MATIC price prepares for a 25% upswing with minimal obstacles ahead

- MATIC price action shows that the bears seem to be exhausted, as Polygon is primed for a fresh rally.

- The Ethereum scaling solution is aiming for a 25% climb.

- MATIC price sees little resistance ahead as it heads higher.

MATIC price appears to be finished consolidating for the time being. Polygon is ready for a trend reversal to the upside as it has set a possible bottom.

MATIC price sees almost no challenges ahead

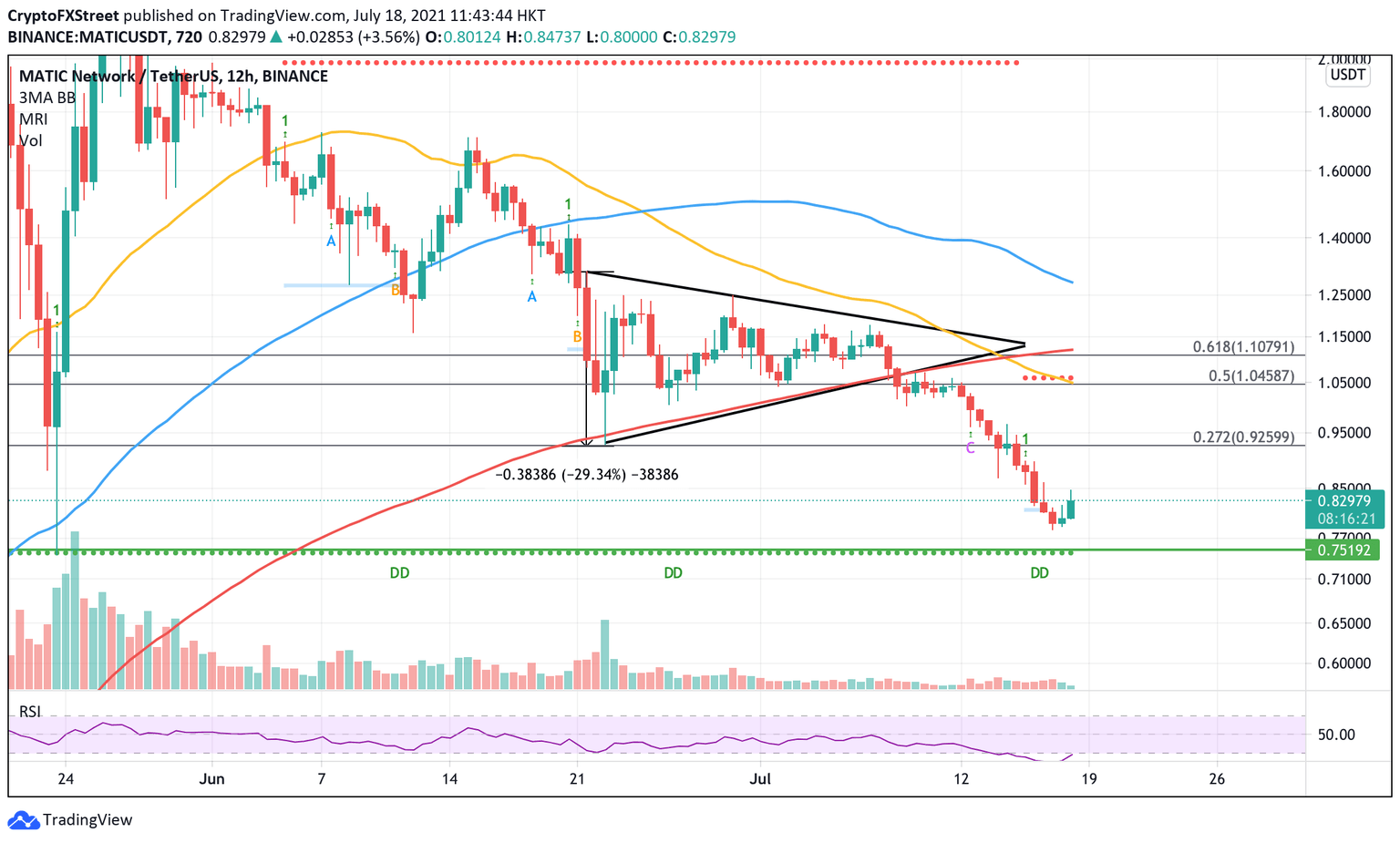

MATIC price formed a symmetrical triangle pattern that emerged on June 21, which lasted until the breakout to the downside on July 8. Polygon fell 26% to the local bottom, nearly carrying out the full 29% decline as the expected target given by the chart pattern.

On the 12-hour chart, MATIC price seems to be rebounding from the July 17 low. Given the current bullish momentum, Polygon is aiming to tag the 27.2% Fibonacci extension level at $0.92.

Further buying pressure would allow MATIC price to target the next level of resistance at the 50% Fibonacci extension level, coinciding with the 50 twelve-hour Simple Moving Average (SMA) at $0.92.

MATIC/USDT 12-hour chart

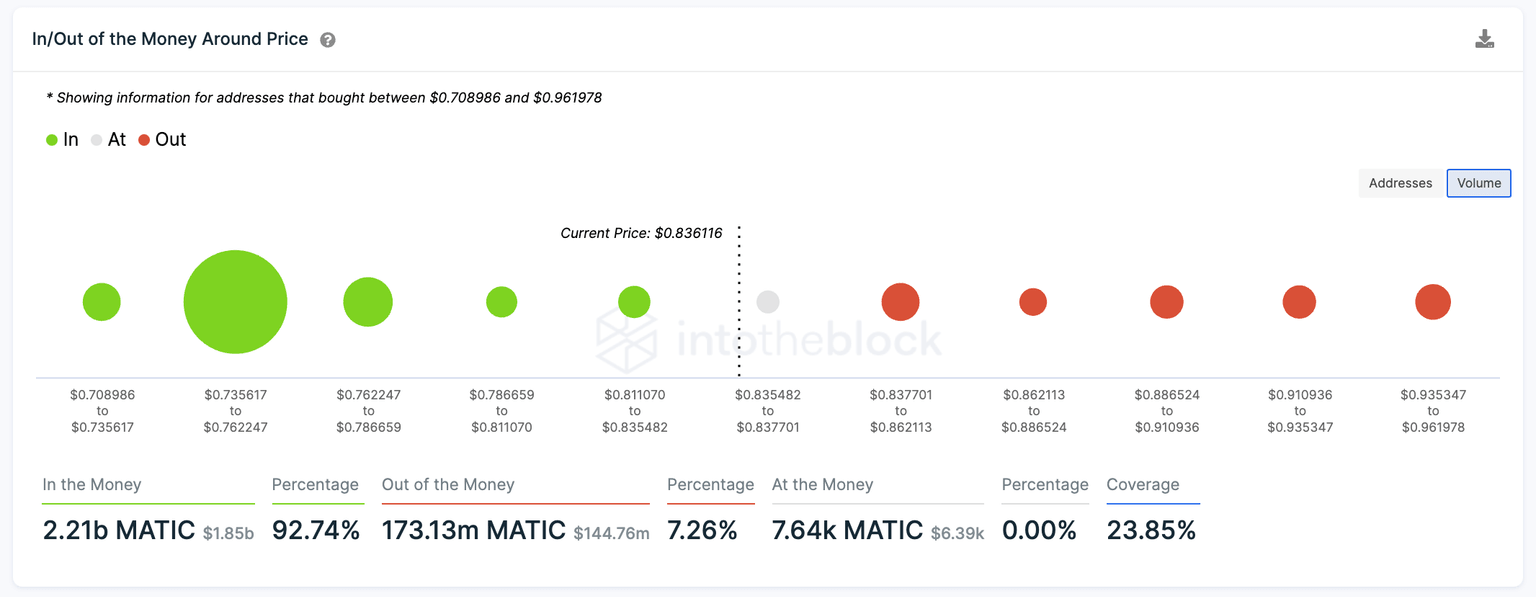

Adding credence to this bullish thesis is the IntoTheBlock’s In/Out of Money Around Price (IOMAP) volume, as it shows little obstacles ahead up to $0.96.

Therefore, further positive sentiment in the market could not void bigger aspirations for MATIC price, even reaching the 61.8% Fibonacci extension level, corresponding with the 200 twelve-hour SMA at $1.11.

MATIC IOMAP

Should the recovery be momentary and not resulting in a sustainable rush higher, Polygon could retest the local bottom at $0.78 before falling further to the projected drop from the chart pattern toward $0.75, the largest area of support as shown by the IOMAP, where 716 addresses hold 1.92 billion MATIC.

The aforementioned strongest level of defense is also supported by the support level indicated by the Momentum Reversal Indicator (MRI). Further weakness should not incentivize MATIC price to explore lower levels.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.