Ripple takes another hit as Grayscale excludes XRP from the Fund's portfolio

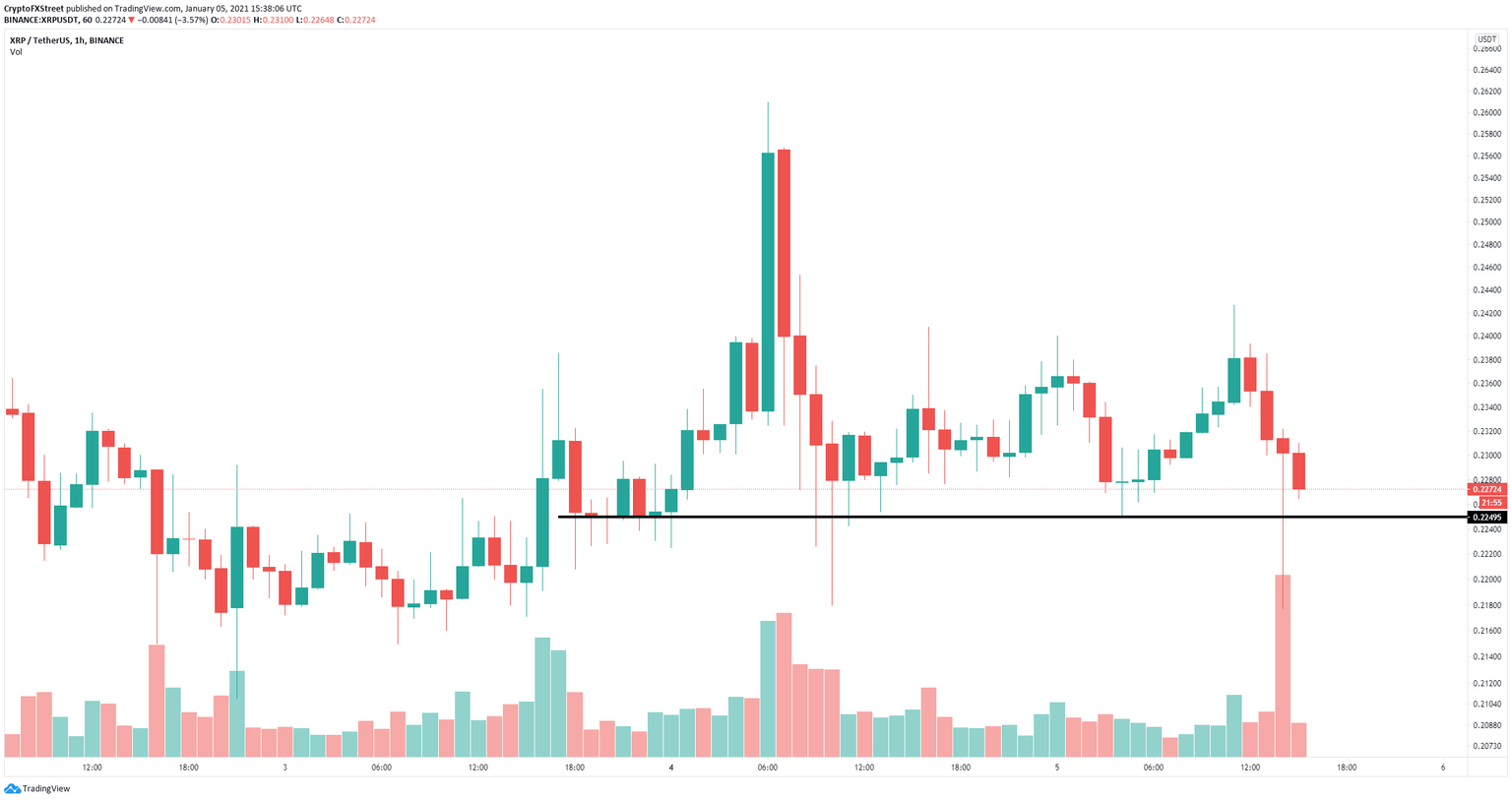

- XRP price plummeted from $0.242 to a low of $0.217 following Grayscale’s announcement.

- The digital asset remains surprisingly stable despite all the bad news.

Earlier today, the giant Bitcoin Trust Fund, Grayscale, announced that it will remove XRP following DLC Fund’s Quarterly Review. Of course, this removal was motivated by the SEC suing Ripple, although the fund didn’t explicitly mention it.

XRP price remains stable but continues taking hits

Right after the announcement, XRP price plummeted 6% within a few minutes. However, the bulls bought the dip and the current price is $0.227, staying above the crucial support level at $0.2. The impact of Grayscale’s announcement was not as strong because there were already several rumors that the fund would remove XRP.

XRP/USD 1-hour chart

Despite all the bad news, XRP bulls have established a robust support level at $0.225 which was defended several times in the past three days. Unfortunately, some on-chain metrics are not in favor of the digital asset.

XRP Holders Distribution chart

It seems that the number of whales holding between 1,000,000 and 10,000,000 has declined significantly since November 21, 2020, from a high of 1,350 to a low of 1,127. Similarly, the number of large holders with at least 10,000,000 coins dropped steeply from a high of 356 on December 25, 2020, to a low of 309.

XRP Exchange Inflow chart

Additionally, during the past month, the number of XRP coins going to exchanges has spiked massively to numbers never seen before, not even during the 2017 bull rally. This metric indicates that a lot of investors have deposited their coins into exchanges to sell them or at least take some profit which adds a lot of selling pressure to the digital asset.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.37.44%2C%252005%2520Jan%2C%25202021%5D-637454579056557166.png&w=1536&q=95)

%2520%5B16.37.35%2C%252005%2520Jan%2C%25202021%5D-637454579084528395.png&w=1536&q=95)