Ripple Price Forecast: XRP ETF inflows, rising retail demand could strengthen recovery outlook

- XRP uptrend takes a breather below resistance at $2.21 while the 50-day EMA offers support at $2.08.

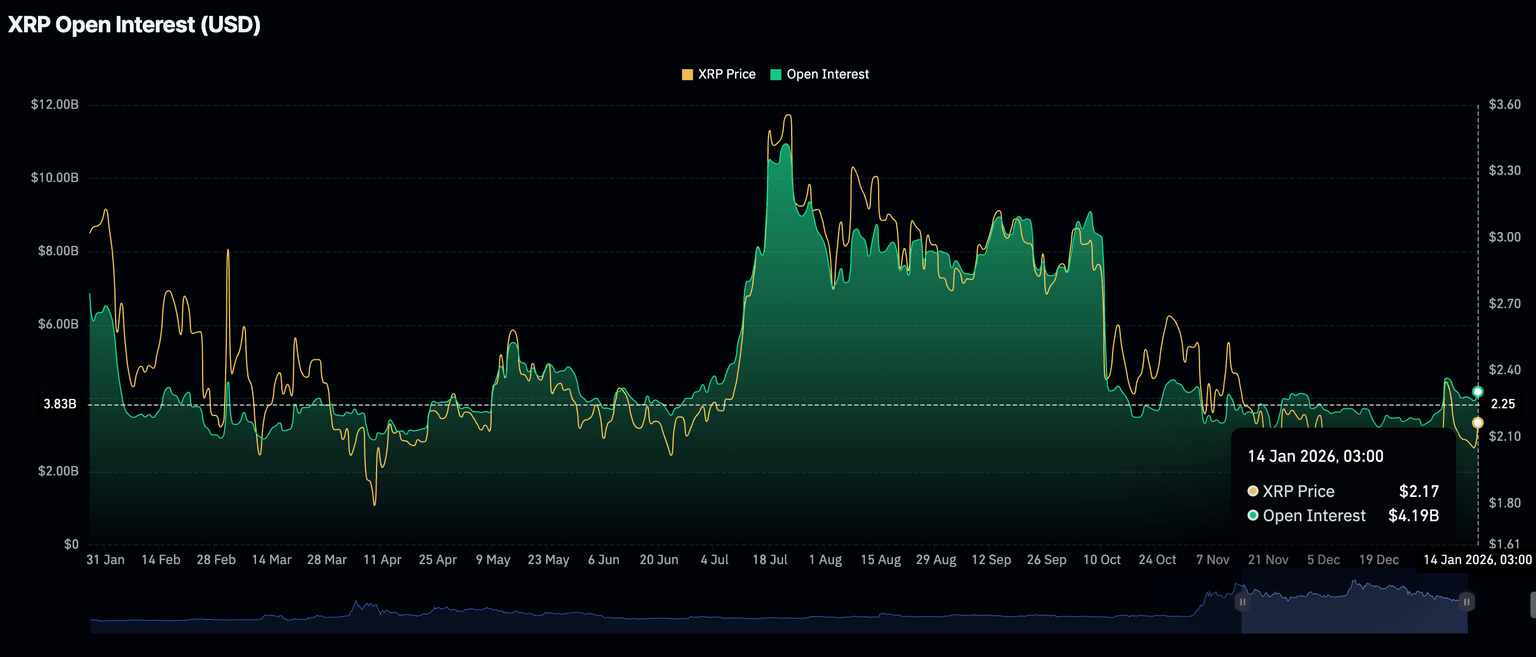

- The derivatives market shows strength, with futures Open Interest rebounding to $4.19 billion.

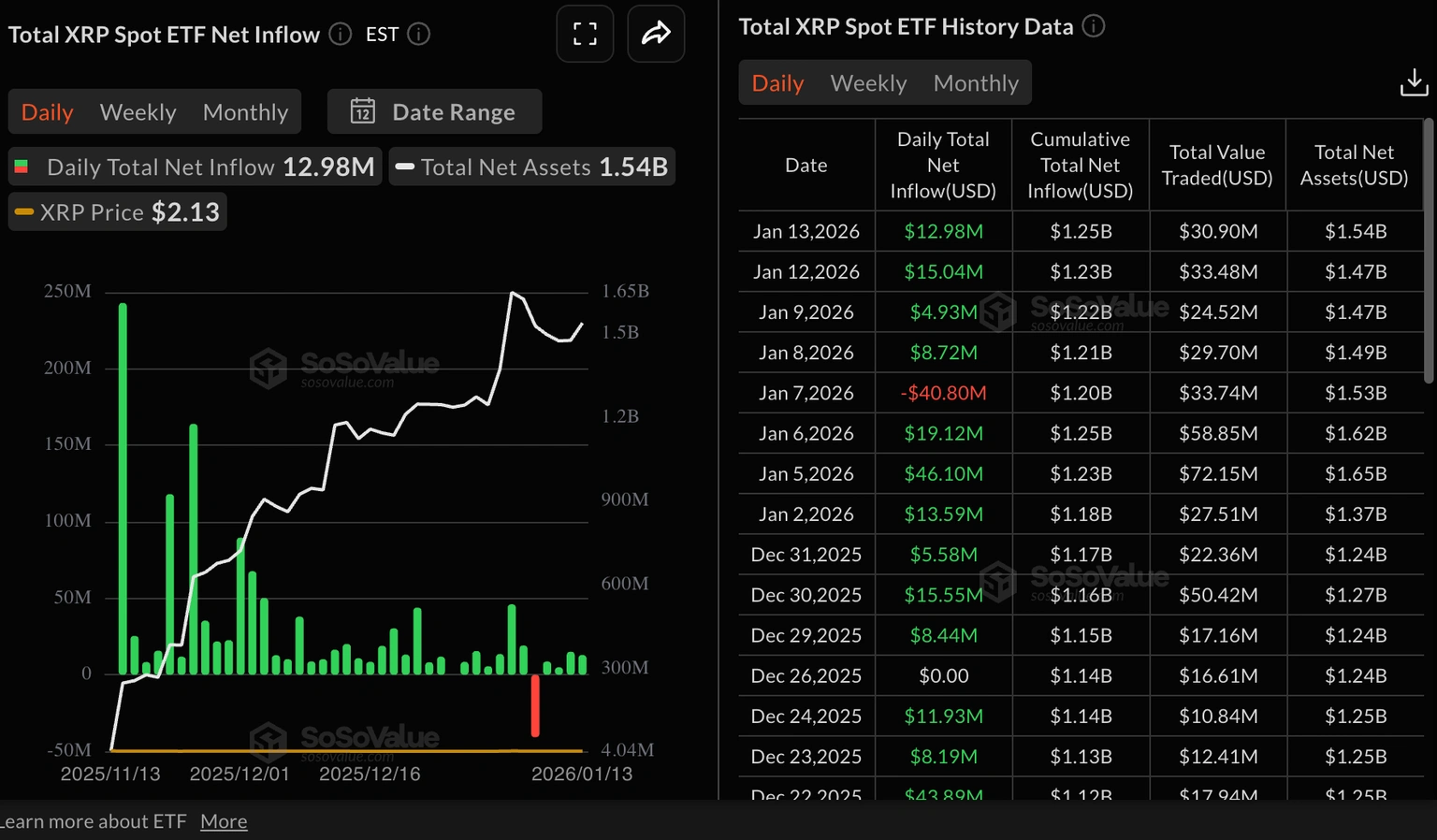

- XRP ETF recorded $13 million in inflows on Tuesday, led by Grayscale’s GXRP.

Ripple (XRP) is trading down to $2.15 at the time of writing on Wednesday after posting a brief rally the previous day. The uptrend, fueled by improved market sentiment after the US reported lower-than-expected core inflation in December, reached $2.19 before the ongoing correction.

Retail and institutional investors drive XRP demand

Retail interest in XRP is rising again, as reflected in futures Open Interest (OI), which averages $4.19 billion on Wednesday, up from $3.93 billion the previous day. The increase, albeit minor, suggests that investors are beginning to lean more into risk.

If this trend continues in the OI, representing the notional value of outstanding futures contracts, XRP could regain momentum to push for a short-term breakout toward $3.00.

Still, the OI sits below the yearly high of $4.55 billion, recorded on January 6, underscoring the need for traders to temper their expectations in the short term.

Meanwhile, interest in XRP spot Exchange Traded Funds (ETFs) continues to build, as SoSoValue reports nearly $13 million in inflows on Tuesday. Since their launch in November, XRP ETFs have recorded just one outflow, totaling nearly $41 million on January 7. The cumulative inflow now stands at $1.25 billion with net assets at $1.54 billion.

Technical outlook: Can XRP resume its uptrend?

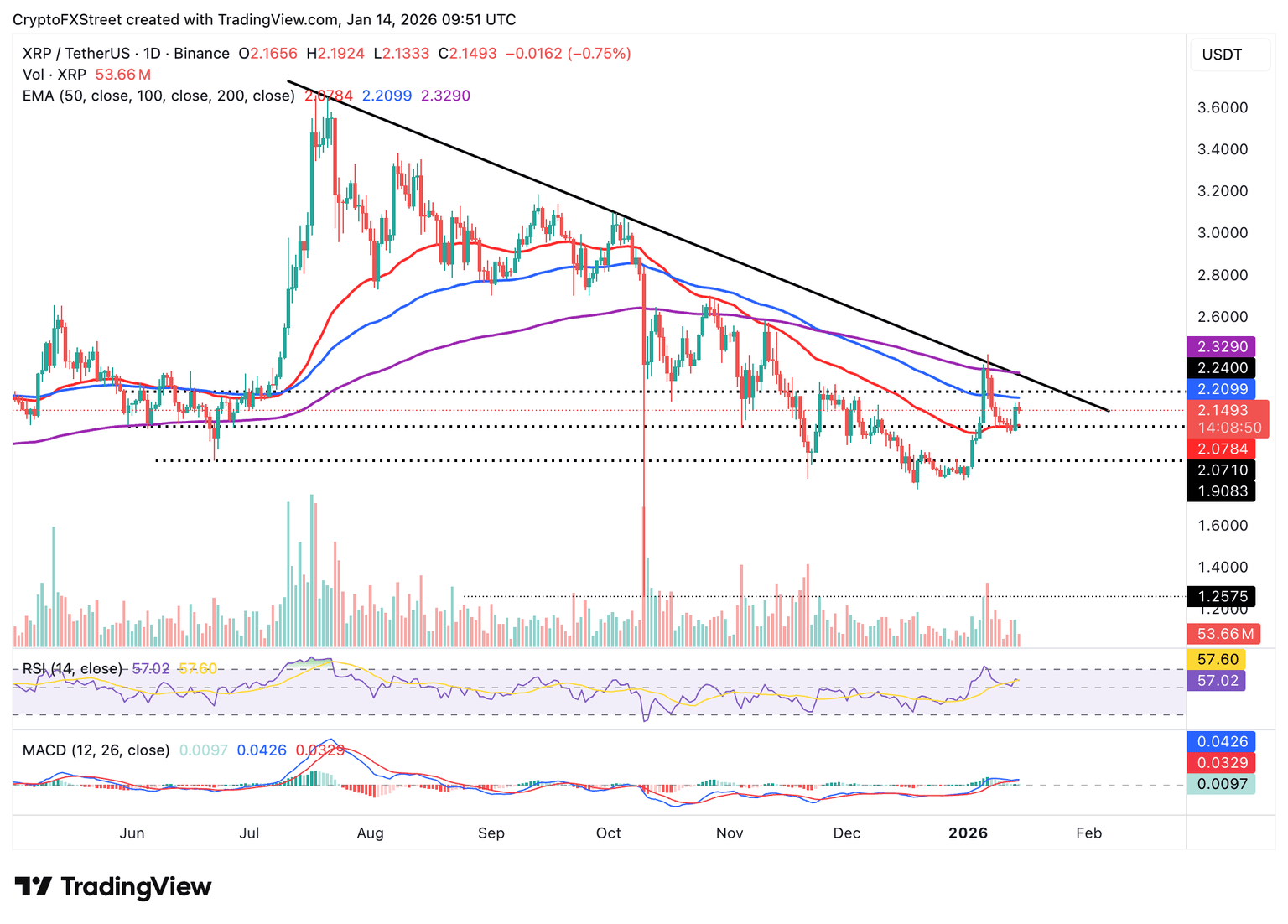

XRP is trading between a key support provided by the 50-day Exponential Moving Average (EMA) at $2.08 and the 100-day EMA at $2.21 at the time of writing on Wednesday.

The cross-border money remittance token is down over 1%, indicating early profit-taking after Tuesday's rally. A minor decline in the Relative Strength Index (RSI) to 57 on the daily chart confirms the buildup of downside pressure. If the RSI continues to fall, XRP could extend its correction toward the 50-day EMA.

Looking ahead, the Moving Average Convergence Divergence (MACD) indicator on the same chart holds above the signal line, which may prompt investors to increase their risk exposure.

The green histogram above the mean line should continue to expand, reinforcing bullish momentum and increasing the odds of a breakout. A close above the 100-day EMA at $2.21 could accelerate the uptrend toward the 200-day EMA ($2.33) and the descending trendline resistance.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren