Polkadot price is on pace for $4, but a pullback is expected for these reasons

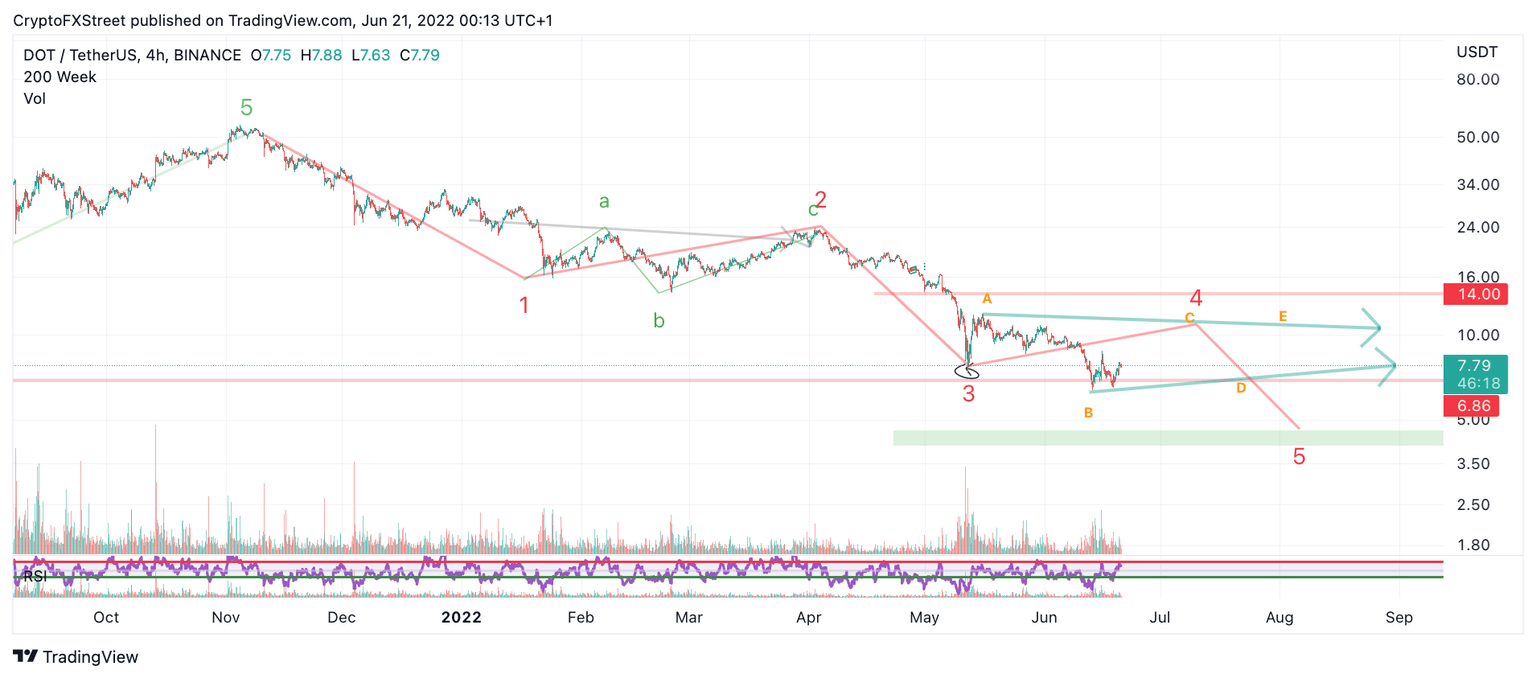

- Polkadot price is still in a significant downtrend unless $16.42 is touched. One more decline is possible to create the fifth wave down.

- The volume profile shows bullish re-entrance into the market while bitcoin has been signaling multiple market bottom indicators.

- Invalidation of this downtrend idea is a breach above wave A at $11.47.

Polkadot price could print one more decline into $4. Bitcoin, however, shows bullish evidence; thus, a pullback scenario is likely.

Polkadot price may go up, sideways, then back down.

Polkadot price, like many cryptos in the market, shows signals of a temporary bottom. Still, this thesis is written more as a warning of certain levels and a potential forecast on how the next move might play out.

Polkadot price declining structure may pull back but not exceed the $11.47 mark if these technicals are correct. Since its first decline on January 20, 2022, the DOT Price produced a very common zigzag structure as a wave two retracement. The current pullback warrants the idea that a wave four triangle may be underway as a rule of Elliot Wave alternation. The Volume Profile indicator confounds the idea of a brief relief rally as bulls are visibly re-entering the market. Bitcoin has also shown reasons to believe that a local bottom is near.

DOT/USDT 4-Hour Chart

A breach above $16.42 can invalidate the macro downtrend. However, traders looking to play the range can use wave A at $11.47 as a bearish invalidation and potentially short the DOT price in the coming weeks if the opportunity presents itself. If 11.47 were to get breached, the bulls could rally as high as $15, resulting in a 102% increase from the current DOT price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.