XRP price finds stable support at $0.20 while investors seek an amendment of the SEC's complaint against Ripple

- XRP price remains flat despite overall market strength.

- XRP investors are desperately seeking clarity in the SEC’s complaint against Ripple.

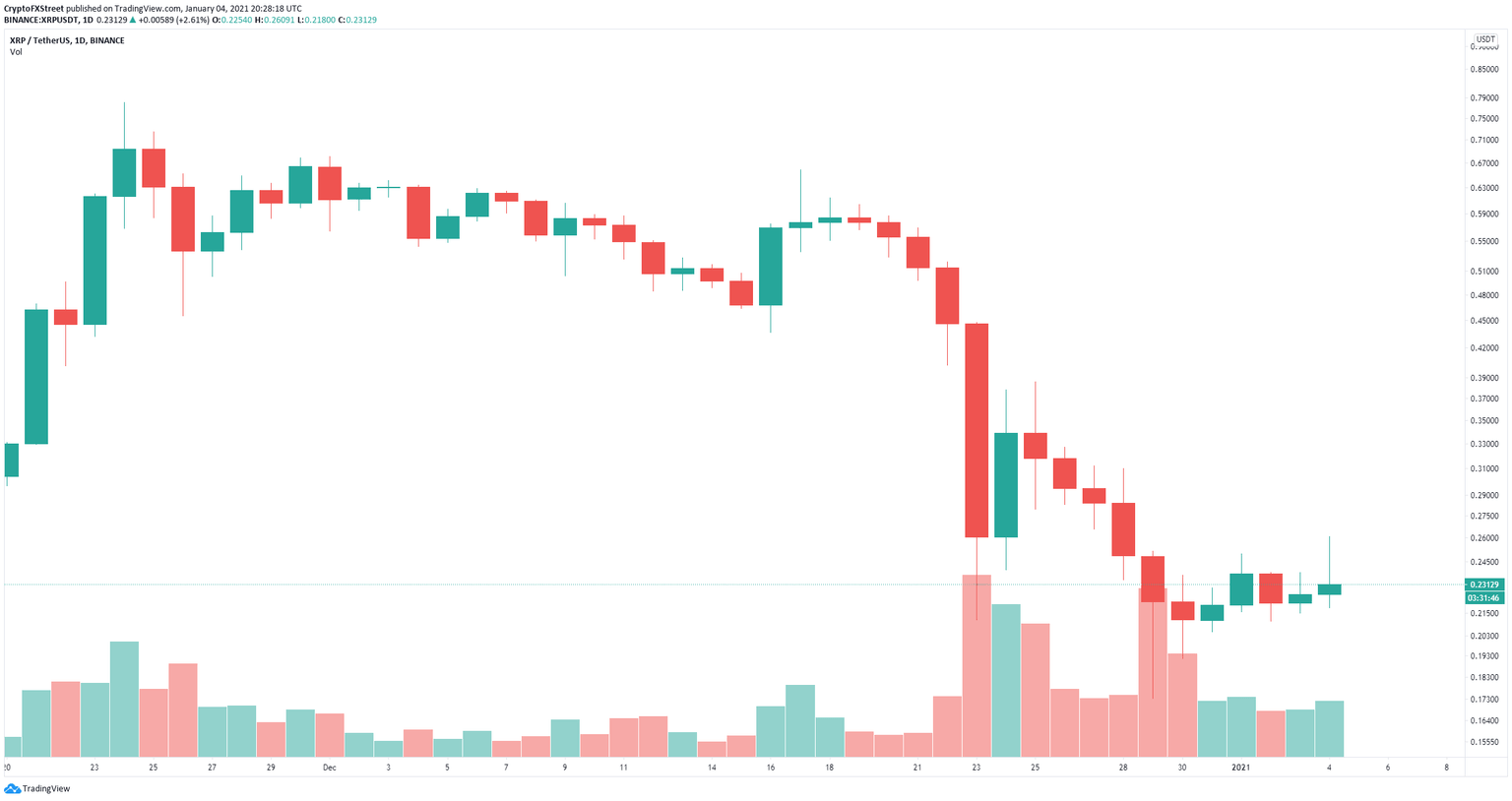

After the announcement from the SEC about Ripple, XRP price plummeted from a high of $0.55 down to $0.173 in just over a week. The current price is around $0.23 as the digital asset struggles to recover.

The SEC has sued Ripple and CEO Brad Garlinghouse and co-founder Chris Larsen on December 22. The SEC considers XRP a security which has forced several major exchanges including Coinbase to halt the trading of XRP.

On Friday 1, 2021, a group of XRP investors filed a petition in the Rhode Island District Court against Elad Roisman, the acting chairman of the SEC seeking an amendment of the complaint against Ripple. The investors state:

The former chairman of SEC, Jay Clayton, knowingly and intentionally caused multibillion-dollar losses to innocent investors who have purchased, exchanged, received and/or acquired the Digital Asset XRP, including the named Petitioners, and all others similarly situated.

XRP price remains somewhat stable despite the bad news

After the initial crash, it seems that XRP price has remained relatively stable above $0.20 for the past week. Several other exchanges and platforms have announced the delisting of XRP or the halting of trading but the digital asset remained flat.

XRP/USD daily chart

The most critical support level is the last low of $0.173 although $0.20 should also act as a strong psychological support. Unfortunately, it seems that many investors have left the network already.

XRP Holders Distribution chart

The number of whales holding at least 10,000,000 XRP has dropped significantly in the past two weeks from a high of 356 to 308 currently. This indicates that large holders are leaving the network and taking profits expecting XRP price to continue declining.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B21.26.03%2C%252004%2520Jan%2C%25202021%5D-637453889116087547.png&w=1536&q=95)