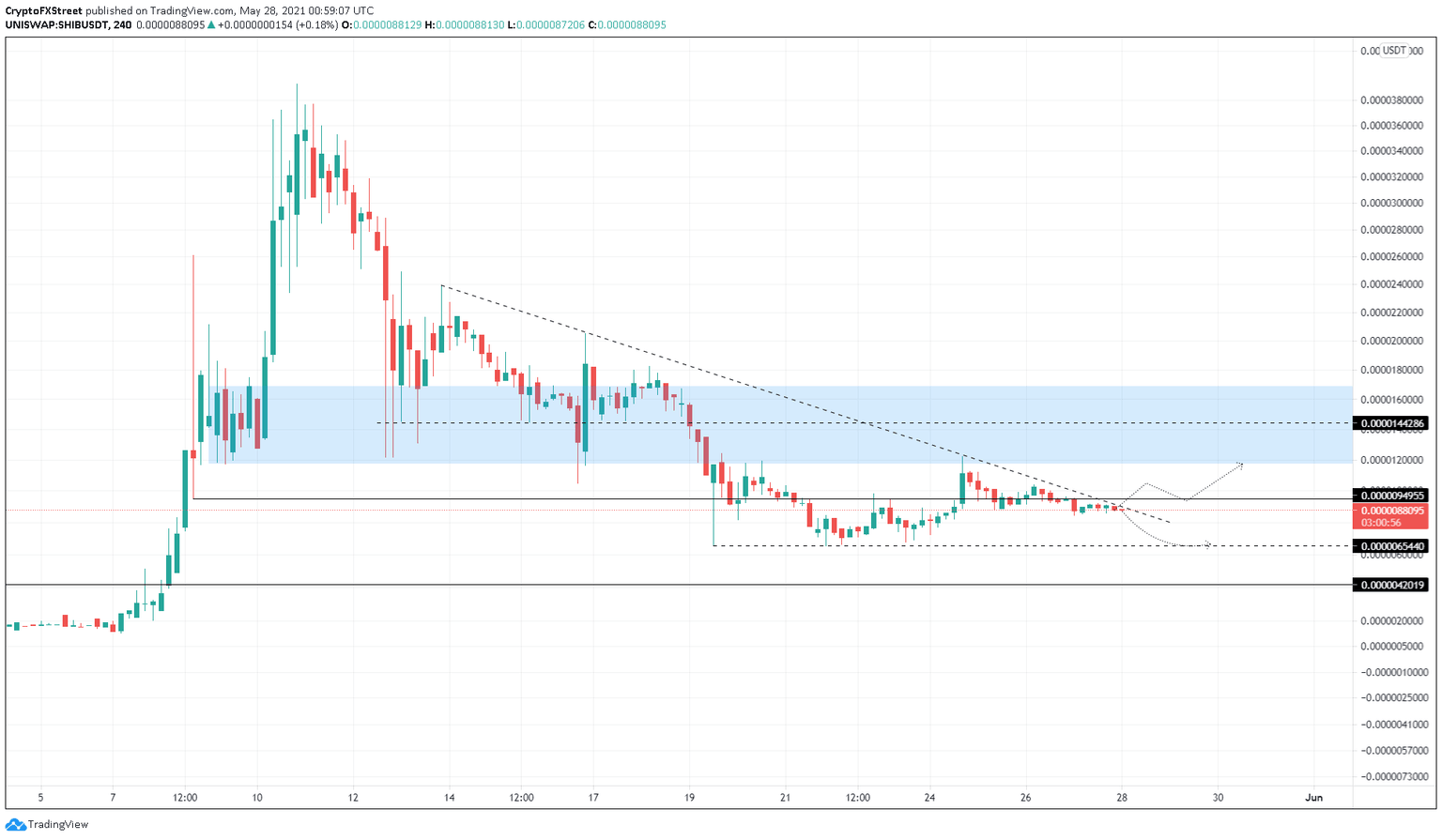

- A trend line drawn connecting the swing highs from May 13 reveals a declining resistance level.

- Shiba Inu might rally lower if it gets rejected at $0.00000949.

SHIB price is stuck between a massive supply zone and multiple barriers that have constricted its movement. Shiba Inu is currently grappling with a declining resistance level with the lack of a clear trend.

SHIB price needs to establish clear trend

SHIB price is currently trading at $0.00000880, just below the declined resistance line. This barrier has prevented Shiba Inu from heading higher three times over the past two weeks, starting from May 13.

The dog-themed cryptocurrency might give this supply level another try. A decisive close above $0.00000949 will signal the start of a 23% uptrend. However, rejection from the declined resistance will push Shiba Inu lower by 23% to the support barrier at $0.00000654.

At the time of writing, SHIB price shows no bias whatsoever. Therefore, investors need to wait for a confirmation that establishes direction.

Assuming a bullish breakout, Shiba Inu needs to close above $0.00000950. In that case, a 23% upswing will put it at $0.0000117, the lower range of a supply zone that stretches up to $0.0000169.

If the bullish momentum persists, SHIB price could tag $0.0000144, which is roughly another 23% rally from $0.0000117.

SHIB/USDT 4-hour chart

On the flip side, a downtrend will continue to evolve if the SHIB price gets rejected at $0.00000950. In that case, a 23% sell-off will put Shiba Inu at $0.00000654.

Further selling pressure at this level that breaks down the floor mentioned above will invalidate the upswing narrative and result in a 36% crash to $0.00000420.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.