Robert Kiyosaki warns of Bitcoin bubble burst, while traders hedge for Trump’s Powell play

- Bitcoin holds steady above $116,000, up nearly 15% in the past month.

- Crypto traders are gearing up for the outcome of the Trump vs. Powell feud and expectation of an interest rate cut.

- Robert Kiyosaki warns Bitcoin traders of a bubble burst, advises traders to buy when BTC price crashes.

Crypto traders are unpacking the consequences of the latest feud in the US. Trump vs. Powell has taken center stage. Market participants are working on positioning themselves in the event that US President Trump fires the Federal Reserve (Fed) Chair.

Bitcoin could rally in response to an interest rate cut, riding on a liquidity boost and reduced cost of borrowing.

Bitcoin reaction to Trump v. Powell

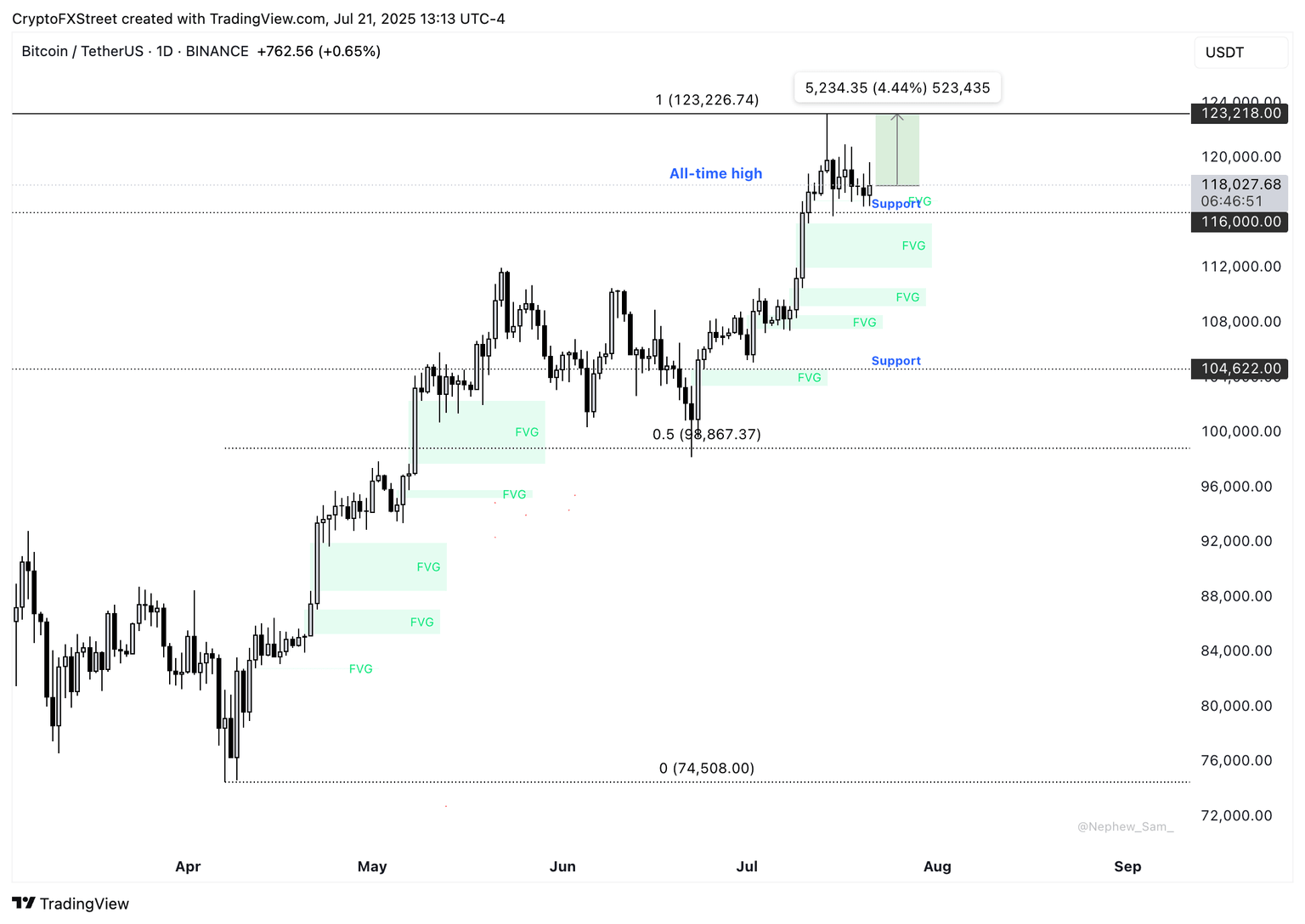

Bitcoin has rallied nearly 15% in the past month. The largest cryptocurrency hit a new all-time high above $123,000 last week on July 14. Since then, BTC erased its newfound gains and hovers above support at $116,000.

