Polkadot price might need to see a strong 20% pullback before resuming uptrend

- Polkadot price had a significant 150% rally in 2021 reaching $19.4.

- The digital asset will be incorporated as a trust in Grayscale.

- If DOT bulls can’t defend a crucial level at $15.8, the digital asset can see a major pullback.

Polkadot had one of the best performances in 2021 reaching rank fourth above XRP with a market capitalization of $16 billion. Although DOT already had a significant pullback from its all-time high price of $19.4, the digital asset could be bounded to fall lower.

Polkadot price needs to defend this level to avoid a 20% fall

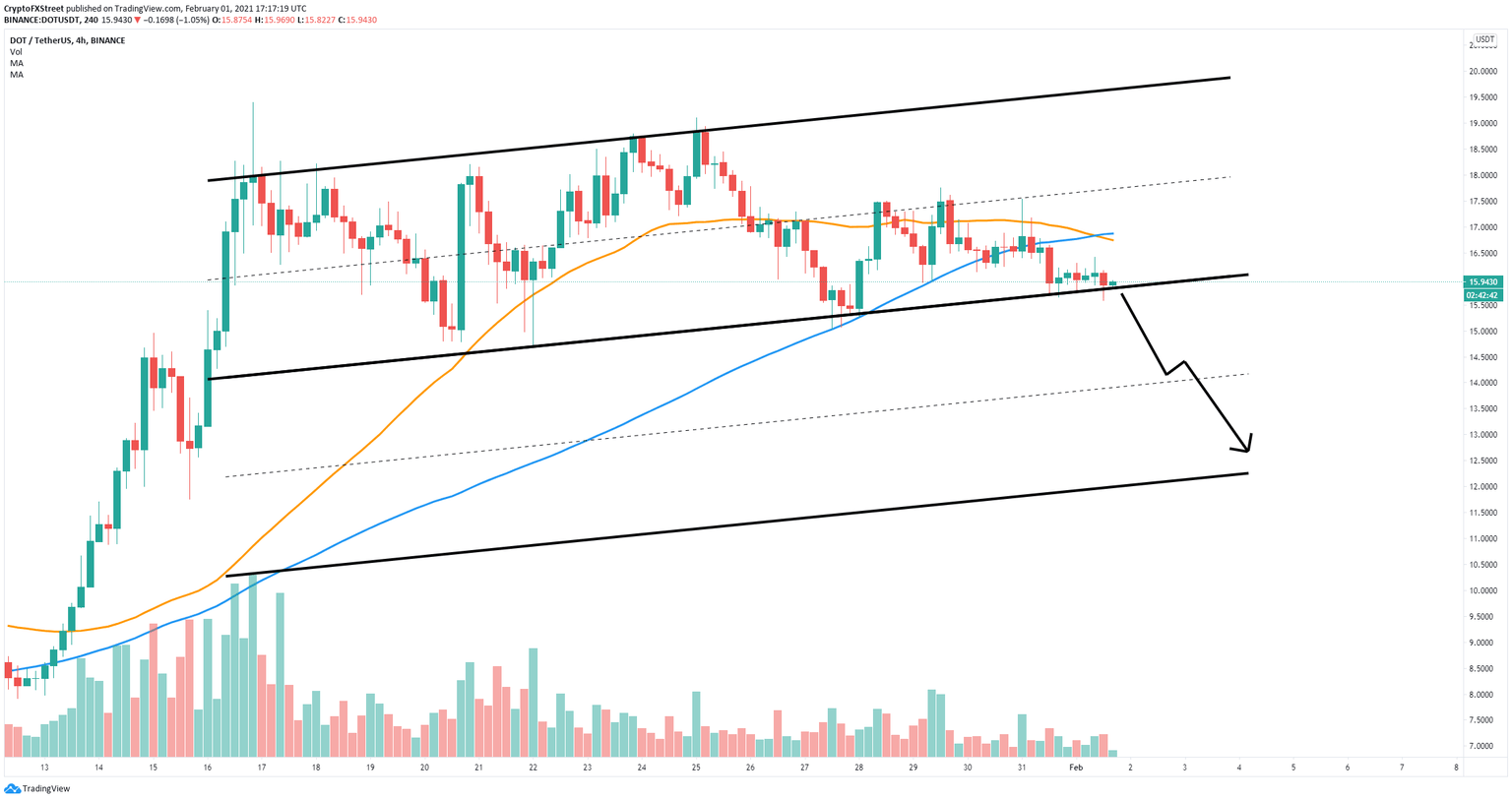

On the 4-hour chart, Polkadot trades inside an ascending parallel channel, right above the support trendline at $15.8. A breakdown below this level will push the digital asset to $14 and as low as $12 in the long-term.

DOT/USD 4-hour chart

The trading volume of Polkadot peaked at $8.7 billion on January 17, right at its all-time and has been declining significantly since then, which indicates another major move is underway. DOT bulls lost the 50-SMA and 100-SMA support levels, adding more credence to the bearish outlook.

DOT volume

However, on January 28, the crypto asset manager Grayscale incorporated six more trusts, including Polkadot. Although Michael Sonnenshein, CEO of Grayscale stated that trust formations do not mean the firm will launch the products, it is still extremely positive for Polkadot.

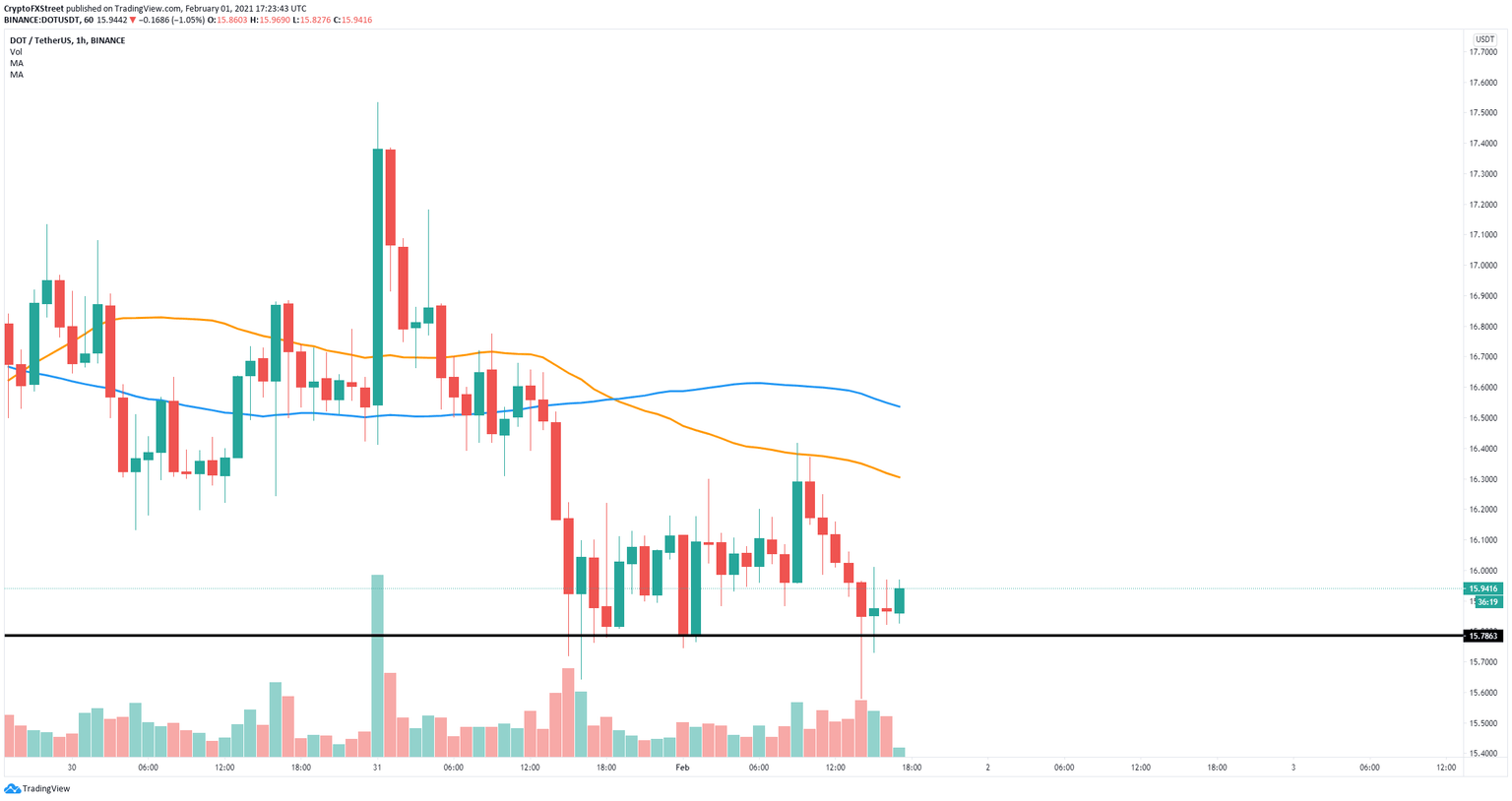

DOT/USD 1-hour chart

On the hourly chart, Polkadot price has established a robust support level at $15.8 which held again in the past four hours. If bulls can push DOT above the 50-SMA at $16.3 and the 100-SMA at $16.5, the digital asset can easily climb towards $17.5.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B18.22.37%2C%252001%2520Feb%2C%25202021%5D-637477972173294765.png&w=1536&q=95)