Pi Network Price Forecast: Bulls eye further gains as a whale acquires nearly 3 million PI tokens

- Pi Network edges higher, breaking out from its recent consolidation range.

- Bitget and MEXC exchanges offload PI to other exchanges amid the short-term recovery.

- A large-wallet investor acquires nearly 3 million PI tokens, marking the largest transaction in the last 24 hours.

Pi Network (PI) edges higher by over 4% at press time on Tuesday after breaking out of a consolidation range. A large wallet investor, popularly known as whales, has acquired nearly 3 million PI tokens, reflecting confidence in the breakout rally.

However, Pi network struggles to surpass the $0.50 psychological mark as Bitget and MEXC exchanges offload their holdings to other exchanges.

Whale adds 2.91 million PI tokens

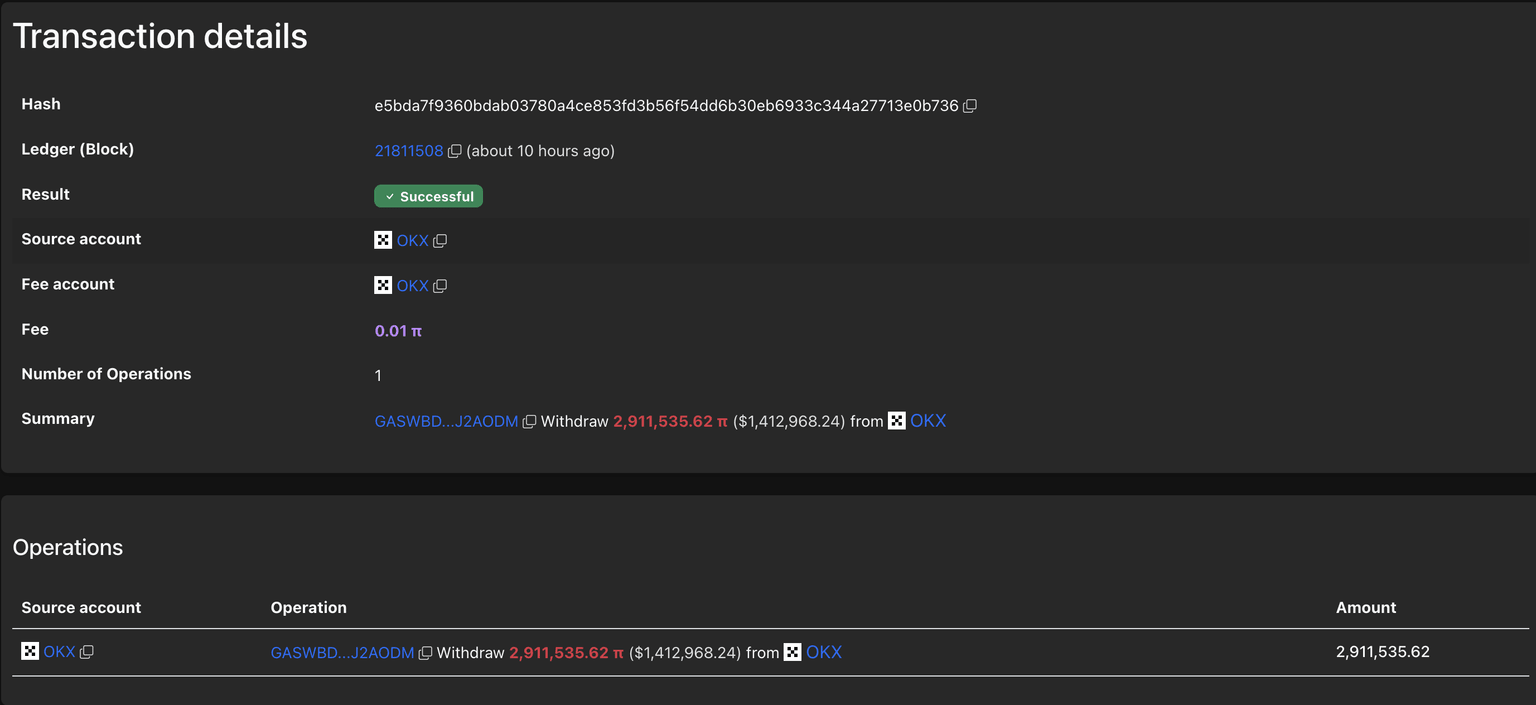

PiScan data shows that the largest transaction over the last 24 hours is the withdrawal of 2.91 million PI tokens, worth $1.41 million, to the “GASWBD…J2AODM” wallet from the OKX exchange. Typically, such high-volume withdrawals reflect the confidence of whales.

Whale transaction details. Source: PiScan

Bitget and MEXC offload PI holdings

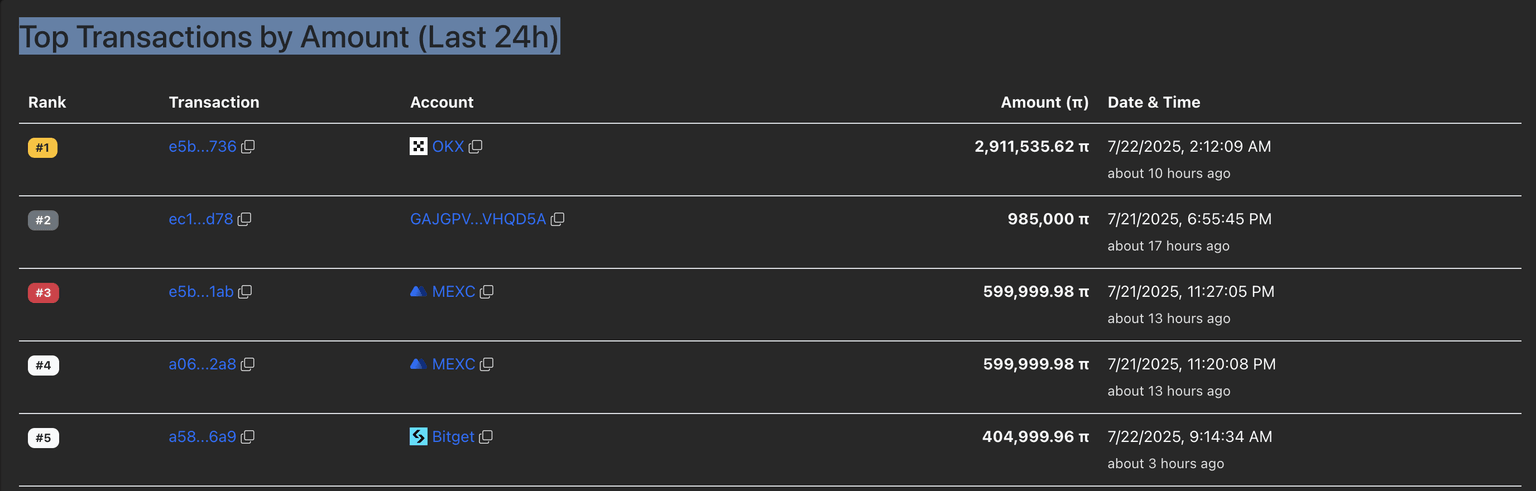

PiScan data of the largest transactions in the last 24 hours shows two high-value transactions of 599,999 PI tokens from MEXC exchange to Gate.io and OKX exchange. Similarly, Bitget deposited 404,999 PI tokens on Gate.io. The outflows from MEXC and Bitget suggest a potential sell-off or a strategic redistribution of PI tokens.

Top Transactions on Pi Network. Source: PiScan

Pi Network targets $0.50 breakout

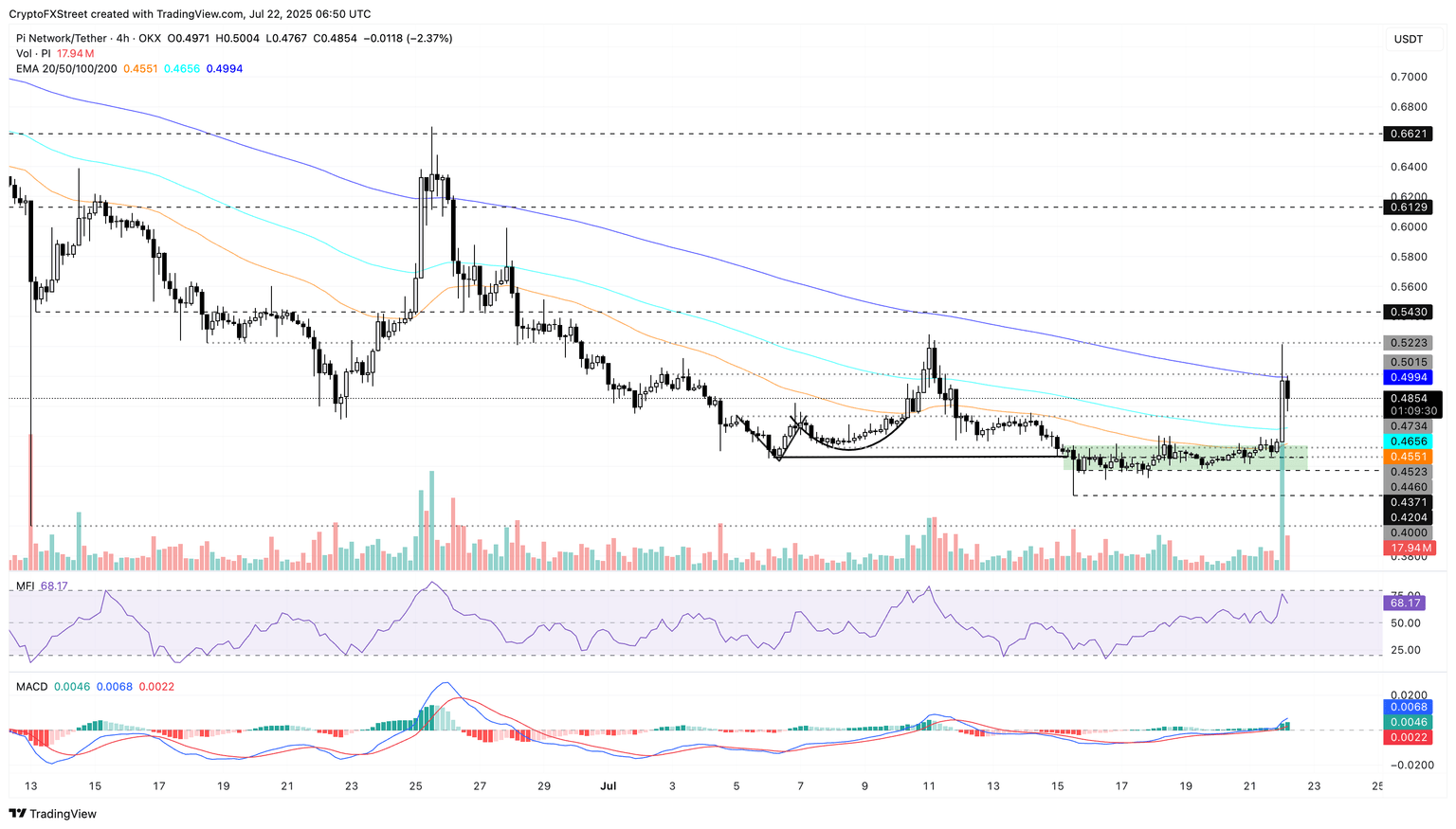

Pi Network breaks out of a consolidation range to test the 200-period Exponential Moving Average (EMA) on the 4-hour chart at $0.4994. PI marks a 24-hour high of $0.5215 but fails to close a candle above the 200-period EMA, resulting in a minor pullback.

If PI succeeds in surpassing the 200-period EMA, it could stretch the uptrend to the $0.5223 level marked by the June 18 low.

The 50-period EMA inches closer to surpassing the 100-period EMA, generally known as a bullish crossover. Sidelined investors could consider this a buy signal as a short-term rally outpaces the medium-term trend.

The Moving Average Convergence/Divergence (MACD) and its signal line cross above the zero line. A resurgence of green histogram bars from the same line suggests increased bullish momentum.

The Relative Strength Index (RSI) stands at 68 on the 4-hour chart, remaining above the halfway line, indicating an increase in bullish momentum in short-term trading activity.

PI/USDT daily price chart.

On the downside, if PI fails to hold grounds above the 100-period EMA at 0.4656, it could extend the declining trend to the 50-period EMA at $0.4551.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.