MATIC price could slide 15% lower as Polygon bulls tire out

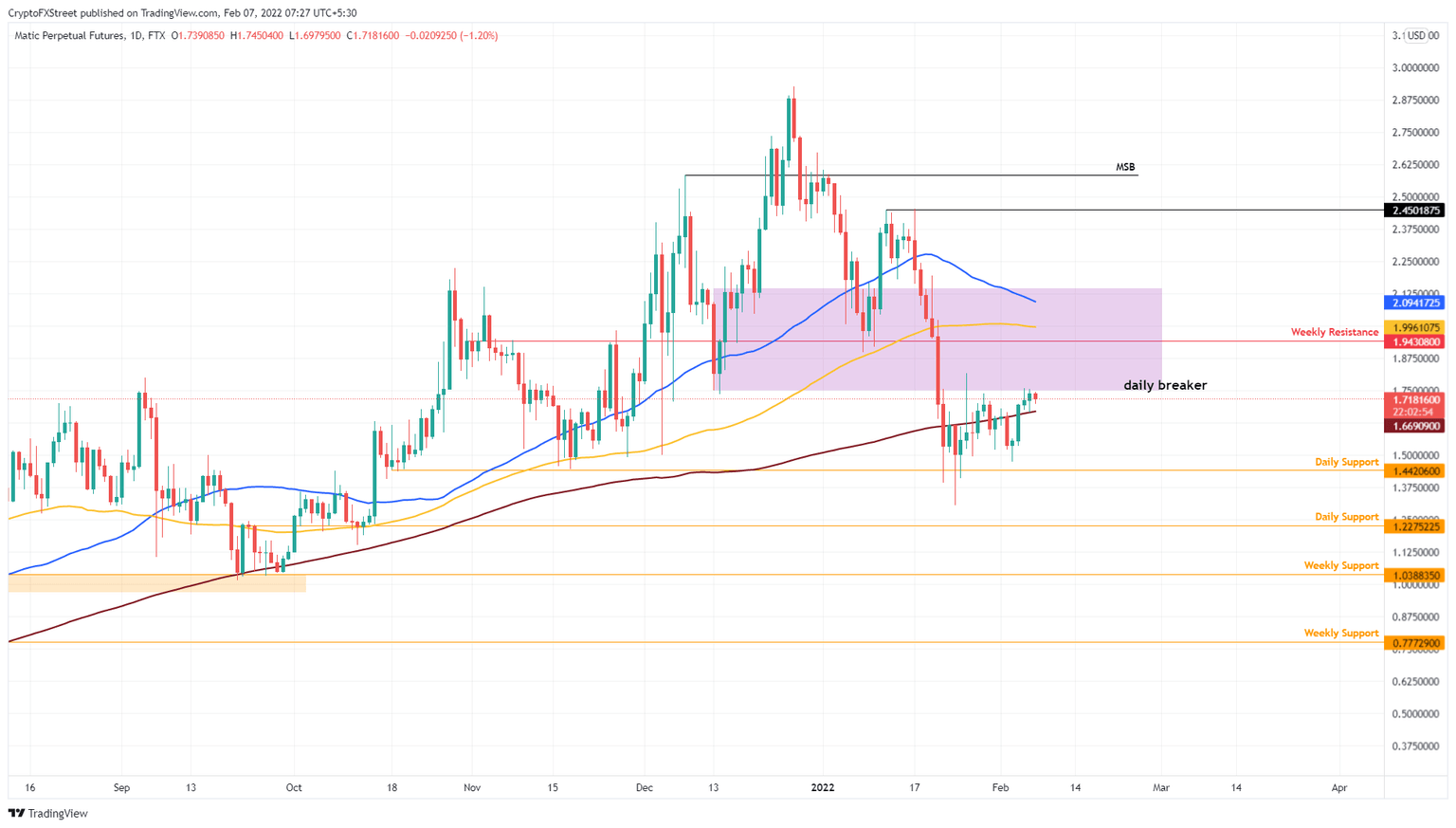

- MATIC price upside is limited as it faces a bearish breaker, extending from $1.75 to $2.15.

- A rejection at this hurdle could see Polygon drop 15% to a support level at $1.44.

- A daily candlestick close above $2.15 will invalidate the bearish thesis.

MATIC price has created a bearish setup that forecasts a correction is around the corner. However, the downswing might be cut short due to the presence of a palpable support level along the way. Regardless, polygon holders should prepare for a minor pullback.

MATIC price to head lower

MATIC price set up a higher high between December 8, 2021, and December 27, 2021. The trough between these two swing points established a demand zone, extending from $1.75 to $2.15.

However, the flash crash on January 21 pushed Polygon to produce a daily candlestick close below $1.75, flipping the said demand zone into a bearish breaker. This setup forecasts that a retest of the breaker leads to rejection and a potential crash.

As MATIC price retests the breaker for the third time, investors can expect another rejection to lead to a 15% retracement to the daily support level at $1.44.

A breakdown of the $1.44 barrier could lead to a retest of the $1.22 foothold. In a highly bearish case, MATIC price could sweep below the $1.04 weekly support level and collect the sell-stop liquidity resting below it. This development would bring the total crash to 40%.

MATIC/USDT 1-day chart

Multiple retests of the $1.75 to $2.15 bearish breaker weakens its potency and could signal that the bulls are making a comeback. If MATIC price pierces through the said breaker to produce a daily candlestick close above $2.15, the bearish thesis will face invalidation. In this scenario, MATIC price could rally 14% and tag the $2.45 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.