MATIC Price Prediction: Polygon might need to retrace before 40% ascent

- MATIC price is hovering above the $1.137 support level, trying to breach it.

- Polygon might pull back or consolidate before triggering a new uptrend.

- A breakdown of the $0.90 support level will invalidate the bullish thesis.

MATIC price is currently grappling with a recently created support as bulls lose steam. Two things could happen here, a minor pullback followed by another leg-up or sideways movement that allows the buyers to recuperate and enter a new uptrend.

MATIC price prepares for the next run-up

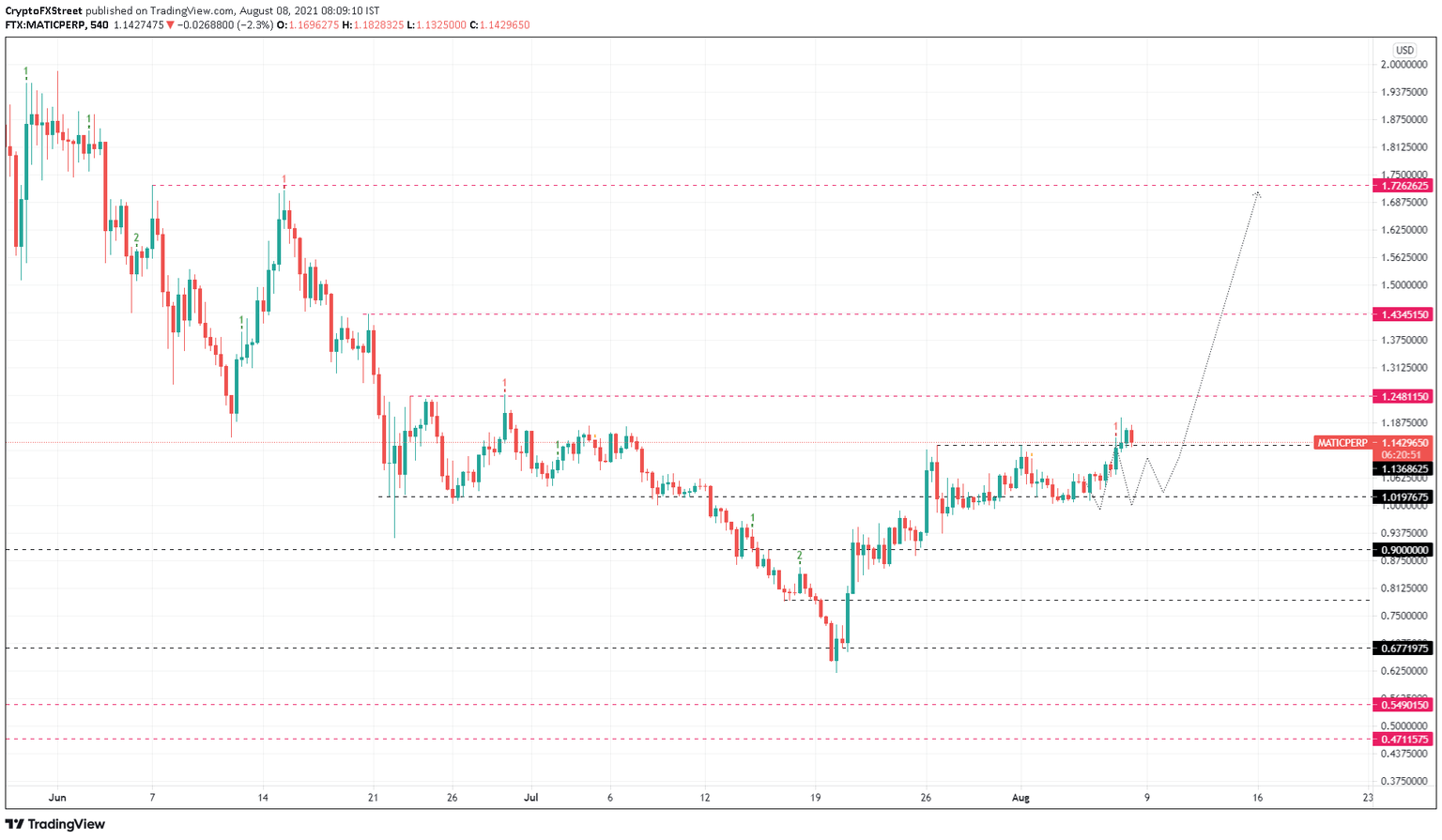

MATIC price set up two swing highs at $1.136 on July 26 and August 1 before briefly rallying above it. Although the ascent produced a 9-hour candlestick close above this barrier, it is currently being contested to be undone.

This move signals that the bulls are either recuperating as investors book profit. Therefore, investors can expect a minor consolidation or a pullback that stays above the $1.019 support level.

Assuming MATIC price retraces to $1.019, the resulting rally should easily slice through $1.136 and tag the subsequent barrier at $1.435, roughly 40% upswing.

In a highly bullish case, Polygon could extend this rally to tag the $1.726 supply level, which would constitute a 70% climb from $1.019.

MATIC/USDT 9-hour chart

While the bulls seem to be secured and out of trouble, things could go awry if the $1.019 support level is breached. This move would jeopardize the uptrend since it would open up the possibility of a lower low that shifts the odds in the bears’ favor.

A breakdown of $0.90 will invalidate the bullish thesis and open the path to further downside.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.