SafeMoon Price Prediction: SAFEMOON confirms start of 77% upswing

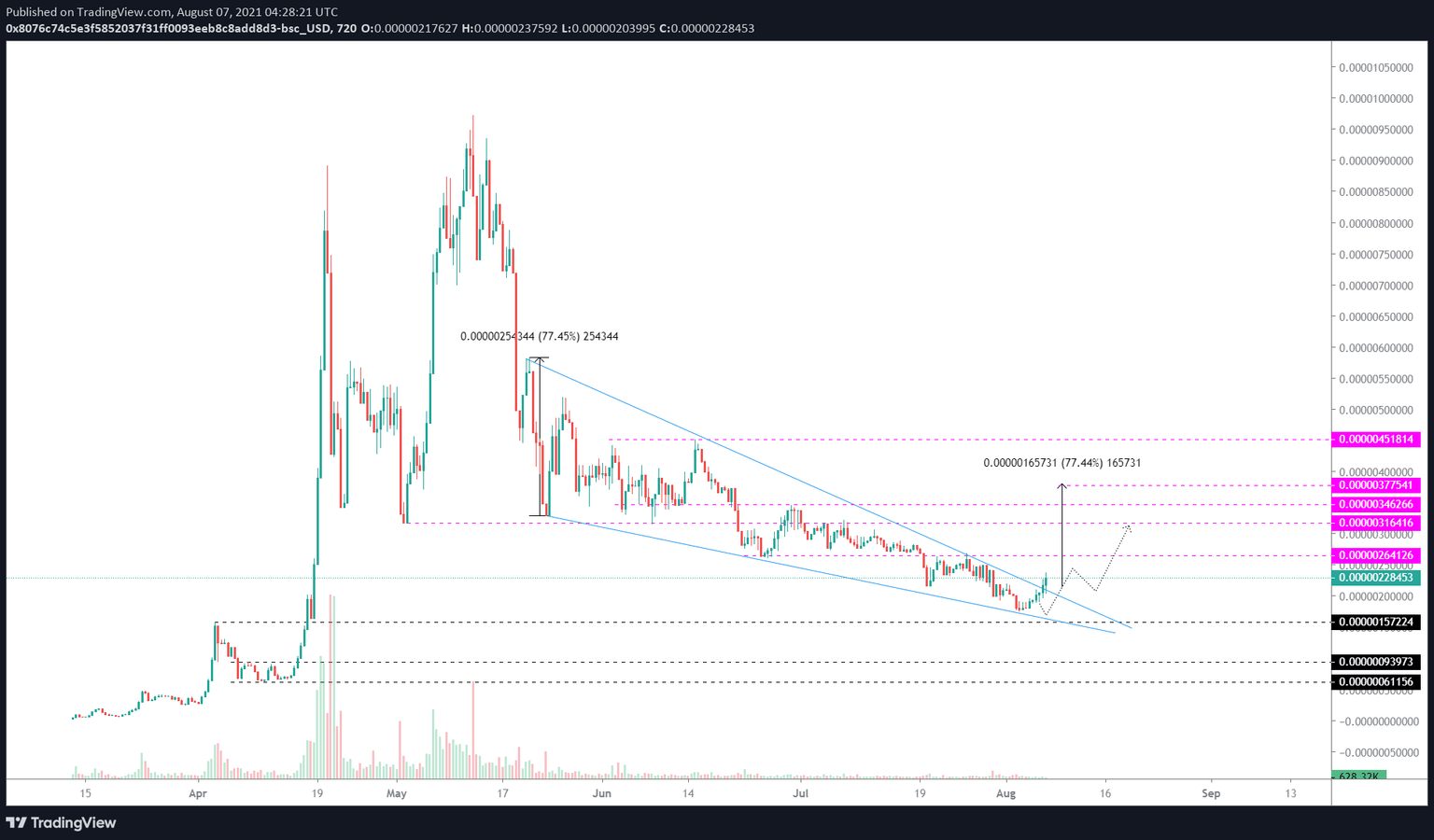

- SafeMoon price has been forming a falling wedge pattern since May 20.

- SAFEMOON broke out of this bullish pattern, confirming a 77% rally to $0.00000377.

- A decisive close below $0.00000157 will invalidate the bullish thesis.

SafeMoon price was consolidating inside a bullish pattern. However, recently, this pattern was breached toward the upside, indicating a bullish breakout confirmation. Going forward, investors can expect this uptrend to continue.

SafeMoon price kick-starts a bullish move

SafeMoon price has been setting up higher lows and lower lows since May 20. By connecting these swing points using trend lines, a falling wedge pattern forms.

This bullish setup forecasts a 77% upswing, determined by measuring the distance between the first swing high and swing low. Adding this distance to the breakout point at $0.00000212 reveals a target of $0.00000377.

As of August 6, SafeMoon price breached the upper trend line, indicating a breakout. Therefore, investors need to pay close attention to the resistance levels that are present between the current position and the forecasted target at $0.00000377.

In some cases, the uptrend might be halted by the ceiling at $0.00000264 since it served as a crucial support level before it was breached on July 19.

Therefore, confirmation of the upswing will arrive after SafeMoon price shatters $0.00000264.

SAFEMOON/USDT 12-hour chart

While things seem bullish for SafeMoon price, a potential spike in selling pressure that pushes the altcoin back into the falling wedge pattern will indicate a weakness among buyers.

If this downswing slices through the lower trend line, the trend will likely shift towards the bears.

A breakdown of the $0.00000157 support level will invalidate the bullish thesis and, in some cases, open the path to retest the $0.000000940 demand barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.