SHIB Price Prediction: Shiba Inu remains indecisive, trapped between significant barriers

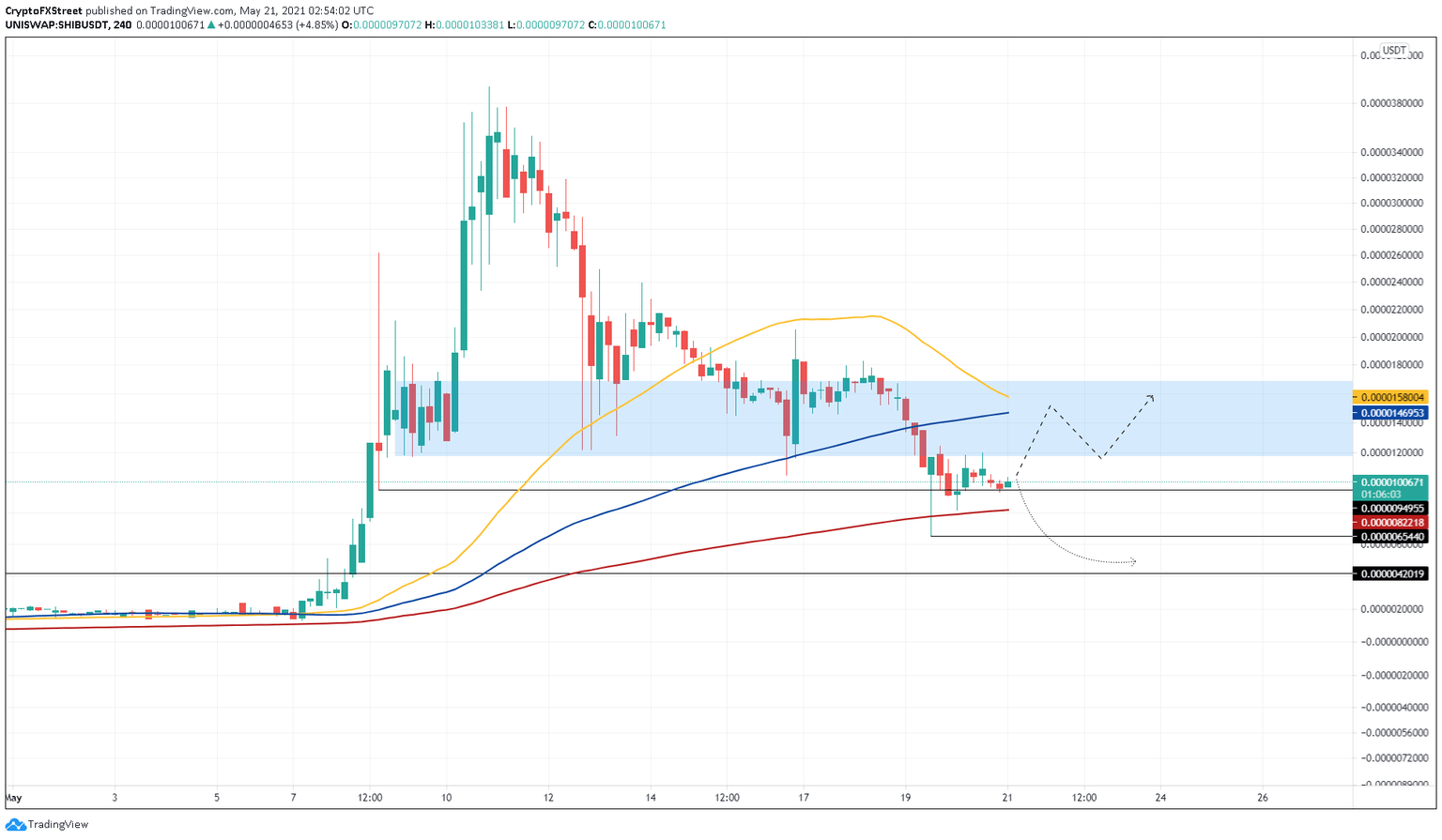

- SHIB price is trading in a tight range between a supply barrier and the 200 four-hour SMA.

- A potential upswing will face overwhelming pressure by the 50 and 100 four-hour SMAs.

- A breakdown of $0.00000654 will invalidate the bullish thesis and signal the start of a steep downtrend.

SHIB price recovery, unlike most altcoins, has been slow, signaling weak buying pressure. Even as Shiba Inu tries to head higher, it will face a wide area of support flipped to resistance after the recent flash crash on Wednesday.

SHIB price to stay range-bound

SHIB price has recovered 48% like most altcoins but fails to show a definitive bullish bias that could propel it upward. Instead, Shiba Inu reveals weak buying pressure that is slightly greater than the bearish momentum, keeping it afloat.

The supply zone that ranges from $0.0000117 to $0.0000168 will be a tough level to crack, considering it harbors the 50 and the 100 four-hour Simple Moving Averages (SMA) at $0.0000158 and $0.0000147.

Therefore, the weak bullish momentum could most likely push SHIB price up by 45% to the 100 four-hour SMA at $0.0000147. While unlikely, a breach of this barrier could further propel the meme coin up by 7% to the 50 four-hour SMA at $0.0000158.

However, investors should note that this is possible only if the buyers slice through the supply zone’s lower boundary at $$0.0000117.

SHIB/USDT 4-hour chart

On the flip side, if SHIB price drops below the 200 four-hour SMA at $0.00000822, it will signal an increased bearish momentum. A continuation of the selling pressure that leads to a decisive close below the swing low created on May 19 at $0.00000654 will invalidate the bullish thesis.

In that case, investors can expect Shiba Inu price to slide 36% to the support level at $0.00000420

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.