Polkadot may continue to slide south, but downside for DOT limited to $32

- Polkadot price, like most cryptocurrencies, has experienced a significant retracement over the past two weeks.

- The threat of continued selling pressure remains, but a strong support level is evident.

- Bulls eye a hint of supportive price action that would eliminate further selling.

Polkadot price has moved beyond the normal range of a technical correction. It has moved as much as 31% below the most recent all-time high and continues to show strong selling.

Polkadot price action shows bears remain in control as bulls struggle to find support

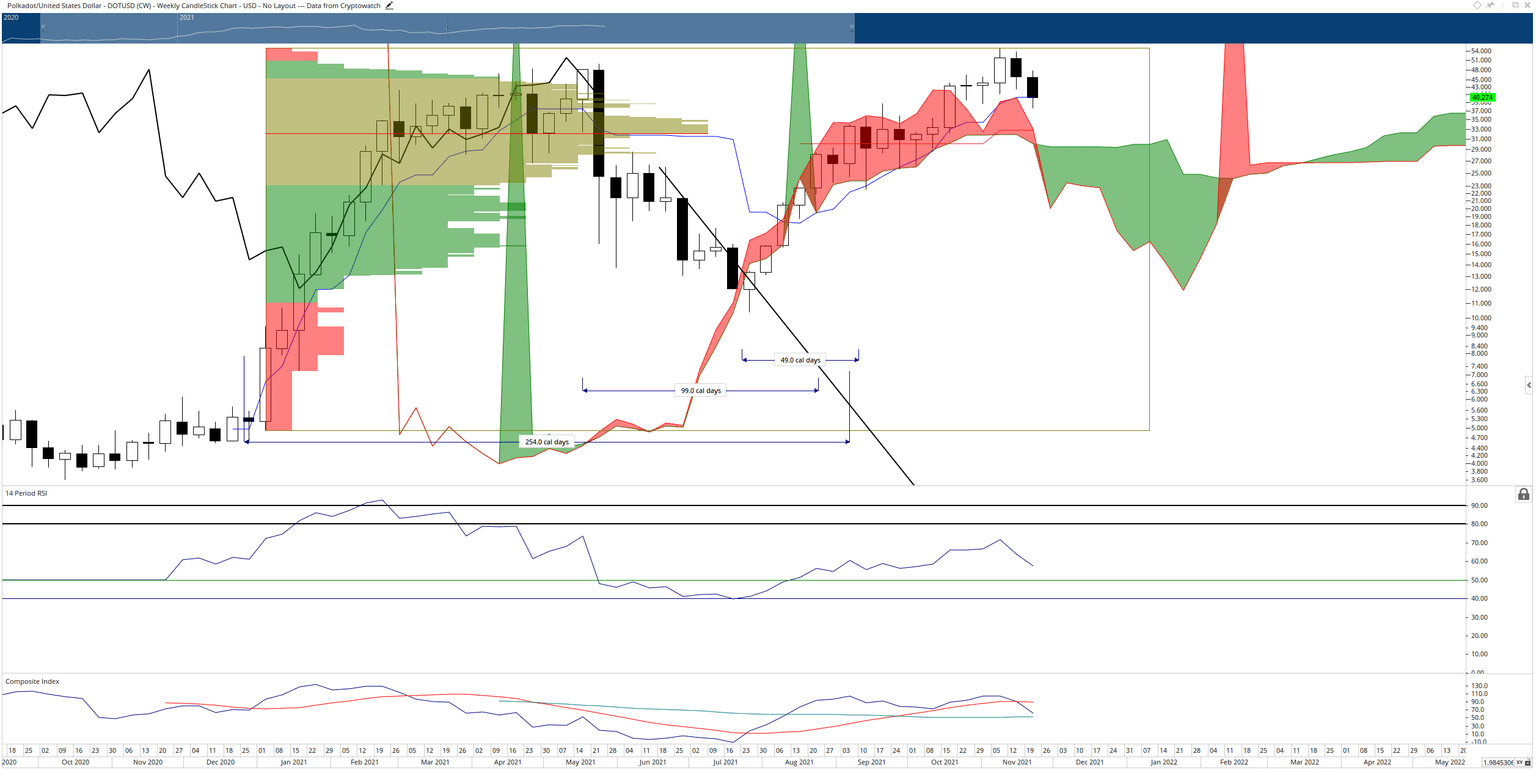

Polkadot price appears to have found some temporary support against the weekly Tenkan-Sen at $40. Sellers have pushed DOT below that level, but buyers have stepped in and returned Polkadot above that support level.

However, the broader cryptocurrency market remains very weak and Polkadot’s oscillators show that lower prices remain a high probability. Downside risks should be limited to the $32 value area. The 2021 Volume Point Of Control, weekly Kijun-Sen and weekly Senkou Span B share the $32 price level.

The combination of the most vital support level in the Ichimoku Kinko Hyo system (Senkou Span B) and one of the most potent technical support levels, the Volume Point Of Control, create the most robust support level on the weekly Polkadot price chart.

However, bears should be cautious about getting too greedy. The Tenkan-Sen has held as the primary Ichimoku support level for Polkadot price for the past fourteen weeks. Therefore, any downside outlook will be invalidated if buyers push DOT to a close at or above $46.

DOT/USDT Weekly Ichimoku Chart

Above the $46 price level, the Volume Profile becomes thinner, giving Polkadot price an easier time moving higher than it will moving lower.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.