Ripple Price Forecast: XRP crashes below $1.40 as exchange reserves surge

- XRP extends spiral drip below $1.40 amid aggressive sell-off.

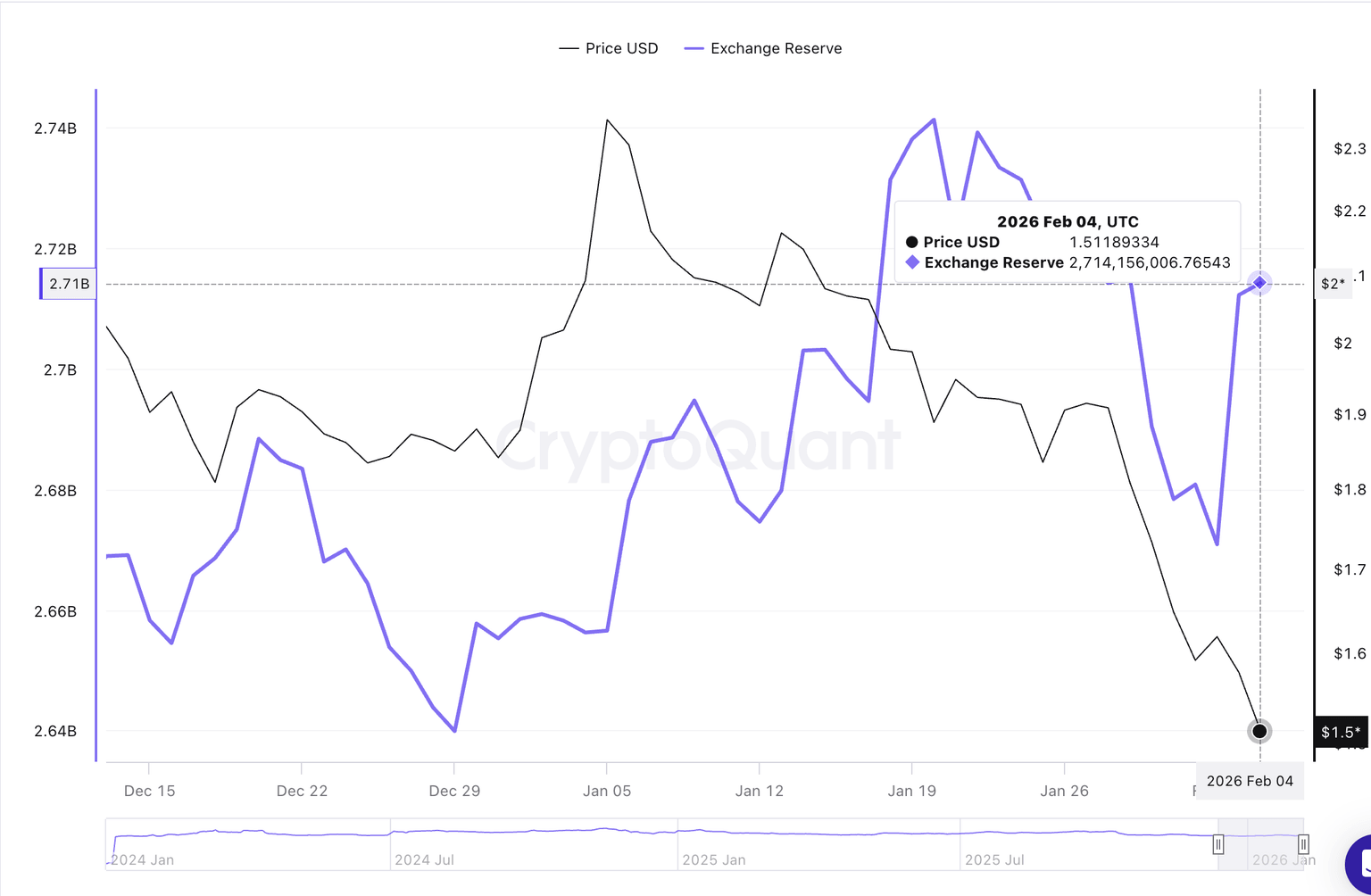

- XRP’s balance on exchanges rose to 2.71 billion tokens on Wednesday as holders prepare to sell.

- Weak derivatives and deteriorating technicals limit XRP’s recovery potential.

Ripple (XRP) is trading aggressively downward, while hovering at $1.37 at the time of writing on Thursday, reflecting a pristine risk-off mood across the crypto market. The remittance token is down nearly 10% intraday, weighed by intense volatility, retail investor exodus and declining institutional interest.

