Sam Bankman-Fried conspired to keep Bitcoin price under $20,000, day six revelations from Caroline Ellison

- Ex-Alameda Research CEO revealed that Sam Bankman-Fried conspired to keep Bitcoin price below $20,000 by selling customer BTC.

- SBF also directed the hedge fund to dump BTC acquired from FTX customer funds to stabilize prices.

- Ellison also had it on her agenda to get regulators to crack down on Binance exchange.

Sam Bankman-Fried, alias SBF, is facing his sixth day in court, with former lover and ex-Alameda Research cofounder Caroline Ellison taking the stand to reveal some rather interesting details about their time together. Among the latest, Ellison noted that SBF deliberately worked to stagnate Bitcoin (BTC) price below the $20,000 mark.

Also Read: Bitcoin open interest at its highest since the slump recorded in August. $26,000 incoming?

Sam Bankman-Fried allegedly tried to control Bitcoin price

According to Ellison, SBF had her create a balance sheet called "FTX Borrows" to help hide the amount of customer money that FTX had borrowed. She also added that Sam Bankman-Fried had instructed her not to put anything in writing that could get the company into trouble.

The testimony steadily transitioned to the witness revealing how the defendant conspired to sell BTC tactfully with hopes of suppressing Bitcoin prices below $20,000 artificially. Specifically, he instructed the hedge fund to dump BTC acquired from FTX customer funds to stabilize prices.

The testimony, in itself, implicates Sam Bankman-Fried for illegally using client funds and the market. Nevertheless, Ellison denied committing crimes in collaboration with SBF by misleading lenders, saying, “he had the power to fire me.”

AUSA: When you were co-CEO, what did you do?

— Inner City Press (@innercitypress) October 10, 2023

Ellison: It didn't change much.

AUSA: Did you feel qualified?

Ellison: Not really. But Sam said I should do it. I checked everything with him. He was the person I reported to. He could fire me

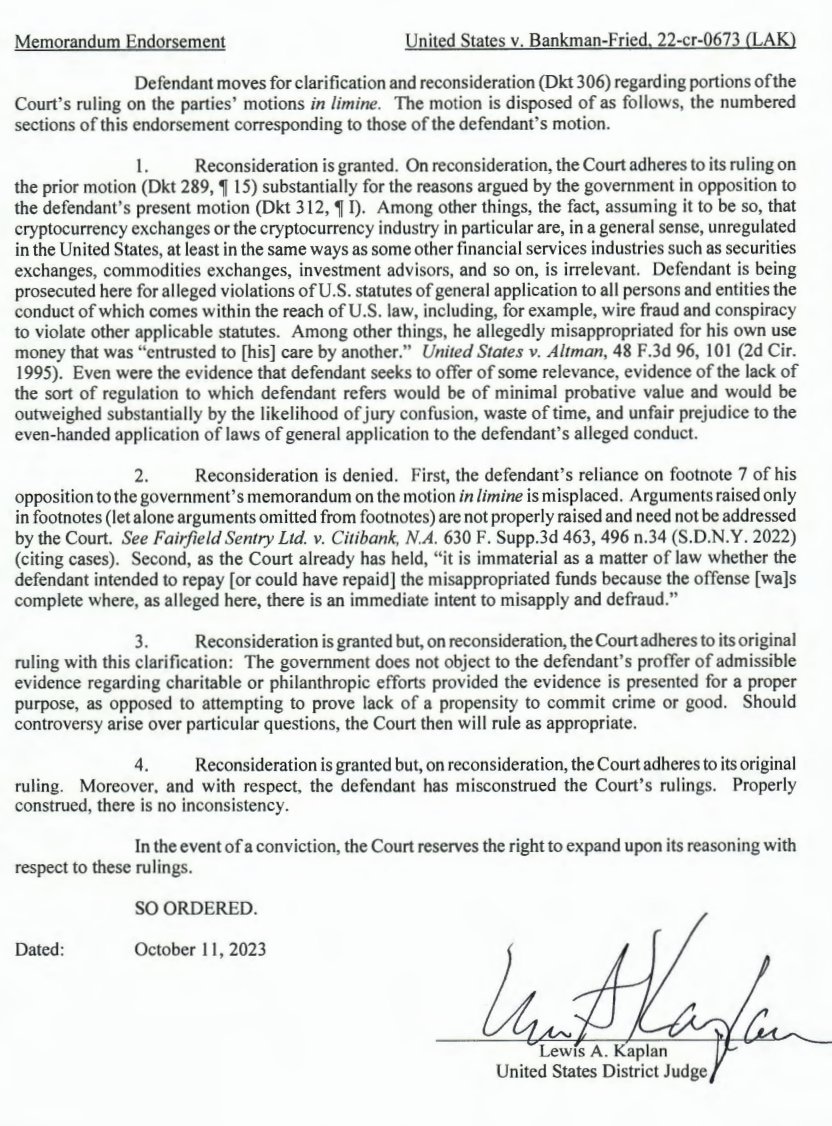

SBF had requested the court for reconsideration but Judge Kaplan has rejected the application.

SBF applications for reconsideration

Ellison on Binance exchange

The testimony has also led to the revelation that FTX had actively pushed for the regulators to clamp down on Binance exchange. It came after the jury was presented with a to-do list written by Alameda ex-executive, Ellison, with regulators focusing attention on Binance adding to the to-do list.

Needless to say, the industry and market rivalry between FTX (when it existed) and Binance were common knowledge considering they both large players in their individual spaces. When the crisis hit FTX, Binance almost acquired the exchange but pull back during the last minute, ultimately sealing the fate of the exchange.

Only days ago, a new lawsuit alleged that Binance CEO Changpeng Zhao (CZ) had a vendetta against FTX. Filed by SBF, he claimed that it was this vendetta that drove CZ to post misleading information about the platform.

Also Read: Binance CEO had a vendetta against FTX exchange - new lawsuit alleges; SBF faces first court day

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.