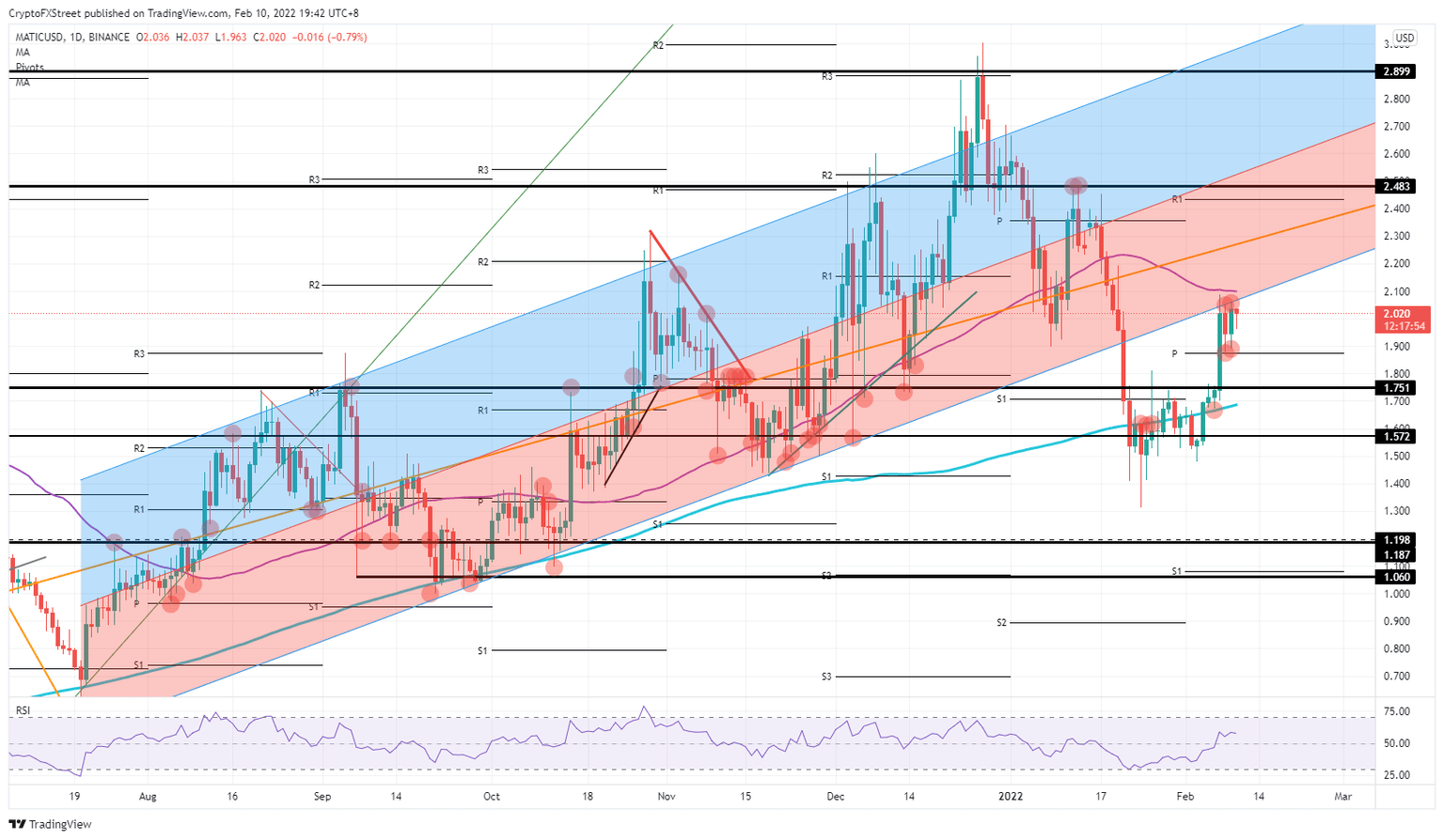

Matic price action set to re-enter bullish trend channel towards $3.0

- Polygon price action sees bulls knocking on the door of the lower end of a longer-term trend channel.

- The short-term resistance at $2.10 looks solid for now, but expect a breakthrough once a catalyst kicks in.

- MATIC could see a quick follow-through towards $2.40-ish once on re-entry in the trend channel.

Polygon (MATIC) price action drifted quite a bit lower when it broke out of its bullish trend channel on January 21. Since then, MATIC price action has been bouncing back and is now knocking on the lower barrier of the trend channel for the third day in a row. With more and more global tailwinds aiding cryptocurrencies, expect a breakthrough soon and re-entry back into the channel, with a solid follow-through towards $2.40 in the short term.

Bulls are eager to enter and are set to join the rally

Matic price action has used a base station as an entry point for bulls to engage in the leg up. The monthly pivot at $1.87 has seen a solid test and firm pushback from bulls against bears trying to break it and push price action further to the downside. Instead, it looks like bulls are taking over and are now squeezing bears against the ascending bottom trend line of the marked-up trend channel.

Expect bulls to keep pushing as the lows get higher while the highs keep pushing against the ascending trend line. The 55-day Simple Moving Average will be broken instantly as the mounting pressure to the upside ends up being too big a match for bears to withstand. A breakout above $2.10 will see the rally follow-through in a big ways and hit the monthly R1 resistance level around $2.43, probably in just a matter of a few trading sessions, returning 20% gains from where MATIC price action trades at the moment.

MATIC/USD daily chart

With three rejections on the docket already, the rejections on the trend line could be one too many for investors, and the bull run could start to lose pace as investors pull their funds and book profits. With that shift in sentiment expect a fade back to the monthly pivot at $1.87. With already two support tests, expect a possible break and a return to $1.75, erasing 19% of market value in MATIC.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.