MATIC price shows bullish signs of complete recovery

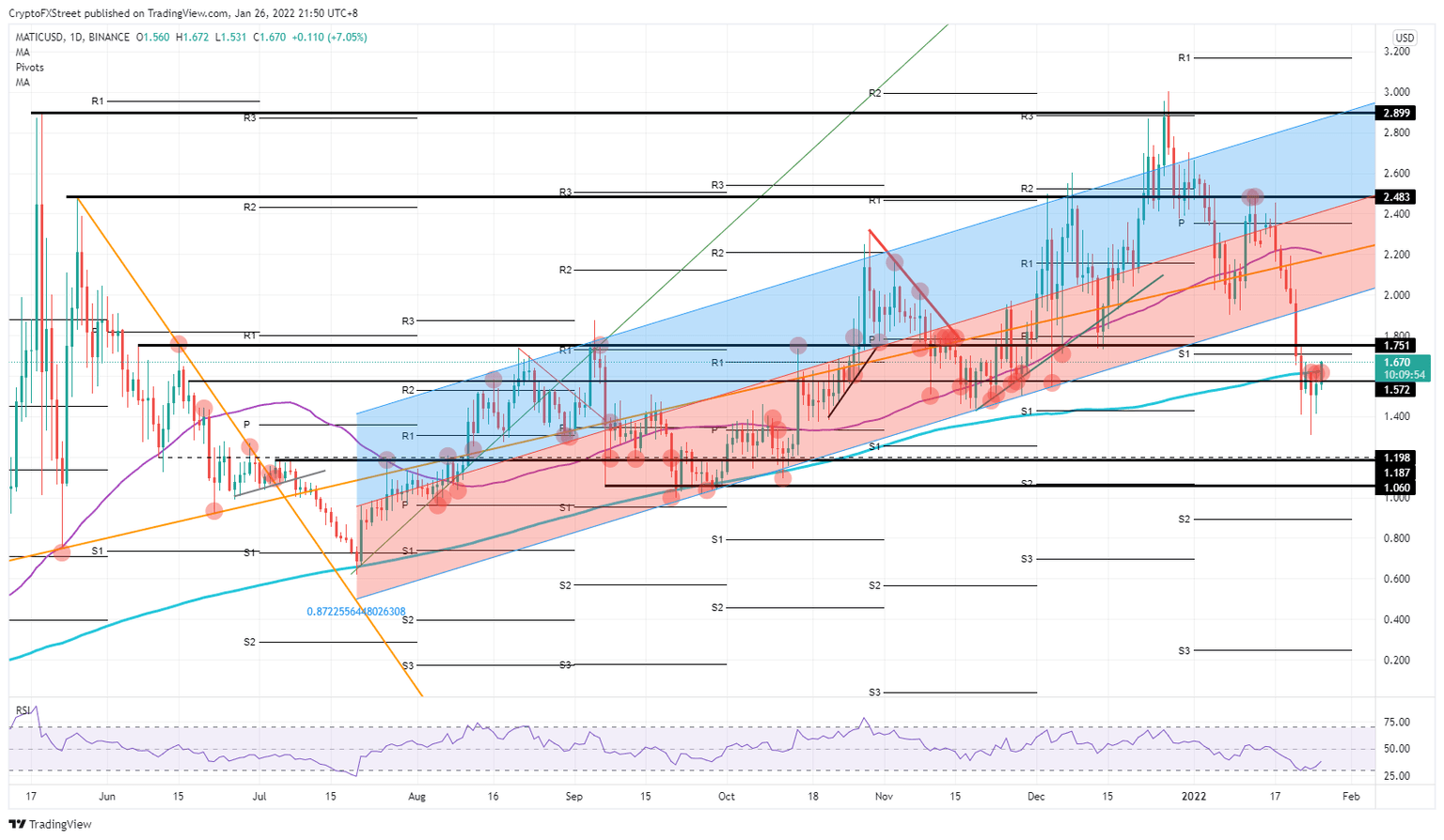

- Polygon price breaking above the 200-day SMA.

- MATIC price set for return into the ascending trend channel at $2.00.

- Expect MATIC to rally further going into the Fed rate decision towards $1.75.

Polygon (MATIC) price has made a U-turn after slipping below $1.40 earlier this week. Global markets seem to be looking beyond the Fed rate decision later on today and are set for some good news that could make MATIC price action make a recovery first, and next restart an uptrend. The price target for today is set to $1.75-$1.80, but re-entering the ascending trend channel will be the ultimate goal for this week.

MATIC price set for the bullish breakout above 200-day SMA

MATIC price is set for a sizable bullish reversal of the downtrend that occurred the past few days as Polygon’s trend channel got broken to the downside. With that correction, bulls were able to stop and turn the descent around $1.40 and push the price back towards the 200-day Simple Moving Average (SMA) at $1.63. With that move, the Relative Strength Index (RSI) bounced off the border of being oversold and made a bullish knee-jerk reaction.

Expect to see this rally going into the Fed rate decision later today. If that decision falls in line with market expectations or holds a slight dovish message, expect investors to join in big numbers, pushing up buying volume and leading to a massive breakout trade that could touch $1.75 and the monthly S1 support level in a first phase. After that, expect buying to persist going into the late US close and even see price action fully regain the incurred losses towards $2.00, and following that re-enter the ascending trend channel. This means investors and bulls are in for a treat and could see 30% gains going into the trade.

MATIC/USD daily chart

Although currently, markets look to be set to book solid gains in the coming days, expect the Fed meeting to break that mood as quickly as it has arisen. A surprising comment of a rate hike could trigger another sell-off in the markets and set MATIC price back to the lows around $1.40, possibly even leading to a dip down towards $1.20. At that stage, MATIC price action is entering an area ideal for a fade-in trade between $1.20-$1.06.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.