Ripple Price Forecast: XRP soars above $0.53, defies risk of a 45% correction for now

- XRP price tussles with the $0.50 resistance level, which coincides with a confluence of multiple technical hurdles.

- Rejection at this level increases the odds for a 45% drop in Ripple’s market value.

- The potential correction could be cut short by the 50 four-hour MA around $0.42.

It is an understatement to say that XRP price has been affected by the SEC’s charges on Ripple. Indeed, the remittance token has suffered a liquidity shortage as many cryptocurrency exchanges suspended it for trading. While some market participants have done everything in their power to push it upwards, this altcoin seems primed for another downswing.

Update: Ripple's XRP is defying gravity as of Wednesday – trading above $0.53, an increase of over 11%. The token has been experiencing elevated volatility as it remains in the spotlight for right and wrong reasons alike. Regulatory issues loom over its price and so do some technical aspects of its price. On the other hand, XRP benefits from the growing interest in cryptocurrencies stemming from Elon Musk's venture in Bitcoin. Tesla, founded by Musk announced it is investing $1.5 billion in the granddaddy of cryptocurrencies and may also accept BTC payments under some conditions. Ripple's offering is also promising for transactions, and some investors may be trying to jump on XRP – seeing it as the next digital coin to gain more substantial adoption in the real economy. More: Elrond may provide a buying opportunity.

XRP could be overrun by bears soon

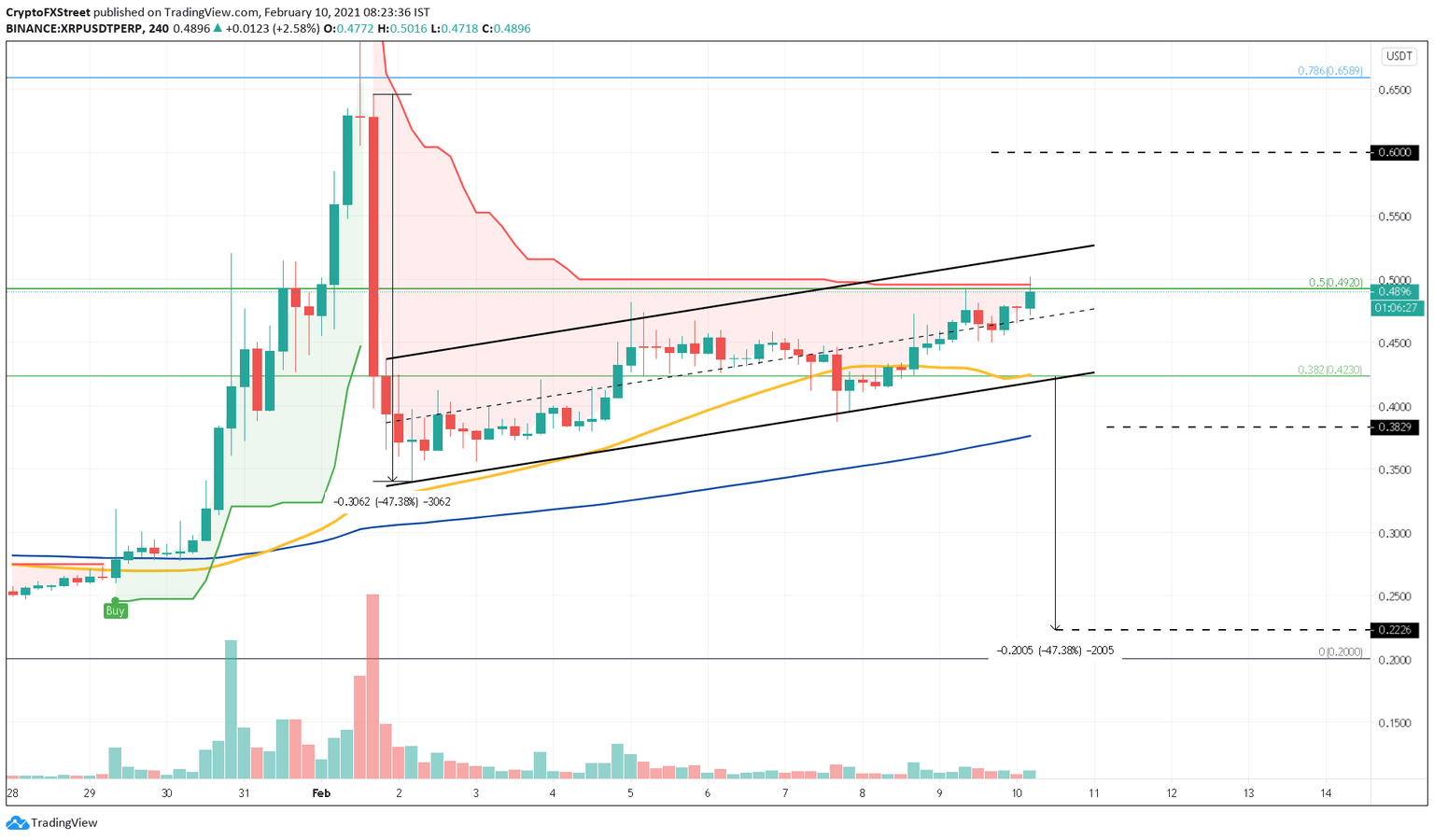

XRP price has developed a bear flag on its 4-hour chart. Since this is considered a continuation pattern, the flag pole’s height suggests this altcoin could drop by 45%.

Nonetheless, this bearish scenario isn’t set in stone.

The $0.50 resistance level is crucial in determining where XRP price is headed next. This hurdle is made up by the 50% Fibonacci retracement level and the SuperTrend’s sell signal. Thus, moving past it will not be an easy task.

A spike in selling pressure around this level might be significant enough to push the XRP price to $0.42. Here, the 50 four-hour MA coincides with the 38.2% Fibonacci level, adding an extra layer of support.

But If this level is breached for any reasons, then XRP price may drop to $0.22.

XRP/USDT 4-hour chart

Regardless of the pessimistic outlook, an increase in buying pressure that leads to a 4-hour candlestick close above the channel’s upper trendline at $0.53 might see XRP price head to greener pastures. Slicing through resistance will open the possibility for a 20% surge to $0.60.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.