XRP accelerates sell-off as exchange reserves rise

The sell-off holding XRP downward follows a sudden increase in exchange reserves, which, according to CryptoQuant data average 2.71 billion tokens on Wednesday, from 2.67 billion recorded on Monday.

During periods of high volatility, investors often transfer their holdings to exchanges, intending to sell to reduce overexposure to risk. This trend increases the supply readily available in the open market, adding to the selling pressure.

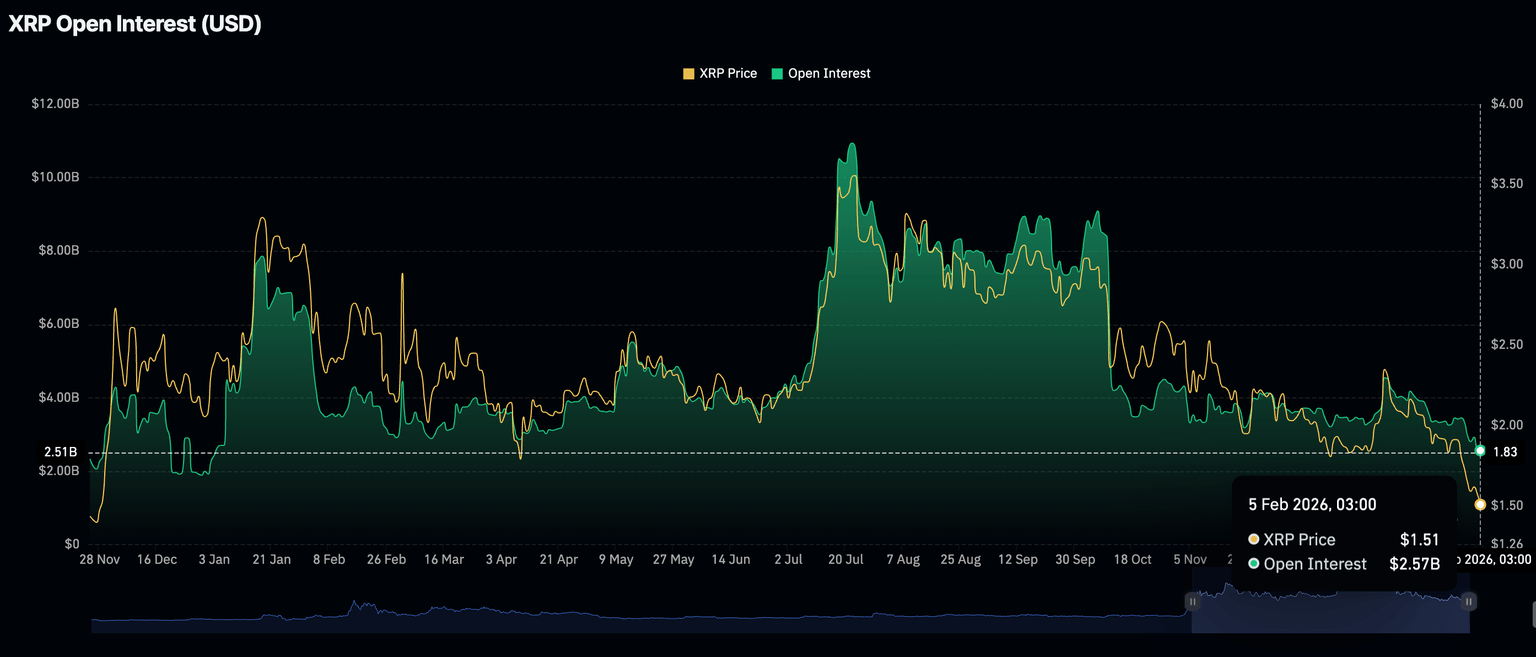

The XRP derivatives market paints a grim picture, as futures Open Interest (OI) falls to $2.57 billion on Thursday, from $2.61 billion on Wednesday. CoinGlass data shows that the OI hit a record $10.94 billion on July 22, ahead of the October 10 crash that liquidated over $19 billion in leveraged crypto assets.

If the sell-off in the derivatives market continues, characterized by traders closing their positions while not opening new ones, recovery would remain a pipe dream. The slump in XRP could extend toward the October 10 low at $1.25.

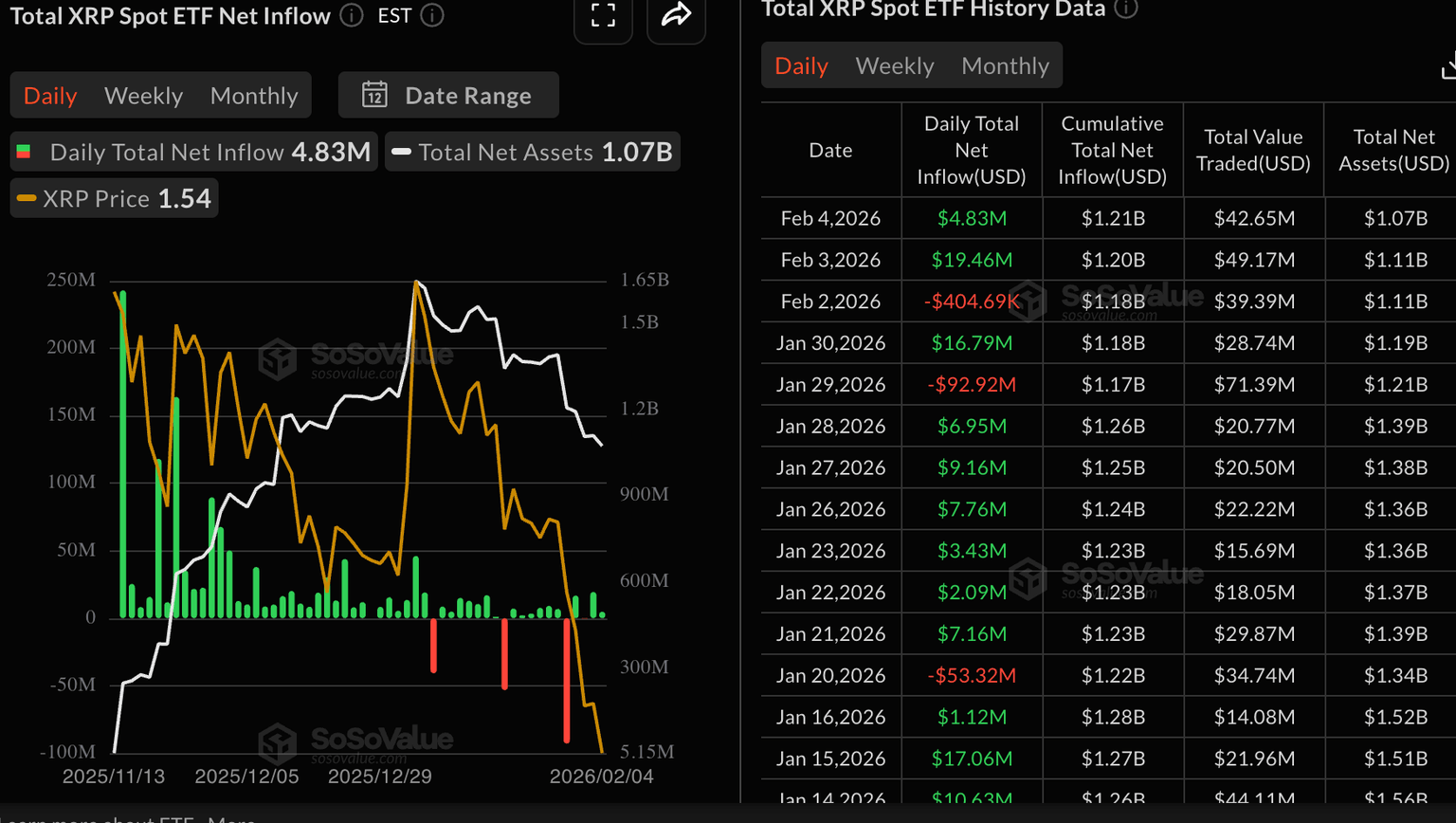

Meanwhile, demand for XRP spot Exchange-Traded Funds (ETFs) dropped on Wednesday, with inflows of nearly $5 million. Although mild, this marked a second consecutive day of inflows following approximately $19 million posted on Tuesday. The cumulative inflow currently stands at $1.21 billion, and assets under management at $1.07 billion.

Technical outlook: XRP tumbles as selling intensifies

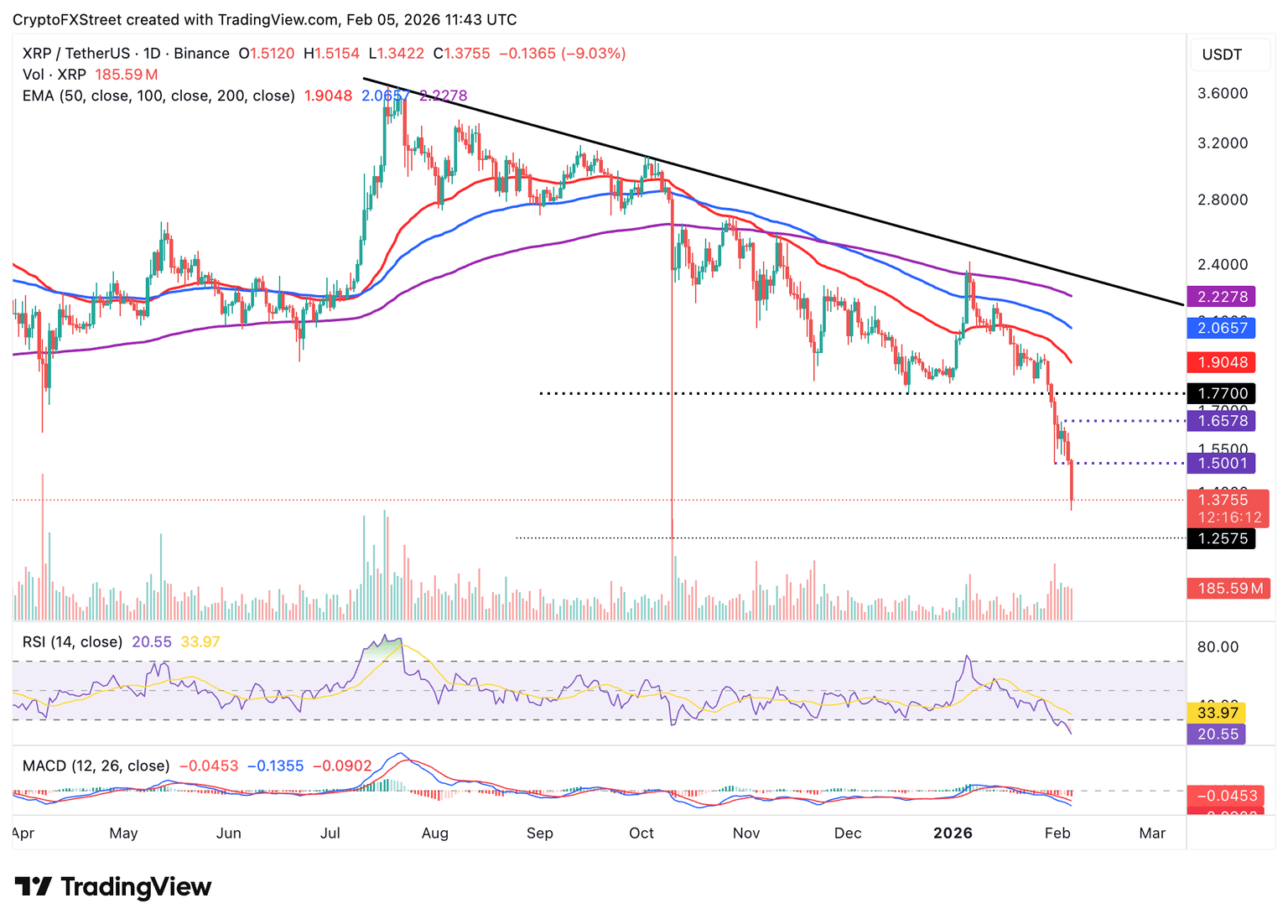

XRP is trading amid aggressive selling as the price holds well below the 50-day Exponential Moving Average (EMA) at $1.90, 100-day EMA at $2.07 and the 200-day EMA at $2.23. All three moving averages are trending lower, reinforcing a bearish bias.

The Moving Average Convergence Divergence (MACD) remains below the signal line and under the zero mark on the daily chart, with a deepening negative histogram that underscores strengthening bearish momentum. Similarly, the Relative Strength Index (RSI) at 20 is oversold, signaling an overextended downside that could precede a reflex bounce.

The descending trend line from $3.66 limits recovery attempts, with resistance aligning near $2.21. Momentum signals favor sellers, though an oversold RSI could potentially fuel a corrective bounce. Still, a daily close above the psychological $1.40 threshold would ease the bearish pressure and hint at a broader recovery.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

(The technical analysis of this story was written with the help of an AI tool.)

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren