Pi Network Price Forecast: PI nears range breakout as bullish momentum revives

- Pi Network remains muted in a consolidation range, under the $0.45 resistance level.

- Pi App Studio gains traction with over 7,600 chatbot apps and 14,100 custom apps, boosting the Pi Network ecosystem.

- The large transactions over the last 24 hours indicate increasing whale activity at lower price levels.

Pi Network (PI) edges higher by over 1% at press time on Monday while maintaining a sideways trend in a consolidation range. The recently launched Pi App Studio on Pi2Day (June 28) gains traction with increased developer activity, while the large transactions over the last 24 hours hint at rising whale activity. The technical outlook suggests a decline in bearish momentum, indicating a potential breakout from the consolidation range.

Pi App Studio boosts developer activity on Pi Network

Pi App Studio is an AI-powered no-code platform launched on the Pi Network on Pi2Day (June 28). In an announcement on Sunday, it was revealed that over 7,600 chatbots and 14,100 custom apps were built with the help of Pi App Studio. The increased developer activity on Pi Network translates into a growing ecosystem.

Pi Network whale makes a strategic allocation move

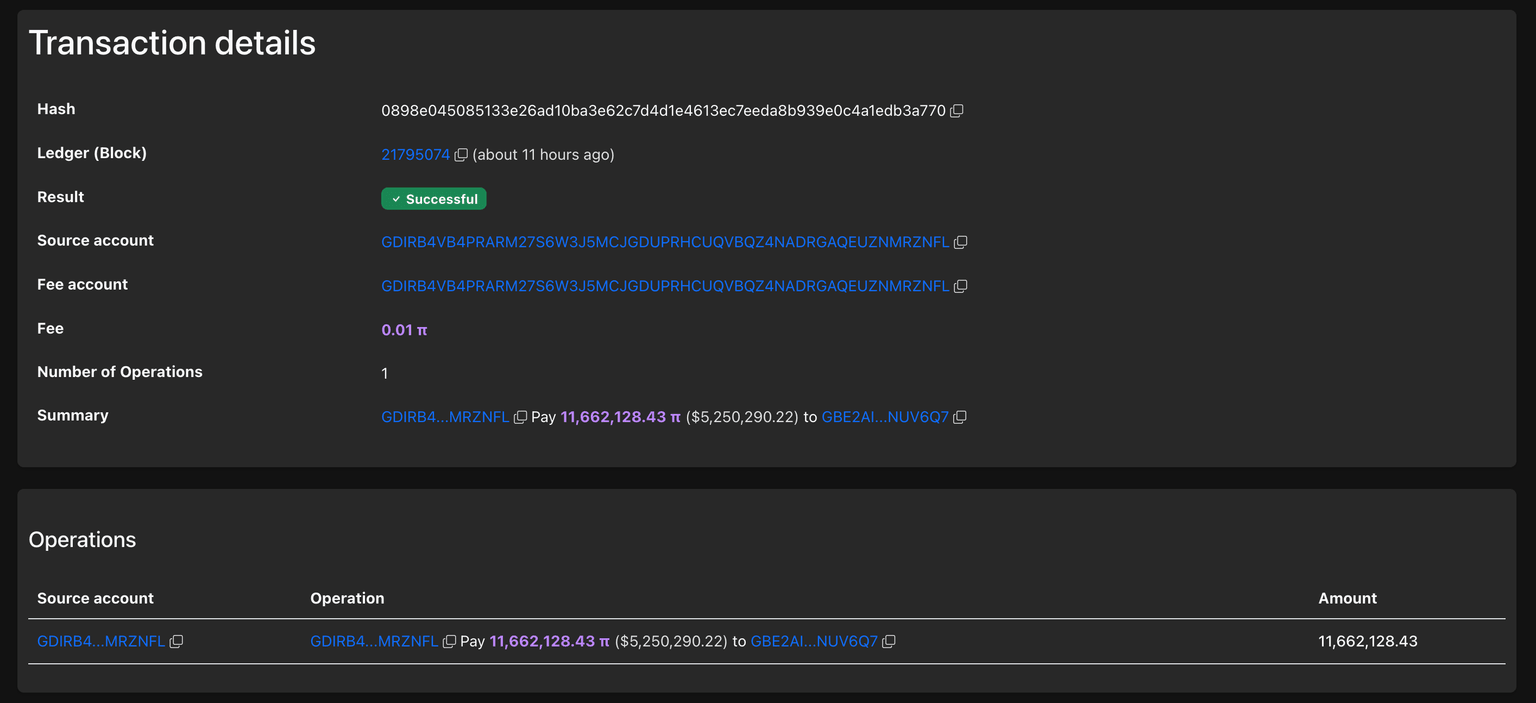

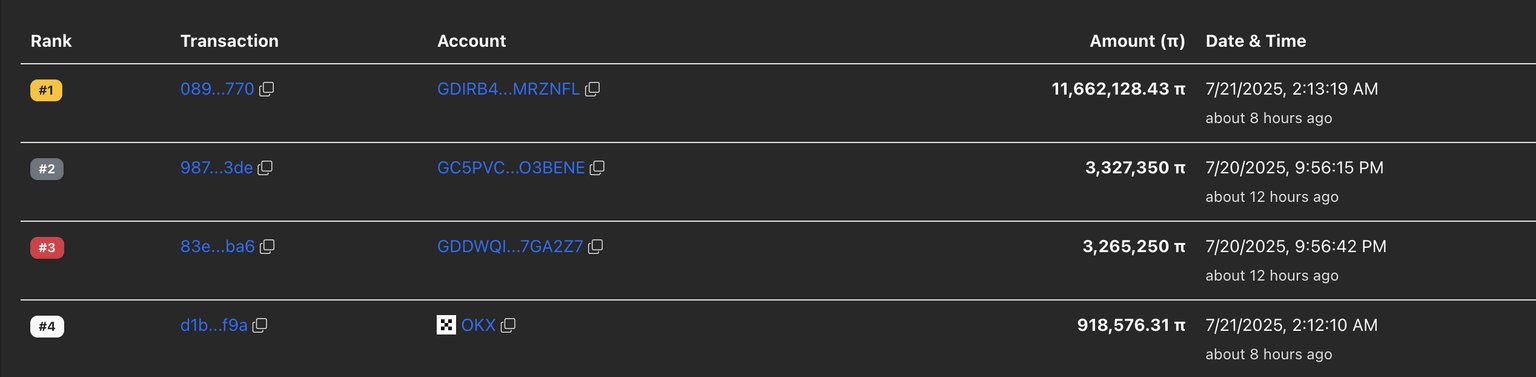

PiScan data shows that the three largest transactions in the last 24 hours account for over 18 million PI tokens. The largest transaction refers to a transfer of 11.66 million PI tokens worth $5.26 million from GDIRB4…MRZNFL to GBE2AI…NUV6Q7.

Pi Token transaction details. Source: PiScan

It is worth noting that the other two largest transactions are 3.32 million and 3.26 million PI token transfers to the GDIRB4…MRZNFL wallet. This suggests a strategic allocation of PI tokens by a whale.

Pi Network's largest transactions. Source: PiScan

PI trapped in a range, eyes bullish breakout

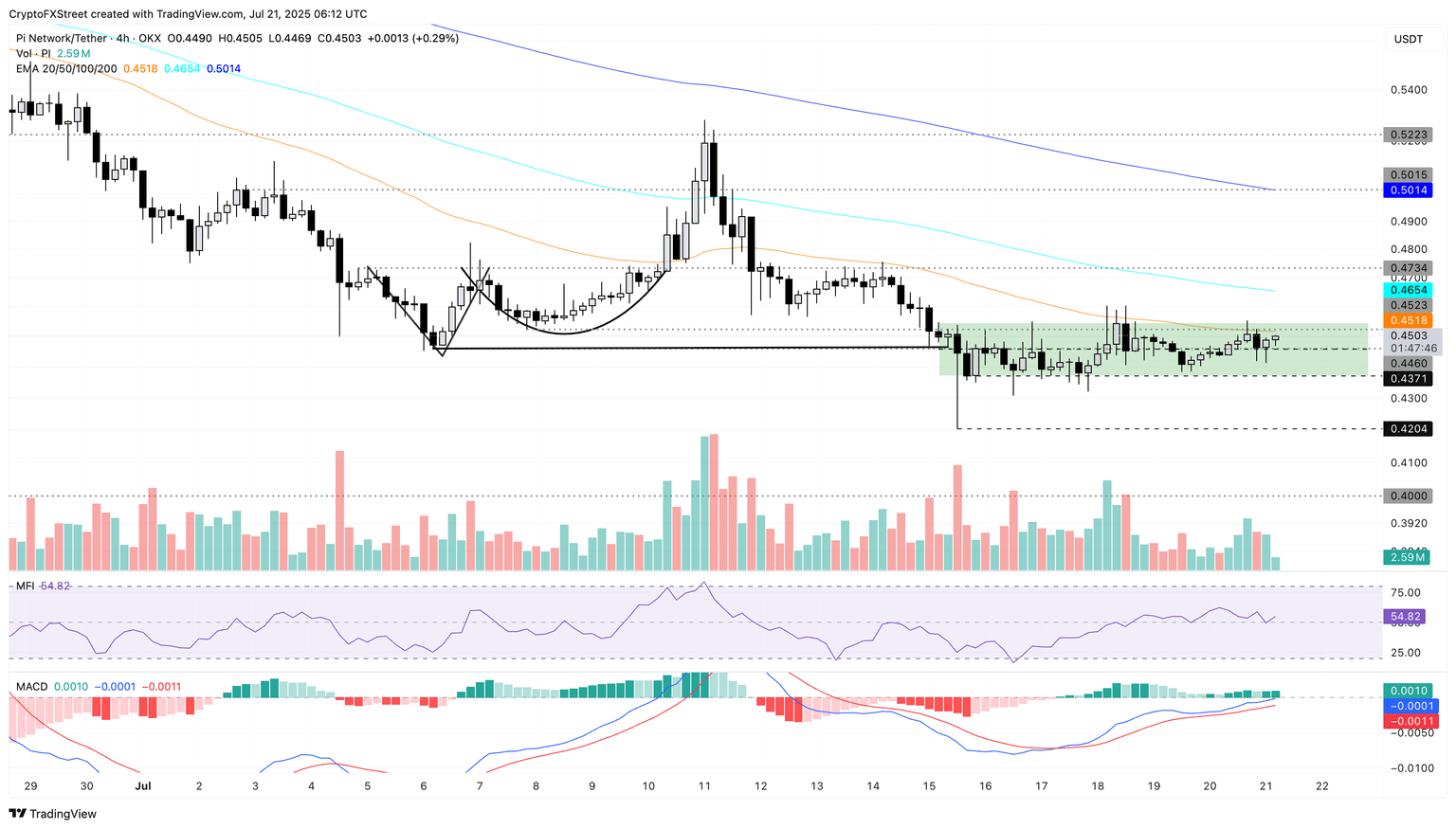

Pi network edges higher within a consolidation range marked by a green band on the 4-hour chart shared below. The recovery run struggles to surpass the 50-period Exponential Moving Average (EMA) at $0.4518, acting as a dynamic resistance.

A potential daily close above the upper boundary of the consolidation range, at $0.4547 or the 50-period EMA, could extend the breakout rally to the $0.4734 resistance level, last tested on July 14.

The Relative Strength Index (RSI) stands at 54 on the 4-hour chart, hovering slightly above the midpoint, flashing a neutral signal.

The Moving Average Convergence/Divergence (MACD) and its signal line display a rising trend, inching closer to crossing above the zero line. A trend of growing green histogram bars indicates a boost in bullish momentum.

Still, investors must remain cautious as the bullish momentum shift on the 4-hour chart reflects short-term changes and could result in a false positive.

PI/USDT daily price chart.

On the downside, a reversal in Pi Network from the 50-period EMA within the range could retest the lower boundary at $0.4369. A decisive close below this level would invalidate the range, potentially extending the decline to $0.4204, marked by the July 15 low.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.