OMG Network Price Analysis: OMG bound for massive move as $8 beckons

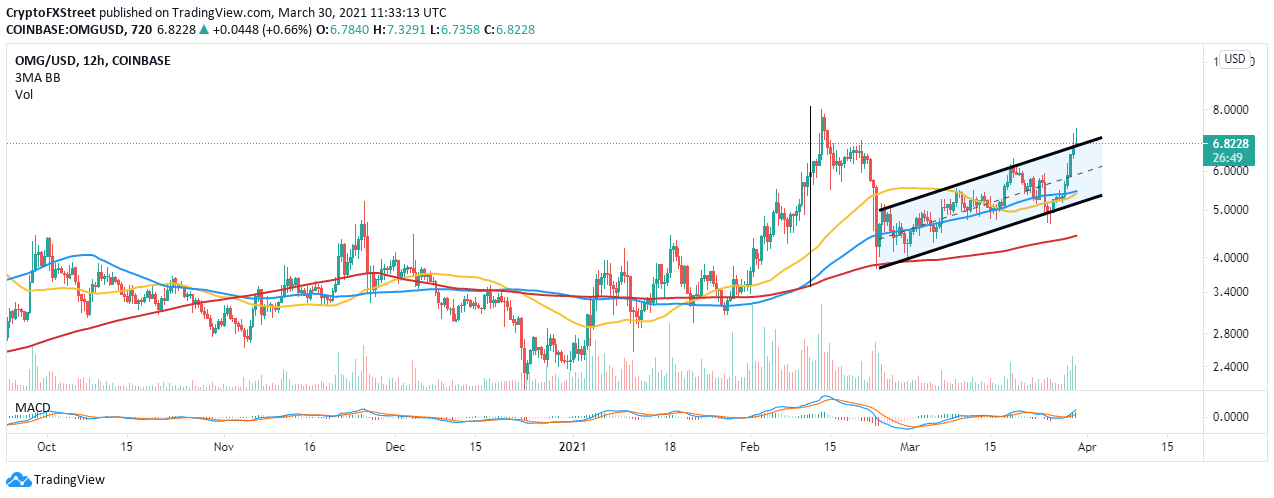

- OMG Network sustains an uptrend within the confines of a parallel ascending channel.

- The transaction history reveals the absence of resistance, validating the upswing.

- Failing to close the day above the immediate resistance at $7 could lead to a correction toward $5.

OMG Network has sustained an uptrend from the support embraced at $4. An ascending parallel channel has since March kept the bears in check. However, upward price action is still limited by the upper boundary resistance. Additional gains are expected as soon as OMG lifts off this hurdle and settles above $7.

OMG Network charts recovery path to $8

At the time of writing, OMG is teetering at $6.8, while bulls fight the resistance at the ascending channel's upper trend line on the 12-hour chart. Trading above this level and by extension, the seller congestion at $7 would open the door for gains eyeing $8.

The asset's bullish outlook has been validated by the Moving Average Convergence Divergence (MACD) indicator. The MACD line (blue) increased the signal line's divergence, stepping into the positive region. This shows that the trend will remain in an upward direction in the near term.

OMG/USD 12-hour chart

The IOMAP model reveals that OMG Network faces little resistance with its recovery mission. Nonetheless, traders should anticipate some delays between $7.63 and $7.84. Here, nearly 5,000 addresses previously bought around 719,000 OMG. Trading above this zone would pave the way for gains beyond $8.

On the downside, the model highlights robust support between $6.4 and $6.6. Here, 3,300 addresses previously scooped up 6.3 million OMG. It is unlikely that OMG would tumble through this level in the near term, thus adding credence to the bullish narrative.

OMG Network IOMAP chart

It is worth mentioning that the expected move to $8 would not be achieved if the seller congestion at $7 and the ascending channel's upper trend line remain intact. Moreover, overhead pressure may rise if OMG Network closes the day under the above hurdles. On the downside, losses are likely to increase toward $4, especially if support at the lower boundary breaks.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637527041339317446.png&w=1536&q=95)