Ripple Price Prediction: Ripple's stablecoin expansion with OpenPayd partnership could boost XRP price

- XRP consolidates below the 50-day EMA resistance at $2.20 amid prolonged market indecision.

- Ripple has signed a strategic partnership with OpenPayd, integrating Ripple Payments with the Euro and the Pound Sterling.

- The collaboration allows Ripple to leverage the OpenPayd global network, advancing compliant, efficient and scalable institutional-grade payments.

Ripple (XRP) extends its sideways trading, hovering at around $2.18 on Wednesday. Its recovery has largely been limited despite Ripple’s announcement of stablecoin expansion, following a strategic partnership with OpenPayd and the advancements made on the XRP Ledger, which integrated the XRPL EVM Sidechain on Monday.

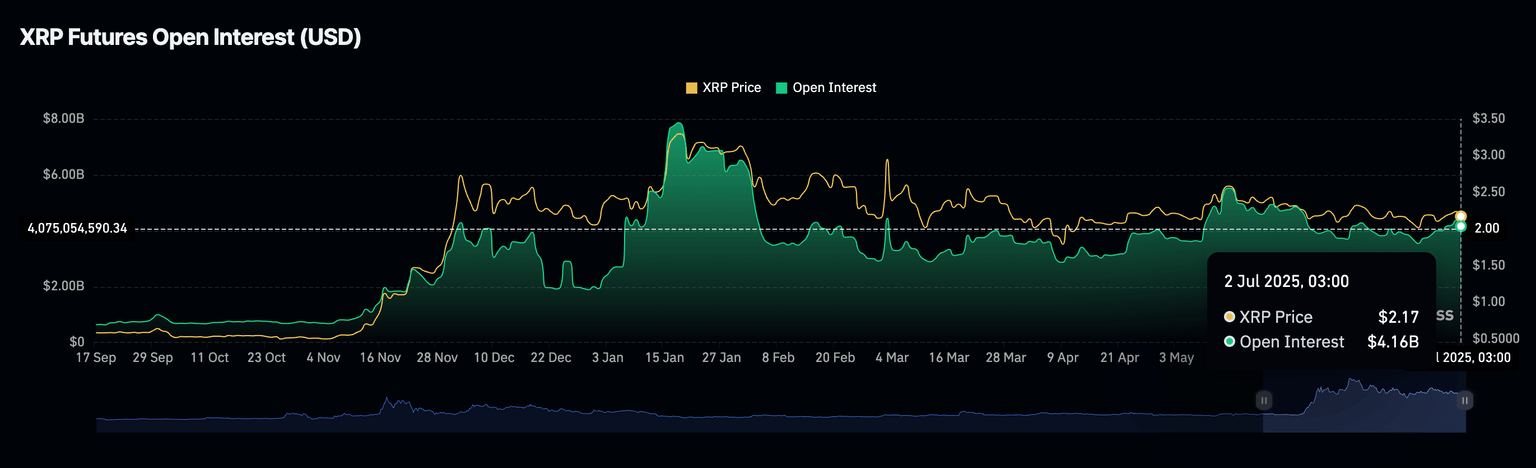

Meanwhile, interest in XRP remains slightly elevated at $4.16 billion, according to the futures contracts Open Interest (OI) data from CoinGlass. According to the chart below, the OI has recovered from the drop to $3.54 billion on June 23. Still, it remains significantly lower than the peaks of $5.52 billion on May 14 and $7.86 billion on January 18.

XRP futures Open Interest chart | Source: CoinGlass

Ripple advances stablecoin infrastructure and reach

Ripple has announced a strategic partnership with OpenPayd, a prominent provider of financial infrastructure, aiming to expand cross-border payments by integrating fiat currencies such as the Euro (EUR) and the Pound Sterling (GBP), as well as Ripple Payments.

The partnership comes a few weeks after OpenPayd launched a stablecoin infrastructure. Its multi-currency financial system supports real-time payment rails and virtual IBANs.

“The future of global finance depends on seamless interoperability between traditional infrastructure and digital assets,” Jack McDonald, Ripple’s SVP, Stablecoins, said.

Using OpenPayd infrastructure, Ripple will mint and burn the RLUSD stablecoin. At the same time, seamlessly move assets between fiat currencies and RLUSD by accessing OpenPayd’s full suite of services, including payments, embedded accounts, and trading, all under a single API.

Ripple’s partnership with OpenPayd will span several use cases, including cross-border transfers, treasury management, and access to US Dollar (USD) liquidity.

“This partnership enables businesses to move and manage money globally, access stablecoin liquidity at scale, and simplify cross border payments, treasury flows and dollar-based operations,” CEO of OpenPayd, Iana Dimitrova, said.

Technical outlook: XRP could resume bullish momentum

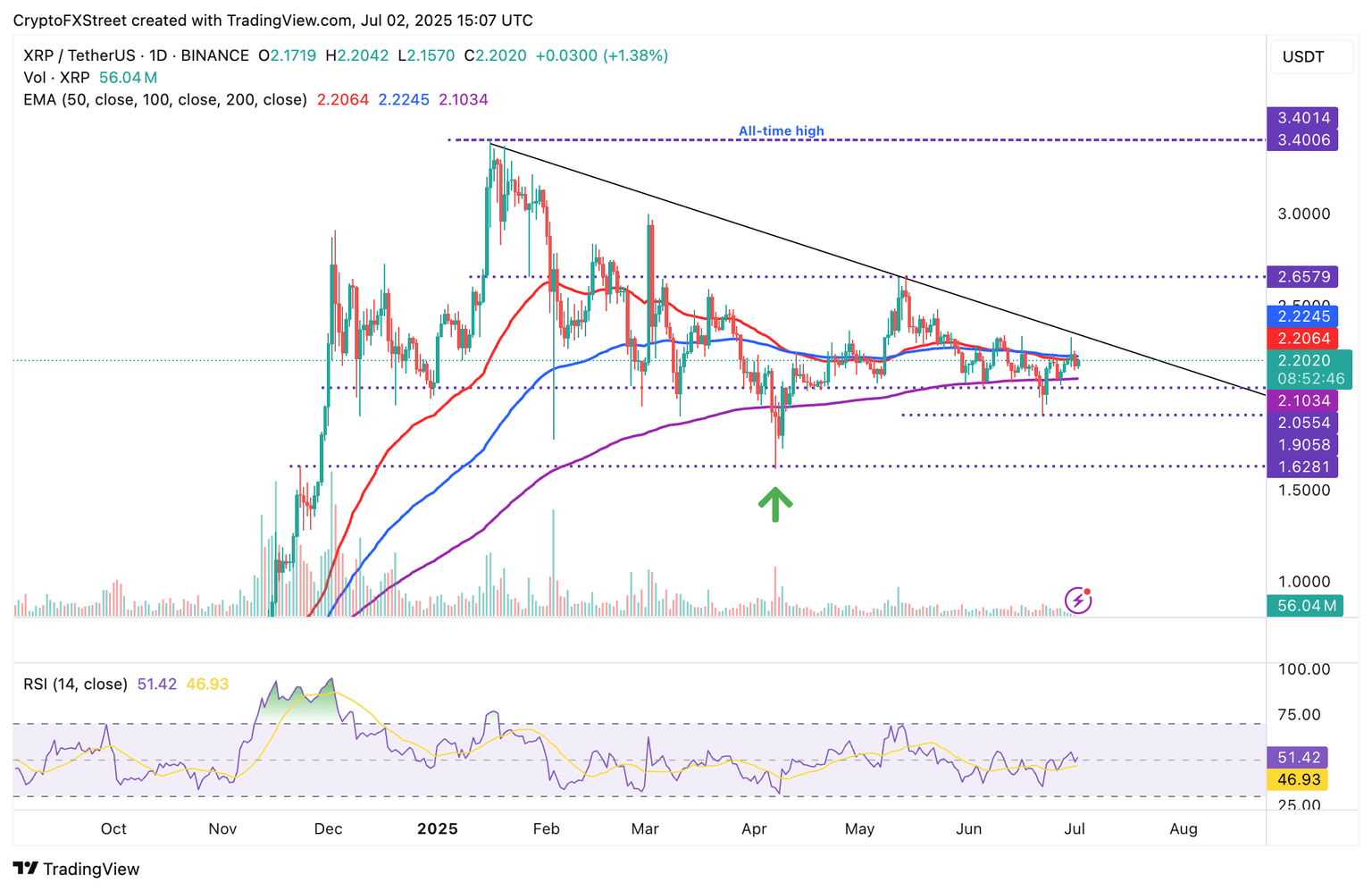

XRP’s sideways trading continues below the 50-day Exponential Moving Average (EMA), currently at $2.20. Slightly above it is the 100-day EMA at $2.22, which may be adding downward pressure.

The Relative Strength Index (RSI) position at 50 affirms the indecision in the market. Traders will look for movement toward overbought territory to ascertain bullish momentum and increase exposure to XRP.

If the price of XRP breaks above the descending trendline, as shown on the daily chart below, optimism for a larger breakout could boost risk-on sentiment. Key areas of interest above the trendline are the highest point in June at $2.34 and May’s peak at $2.65.

XRP/USDT daily chart

On the flip side, there’s a chance XRP could resume the downtrend, especially if the 50-day EMA at $2.20 and the 100-day EMA at $2.22 hurdles fail to give way. Therefore, the areas to monitor on the downside include the 200-day EMA support at $2.10, the demand area at $1.90 and April’s lowest price level at $1.61.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren