Polkadot Price Forecast: DOT screams buy from a counter sentiment perspective

- Polkadot price has defended a crucial support level at $15.5 and aims for a strong rebound.

- The negative sentiment on social media is a bullish indicator.

- The digital asset faces a strong resistance barrier of around $18.

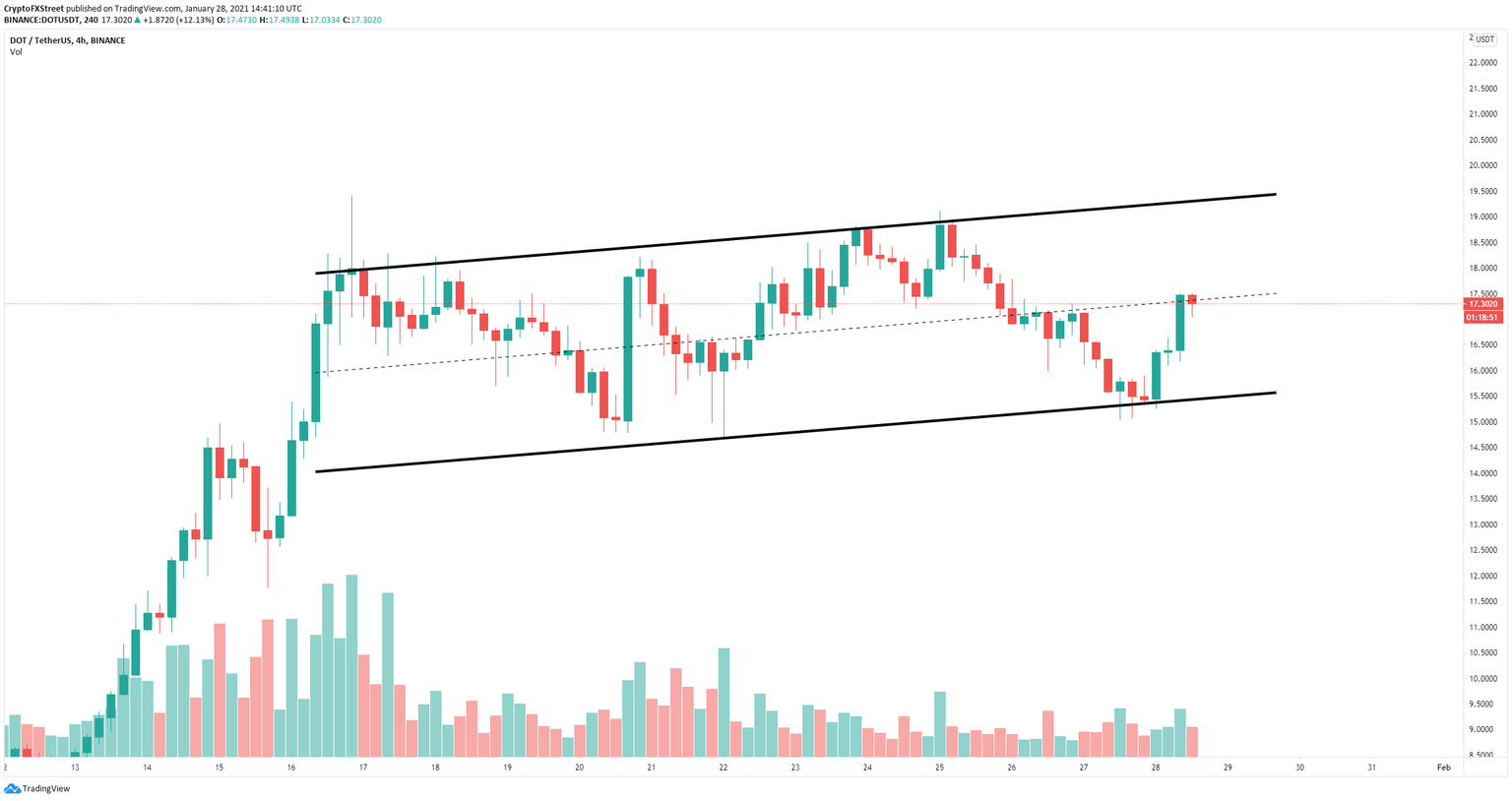

Polkadot has been trading inside an ascending parallel channel on the 4-hour chart since January 16. The digital asset has just rebounded from a crucial support level at $15.5 and could be aiming for a long-term price target of $19.

Polkadot price bounces towards $19 as on-chain metric turns bullish

DOT bulls have just defended the channel's lower trendline support on the 4-hour chart, at $15.5. Polkadot price is up by 14% since touching $15.25 and faces very little resistance to the upside until $18.

DOT/USD 4-hour chart

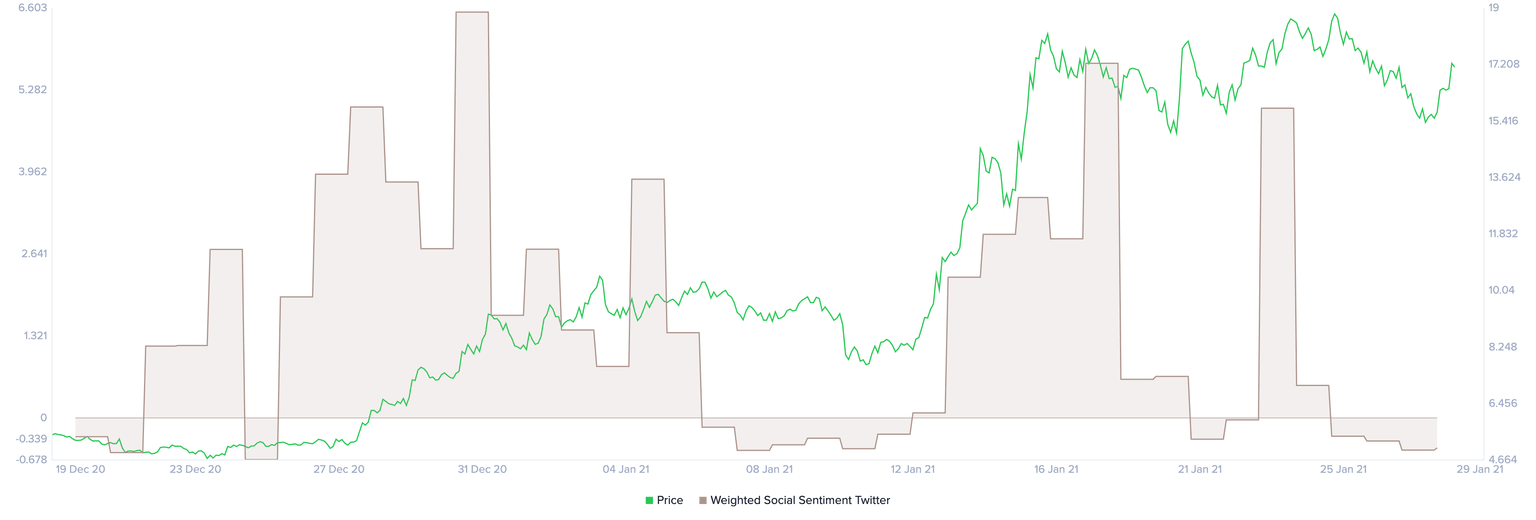

The Weighted Social Sentiment chart is currently negative for the past four days, which can usually translate into good buying opportunities. Similarly, when it’s positive and really high, Polkadot experiences pullbacks.

Polkadot Weighted Social Sentiment Twitter chart

Additionally, the overall social volume that Polkadot has received in the past week has declined significantly. This is another indication of a potential rebound as the low social volume can often lead to significant pumps.

Polkadot Social Volume

Nonetheless, the digital asset has some trouble climbing above the middle trendline of the parallel channel at $17.5. Rejection from this level can push Polkadot price down to the lower trendline at $15.5 again.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.43.23%2C%252028%2520Jan%2C%25202021%5D-637474419595415332.png&w=1536&q=95)