Ripple Price Prediction: XRP wobbles as bearish sentiment spreads

- XRP struggles to hold the 100-day EMA as negative market sentiment takes root.

- XRP's performance hinges on macroeconomic data, particularly the Fed's September interest rate decision.

- XRP has defied bearish sentiment, posting positive monthly returns in September for three consecutive years.

Ripple (XRP) exhibits weakness in its technical structure on Monday amid concerns in the broader cryptocurrency market that September is historically a bearish month.

The cross-border money remittance is trading above $2.76 at the time of writing as bulls search for a short-term support to prevent the decline from extending to $2.50.

Can XRP recover despite bearish sentiment?

XRP's performance in September would largely depend on the United States (US) macroeconomic data. Market participants will closely monitor key inflation indicators, including the unemployment rate on Friday, the Producer Price Index (PPI) on September 10, the Consumer Price Index (CPI) and Jobless Claims on September 11.

The Federal Reserve (Fed) will consider the above indicators, along with others, to assess the economy's status ahead of the central bank's interest rate decision on September 17.

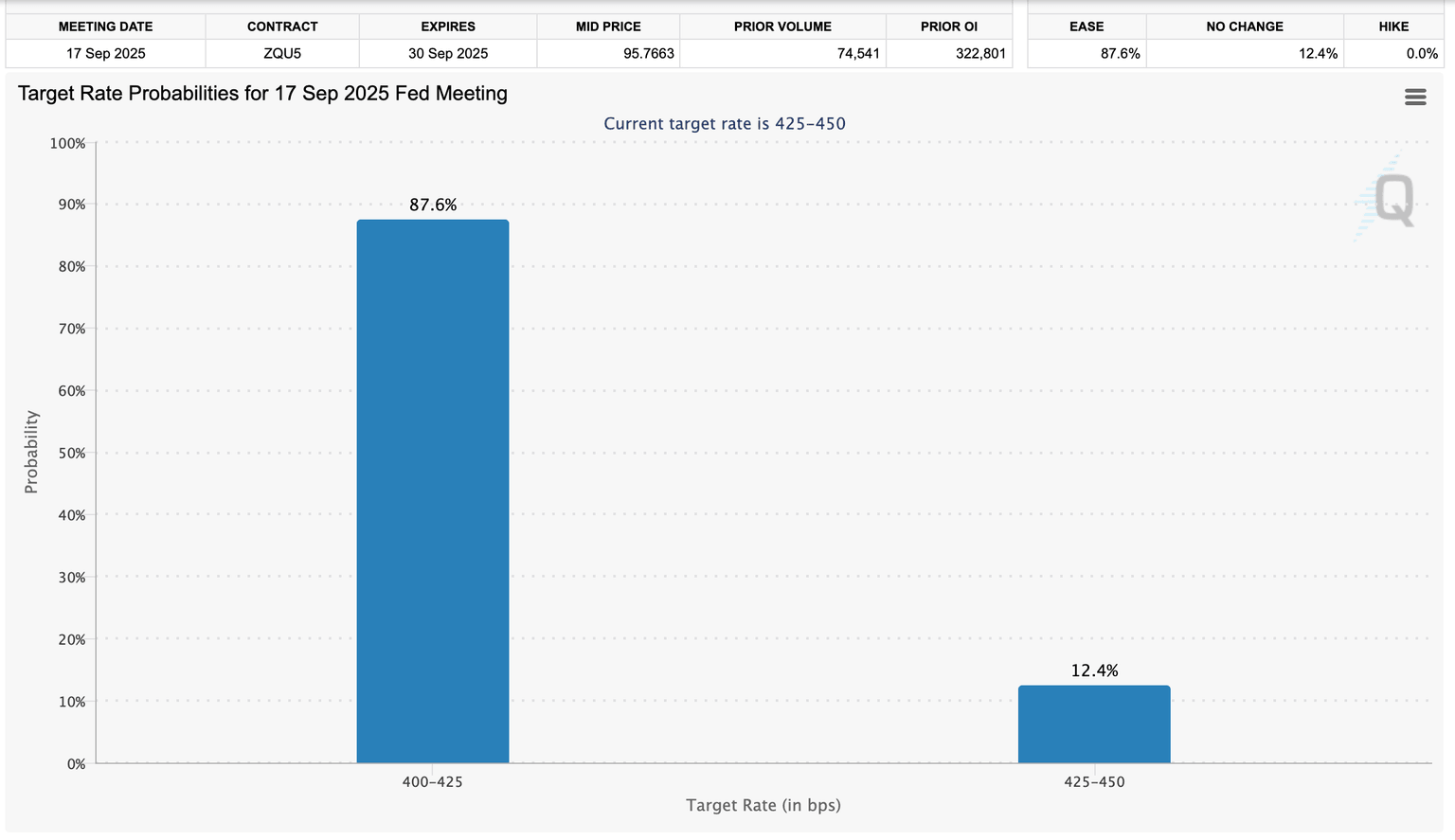

According to the CME Fedwatch tool, there is an 87.6% chance that the Federal Reserve will cut interest rates by 25 basis points (bps) to a range of 4% to 4.25%, a potential lifeline for risk asset classes, such as crypto and equities.

FedWatch Tool | Source: CME Group

Investors are looking forward to the first interest cut this year, which could boost interest in risk assets, including cryptocurrencies. Positive market sentiment could accelerate demand for XRP and intensify the tailwind ahead of a potential rebound above the $3.00 mark.

Still, risk-averse sentiment could prevail if the Fed does not cut the rates. Risk assets could suffer setbacks, affirming the current concerns about bearish sentiment in September.

On the positive side, data shows that XRP has posted positive market returns in the last three consecutive Septembers. In 2022, XRP closed September up 46.2%. In 2023, the token posted a minor profit of 0.42%, which increased to 7.98% in 2024, according to CryptoQuant.

There is a possibility that XRP will extend its profitable streak for the fourth consecutive year if sentiment improves in the coming days and weeks.

XRP monthly returns | Source: CryptoQuant

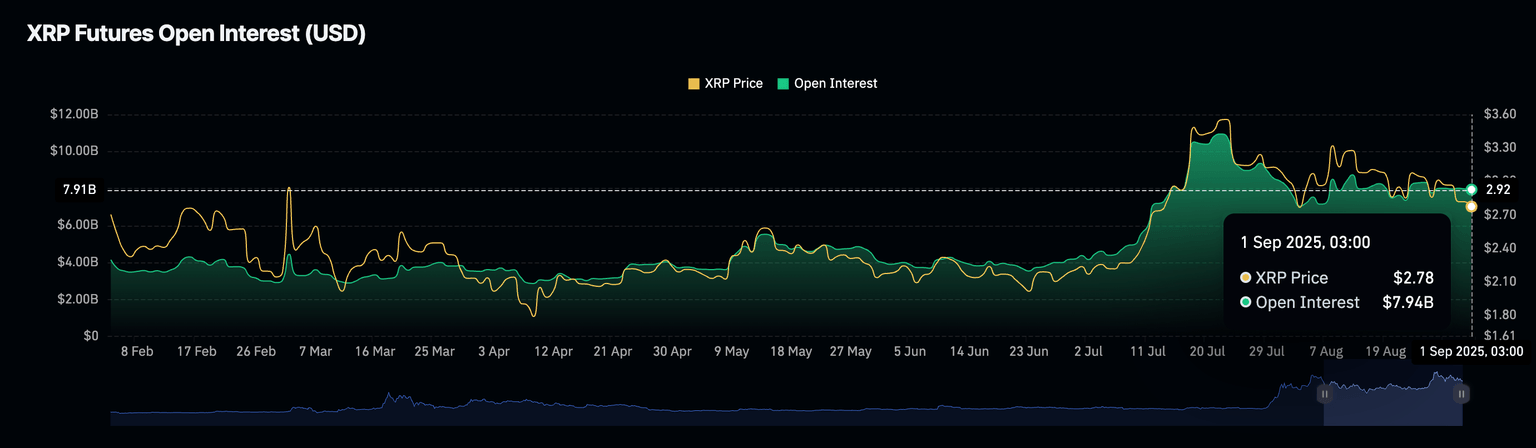

Retail interest in the international money remittance token remains relatively elevated near the $8 billion mark. Traders will be watching the Open Interest (OI), which represents the notional value of outstanding futures contracts, to gauge market sentiment and optimism.

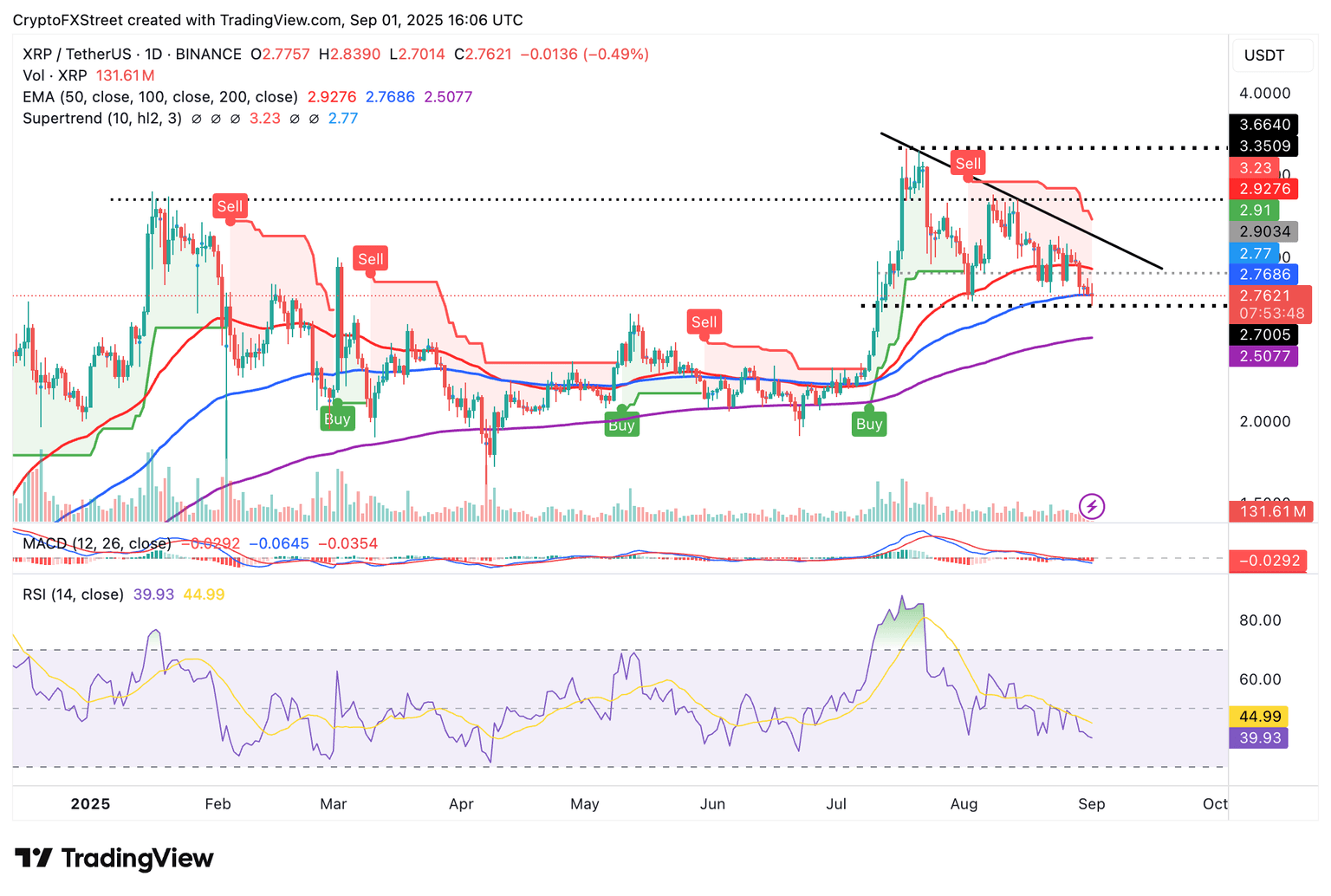

Technical outlook: XRP edges lower

XRP price is struggling to hold the 100-day Exponential Moving Average (EMA) at $2.76 as bearish sentiment spreads in the broader cryptocurrency market. The path of least resistance is downward based on the prevailing technical picture.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator has been maintained since July 25, reinforcing the bearish grip. Traders may continue de-risking with the blue MACD line remaining below the red signal line.

XRP/USDT daily chart

Buying pressure is also on a decline as reflected by the Relative Strength Index (RSI) dropping to 39 from its July peak of 88. Lower RSI readings would imply fading bullish momentum, as traders remain on the sidelines.

On the other hand, a daily close above the 100-day EMA, at $2.76, would go a long way to affirm a strengthening bullish grip. Key milestones include XRP's return above the $3.00 mark and a break above resistance at $3.35, tested in mid-August.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren