Ripple price bound for another leg down after Grayscale dissolves XRP Trust

- The SEC lawsuit against Ripple leads to the dissolution of Grayscales XRP Trust.

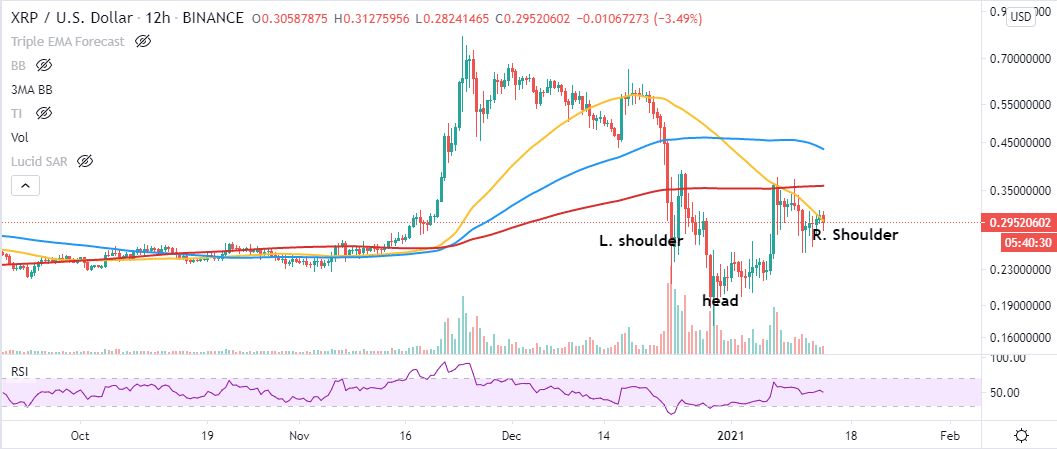

- Selling pressure is likely to soar if XRP/USD closes the day under the 50 SMA on the 12-hour chart.

Grayscale has commenced the dissolution of its XRP Trust following the lawsuit filed by the Securities and Exchange Commission's December 22, 2020. According to the United States SEC, XRP is unregistered security under federal laws.

XRP woes continue as Ripple battles lawsuit

XRP has faced multiple challenges following the lawsuit filed against the $10 billion blockchain startup, including delisting from major trading platforms and other sponsorship cancellations. Converting XRP to fiat money has become increasingly difficult for investors in the United States.

Grayscale's decision will see the XRP Trust dissolved. The Trust's proceeds will be distributed to the shareholders, but after the investment company deducts expenses. The Trust is expected to cease operations after all the proceeds have been distributed.

Ripple poised for another breakdown

The rejection of XRP at the 50 Simple Moving Average on the 4-hour chart is a substantial bearish signal. It also follows a correction from the stubborn resistance at $0.3. If selling pressure accelerates and XRP fails to regain this support, prices could retest $0.29 and perhaps drop back to the recent significant support at $0.25.

XRP/USD 12-hour chart

On the bullish side, the argument is that XRP is has started to print a possible inverted head-and-shoulder pattern. This pattern is very bullish and is used in technical analysis to identify a reversal from a downtrend. It also signifies that sellers are losing momentum while buyers prepare to regain control.

However, it is essential to note that the bullish outlook will be confirmed when XRP reclaims the position above the 200 SMA on the 12-hour chart. The rest of the journey to $0.5 may also encounter delays at $0.4 and the 100 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren