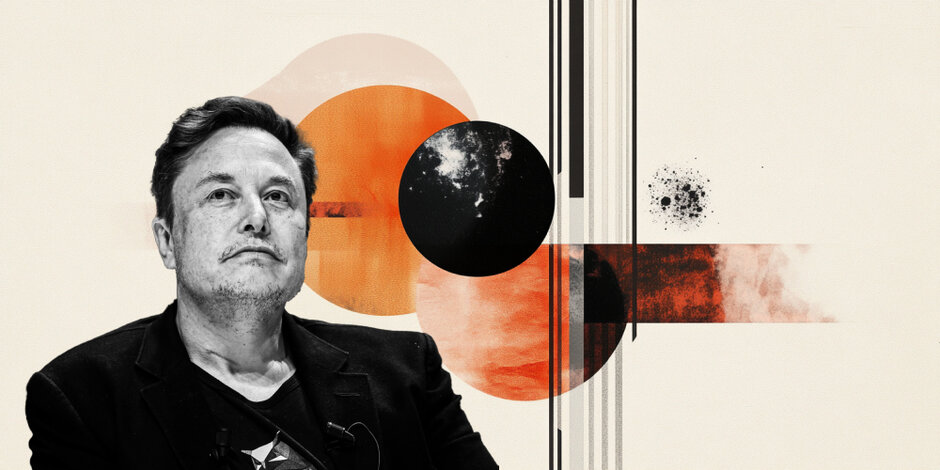

Musk’s D.O.G.E. targets SEC, dividing crypto industry

Musk’s D.O.G.E. investigates SEC inefficiencies, sparking debate as the crypto industry weighs the risks of dismantling a newly cooperative regulatory ally.

Elon Musk’s Department of Government Efficiency (D.O.G.E.) is investigating the SEC, seeking reports on waste, fraud, and inefficiency within the agency. This move has sparked debate within the crypto industry, as some argue that dismantling the SEC could hurt the sector, which has recently benefited from the Commission’s evolving stance.

Since taking office, Musk has been focused on cutting government inefficiencies, including mass layoffs in federal agencies. Now, D.O.G.E. is shifting its attention to the SEC, calling on the public to submit insights on alleged mismanagement within the organization.

“D.O.G.E. is seeking help from the public! Please DM this account with insights on finding and fixing waste, fraud, and abuse relating to the Securities and Exchange Commission,” the group posted.

This could mean that Musk is preparing for significant cuts at the SEC, in line with his broader government restructuring efforts. While some support his drive for efficiency, others warn that slashing the SEC’s resources could create unintended problems.

Ironically, the crypto industry itself could be the SEC’s unexpected defender. After a long battle to oust former Chair Gary Gensler, the Commission is now shifting towards a more favorable stance on digital assets. The SEC has been backing off from enforcement, dropping lawsuits, and working with industry leaders to shape regulations, signaling a major shift from its previous hardline approach.

Hester “Crypto Mom” Peirce, now leading the Crypto Task Force, has been vocal against SEC downsizing. She emphasized the importance of retaining skilled personnel to enact policies that benefit crypto markets.

“We have a lot of really fantastic people at the SEC doing important work. U.S. capital markets are not just large, they are the most significant in the world! It’s about striking the right balance and using our resources effectively,” Peirce stated.

This raises an important question: if the crypto industry spent years pushing the SEC toward a more cooperative stance, would dismantling it now be counterproductive?

Even if Musk envisions a crypto industry with minimal government oversight, experts argue that a complete absence of regulation is neither realistic nor sustainable in the long term.

Not all industry players share the same concerns. Coinbase’s Chief Legal Officer, Paul Grewal, has taken a different approach, advocating for stronger measures against the SEC. He proposed that the agency should be forced to compensate defendants in cases where enforcement actions fail. This could lead to direct payouts for industry players and create deeper divisions between regulators and crypto firms.

As the debate unfolds, it remains unclear what specific steps D.O.G.E. will take against the SEC. The move could gain support from those who favor less regulation, but it could also alienate crypto leaders who view the agency as a newly acquired ally.

Meanwhile, some in the community are expressing an unusual sentiment: nostalgia for former Chair Gary Gensler. While his tenure was marked by intense crackdowns on crypto projects, some now see his enforcement actions as a necessary step in preventing scams and protecting investors.

With the future of SEC oversight hanging in the balance, the industry remains divided on whether Musk’s intervention will be a strategic win or a costly misstep.

Author

Jacob Lazurek

Coinpaprika

In the dynamic world of technology and cryptocurrencies, my career trajectory has been deeply rooted in continuous exploration and effective communication.