A Bloomberg report theorizes that if Donald Trump fires the Fed Chair, a new candidate would most likely “fall in line” with Trump’s push for lower interest rates. Bitcoin and risk assets typically rally when borrowing becomes cheaper and the market receives a liquidity boost.

Typically, easier monetary policy and lower confidence in the central bank could drive risk asset prices higher.

BTC price is nearly unchanged since Wednesday morning when traders first speculated the outcome of the Trump v. Powell conflict and the removal of the US Fed Chair.

BTC/USDT price chart | Source: TradingView

Rich dad warns of Bitcoin price crash

Robert Kiyosaki, a crypto expert and an author widely known for his book Rich Dad Poor Dad has warned traders of an incoming crash in assets like Bitcoin. Kiyosaki’s tweet on X:

X’s AI chatbot Grok says that Kiyosaki has made similar predictions of market bubbles at least 22 times since 2022. Each time the expert recommended that traders buy Bitcoin during the incoming crash.

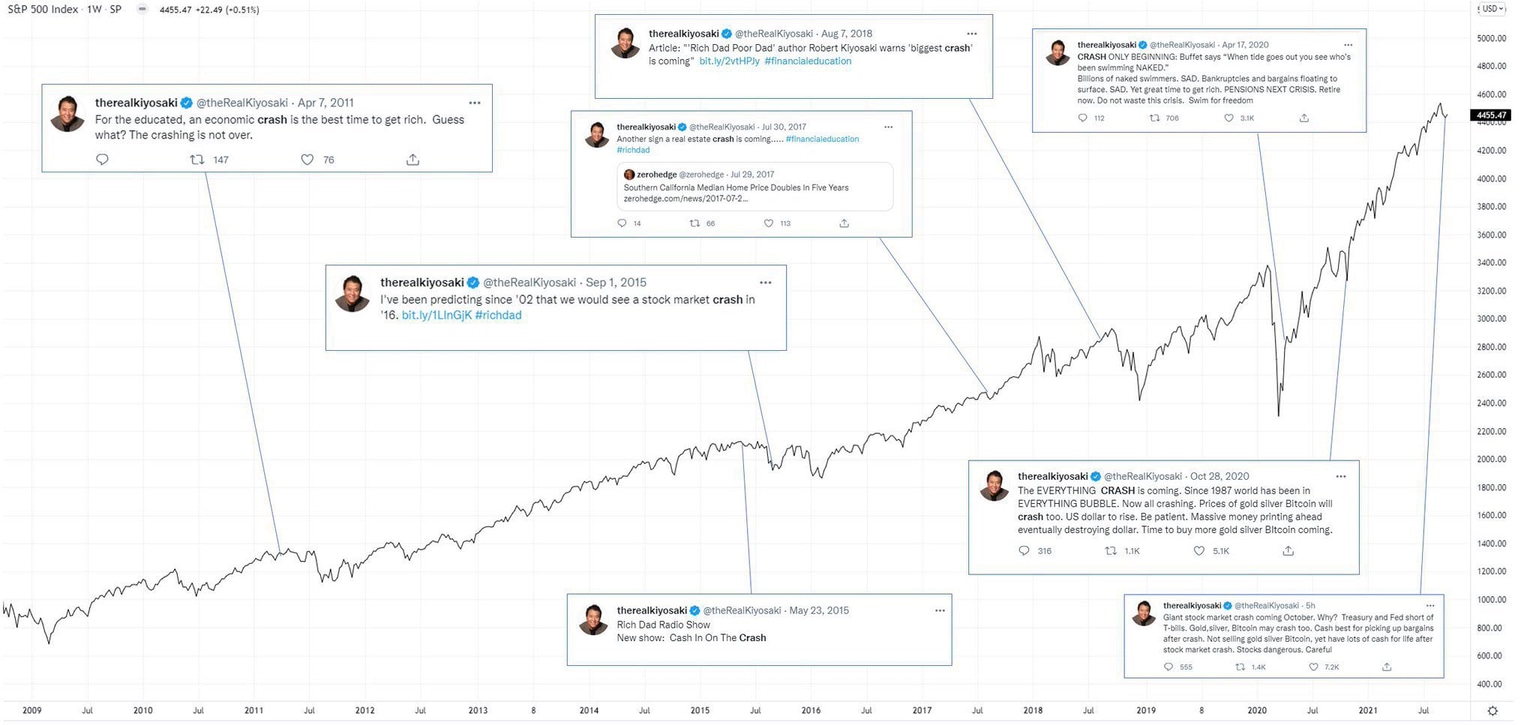

Analysts at Brew Markets, a market newsletter cautioned traders against following Kiyosaki’s advice and shared an S&P 500 chart with Kiyosaki’s tweets, marking an increase each time the expert predicted a crash or bubble burst.

Kiyosaki’s tweets and S&P 500 performance | Source: X

Bitcoin trades at $117,800 at the time of writing on Monday.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.