Ripple Price Prediction: XRP faces macro headwinds despite steady weekly fund inflows

- XRP bulls fight to uphold the $2.00 support level following a widespread sell-off over the weekend triggered by Middle East tensions.

- XRP-related financial products saw inflows of $2.69 million last week, signaling steady institutional interest.

- XRP exchange reserves drop sharply, reaching $2.3 billion after peaking at $2.9 billion earlier in May.

Ripple (XRP) faces increasing downside pressure as it trades slightly above $2.00 at the time of writing on Monday. The flash drop on Sunday followed United States (US) strikes on Iran, resulting in massive liquidations. XRP is currently constrained below support-turned-resistance at $2.00 and weekend lows of $1.90.

"If tensions escalate or Iran retaliates, crypto prices may fall further as investors move their money toward safer assets. Although crypto is decentralized, it remains vulnerable to global instability," Andrejs Balans, Risk Manager at YouHodler, told FXStreet.

Meanwhile, steady inflows into related digital assets and shrinking exchange reserves could spark a recovery in the coming days or weeks, with XRP targeting key levels at $2.25 and $2.65, respectively.

While Iran has vowed to retaliate against the US, market volatility in the broader cryptocurrency market appears to be easing "with digital assets straddling the line between risk-on momentum and risk-off defensiveness," according to QCP Capital's Monday update.

XRP shows resilience amid steady digital

Institutional interest in XRP and related products stabilized last week, alongside inflows into Bitcoin (BTC) and Ethereum (ETH). According to CoinShares' weekly report, XRP recorded an inflow of $2.69 million, falling behind Solana (SOL) with $2.8 million, Ethereum with $124 million and Bitcoin with $1.1 billion.

Digital asset weekly inflows | Source: CoinShares

The steady inflow streak mirrors growing interest in XRP-related products, including spot Exchange Traded Funds (ETFs). While the US Securities and Exchange Commission (SEC) is still considering several proposals, Canada launched three XRP spot ETFs last week.

XRP-focused treasury funds have continued to gain momentum in recent weeks, including Singapore-based Trident Technologies' $500 million investment, China-based Webus International's $300 million, and London-based VivoPower's $121 million, which has been channeled toward decentralized finance (DeFi) and the XRP Ledger.

Fundamentally, XRP remains strong, with CryptoQuant highlighting a nearly 21% drop in exchange reserves to $2.3 billion from $2.9 billion as of May 12. The Exchange Reserves metric tracks the total number of coins in exchange wallets. As the value continues to drop, it indicates lower sell-side pressure, thereby predisposing XRP to a sustainable uptrend.

Exchange Reserve metric | Source: CryptoQuant

However, the derivatives market sheds light on the complex technical situation intertwined with macro factors, such as geopolitical tensions-triggered sell-offs. CoinGlass reports a decline in Open Interest (OI) to $3.54 billion, down from $5.52 billion recorded on May 14.

A sharp increase in trading volume to $8.7 billion indicates a rise in liquidations, valued at $21 million over the last 24 hours, and an increase in activity as traders buy XRP to cover their positions. A short squeeze could trigger a technical reversal in upcoming sessions or days.

XRP futures Open Interest | Source | CoinGlass

Technical outlook: XRP upholds $2.00 support

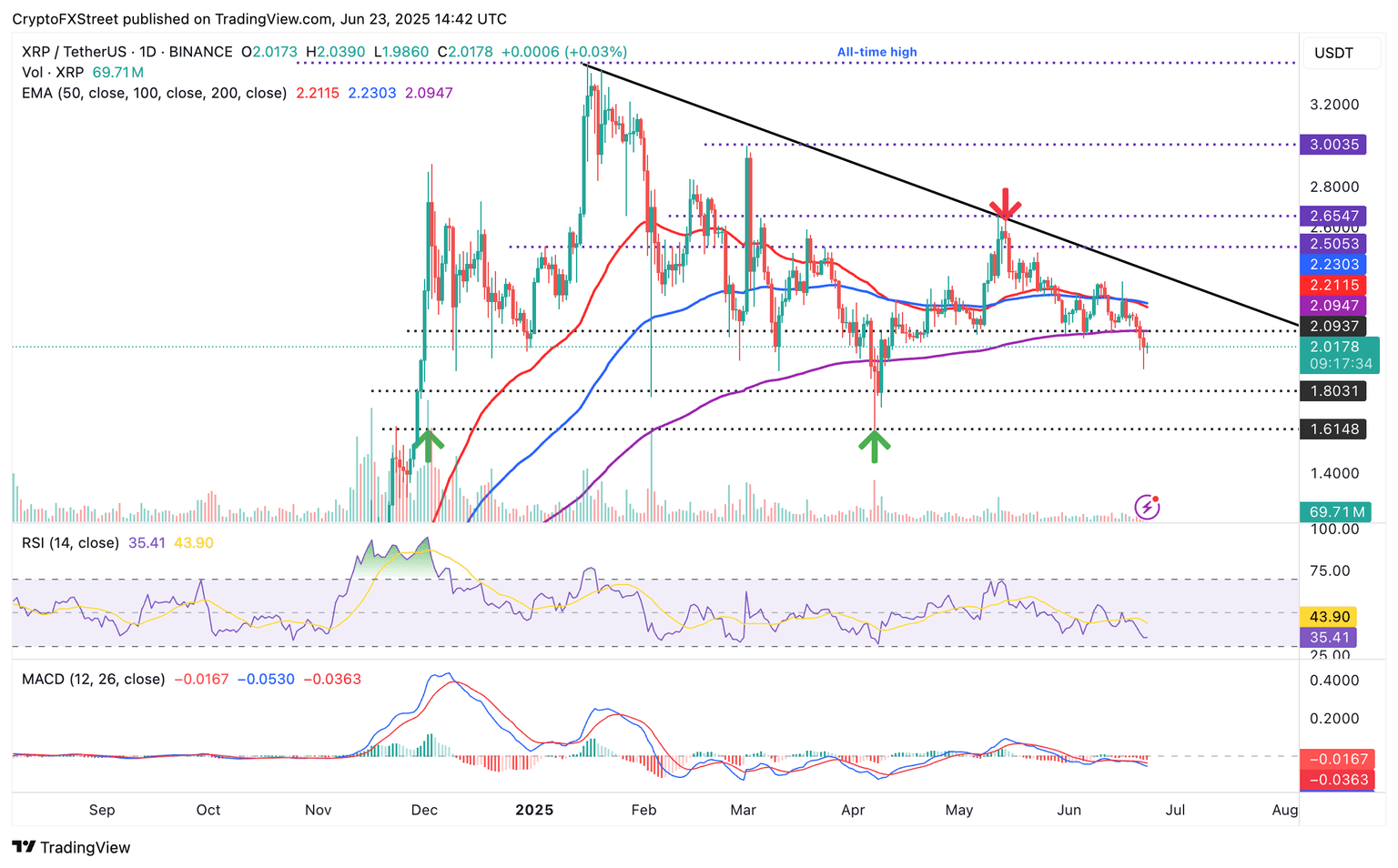

XRP struggles to uphold support at $2.00 amid macro-driven volatility due to the escalation of the conflict between Israel and Iran. Despite strong fundamentals, including steady institutional interest and shrinking exchange reserves, the token remains below a key support-turned-resistance level at $2.09, provided by the 200-day Exponential Moving Average (EMA).

A sell signal sustained by the Moving Average Convergence Divergence (MACD) indicator since mid-May indicates bearish momentum. Traders often consider reducing exposure to XRP when the blue MACD line flips below the red signal line. The red histogram bars beneath the mean line (0.00) uphold a bearish bias, further increasing the potential for losses extending below $2.00.

XRP/USDT daily chart

The Relative Strength Index (RSI) indicates a potential reversal at 35, following a downtrend that began in mid-May. Recovery toward the midline would signal an increase in bullish momentum.

Key areas of interest to traders remain the 200-day EMA resistance at $2.09, the seller congestion at $2.25 and $2.65, tested as resistance in May. On the other hand, price action below the $2.00 level could see XRP slide toward $1.90, tested on Sunday.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren