Ripple Price Prediction: XRP eyeing near-term breakout on rising spot ETF approval odds

- XRP's downtrend persists, reflecting lethargic sentiment in the broader cryptocurrency market.

- Analysts Eric Balchunas and James Sayffart raise the odds of XRP spot ETF approval to 95% by the end of the year.

- Ripple announces the launch of XRPL EVM Sidechain on the mainnet, raising the stakes for developers eyeing cross-chain functionality.

Ripple's (XRP) upside remains heavy, held back by a lethargic sentiment across the cryptocurrency market. Trading at $2.19, the XRP price is down over 2% on Tuesday. If support at $2.18 holds, a technical breakout could follow targeting previous monthly peaks at $2.34, and $2.65, respectively.

Interest in the cross-border money remittance token has significantly declined compared to November, December, and January, as evidenced by the downtrend in the futures Open Interest, which now stands at $4.38 billion, down from $7.76 billion posted on January 17.

XRP Futures Open Interest | Source: CoinGlass

Analysts raise XRP spot ETF approval odds to 95%

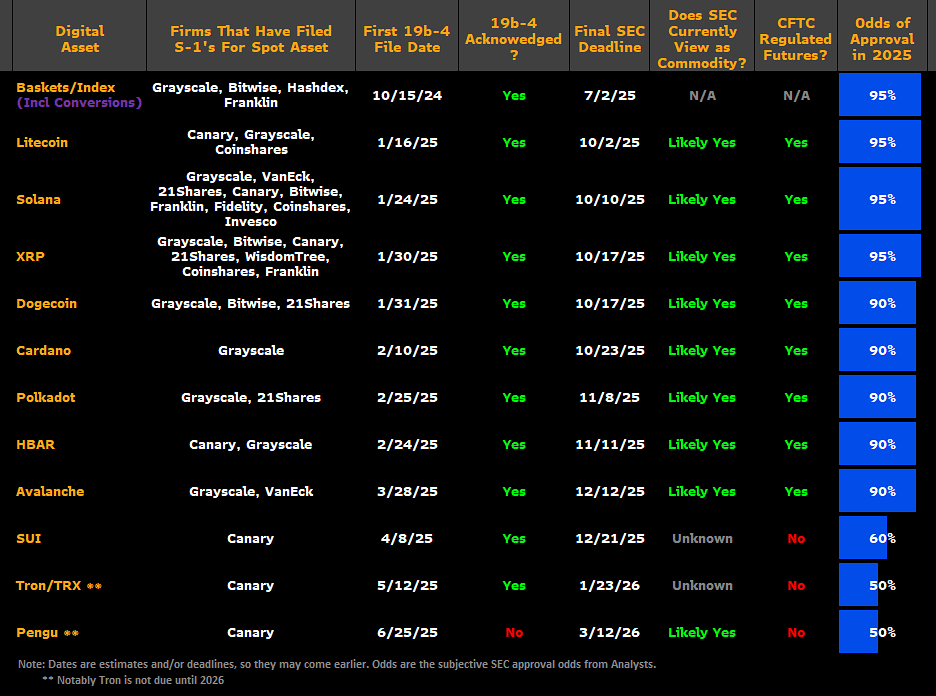

Bloomberg analysts Eric Balchunas and James Sayffart have released their projections for the ratification of various spot Exchange Trade Funds (ETFs), with XRP spot ETFs assigned a 95% approval chance by the United States (US) Securities and Exchange Commission (SEC).

Proposals by Grayscale, Bitwise, Canary Capital, 21Shares, WisdomTree, CoinShares, and Franklin Templeton have been acknowledged by the SEC, all of which have a 95% chance of approval.

Spot ETFs approval odds | Source: Bloomberg

The price of XRP failed to react to the development, which raises the stakes for the acceptance of XRP as an institutional-grade digital asset traded directly on stock exchanges without the need to own the actual cryptocurrency.

XRPL EVM Sidechain live on the mainnet

Ripple has announced the launch of the XRPL EVM Sidechain on the mainnet following years of development in collaboration with Persyst and its broader ecosystem.

The launch marks a major step toward integrating general-purpose smart contract capabilities to the XRP Ledger (XRPL), allowing developers to "build, port, and deploy cross-chain and EVM (Ethereum Virtual Machine) only decentralized applications (dApps)."

Web3 financial functionalities, including stablecoins, real-world asset (RWA) tokenization, and cross-border payments, are heavily dependent on robust blockchain infrastructure that ensures liquidity, speed, security and scalability.

"The XRPL EVM Sidechain introduces a flexible environment for developers to deploy EVM-based applications, while maintaining a connection to the XRPL's efficiency," Ripple CTO and co-founder David Schwartz said in the press release. "It extends the capabilities of the ecosystem without changing the fundamentals that make the XRPL reliable," Schwartz added.

Technical outlook: XRP recovery elusive despite key support

The price of XRP is on the verge of extending its downtrend toward support at $2.06, tested on Friday. A break below the immediate 50-week Exponential Moving Average (EMA) support at $2.18 could validate another sell-off round, considering the slump to $1.90 on June 21, triggered by geopolitical tensions in the Middle East.

XRP/USDT weekly chart

A further decline below the support at $1.90, which sits slightly below the 100-week EMA, could be unlikely, especially with the Money Flow Index (MFI) at 40, reversing the trend toward the midline. This upswing suggests risk-on sentiment is rising, with demand for XRP likely to steady the price and trigger the resumption of the uptrend.

Key areas of interest to traders are the 50-day EMA support at $2.18, the previous month's peak at $2.34 and the highest level reached in May at $2.65.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren