MATIC bulls crawl out of ditch, rebooting Polygon uptrend towards $2.5

- Polygon price sees uptick since November 17, bulls slowly but surely building up steam

- MATIC price sees bulls attempting to regain monthly pivot at $1.80.

- Once bulls can close above $1.80, expect a rally towards $2.48.

Polygon (MATIC) price has been rising despite most cryptocurrencies having been on the back foot these past few days. With this uptick, bulls are now trying to consolidate and perform a daily close above the monthly pivot. Once they clear that hurdle, bulls have a reasonably easy rally up towards $2.48, with the potential for 38% of gains.

MATIC price sees bullish uptrend holding 38% gains

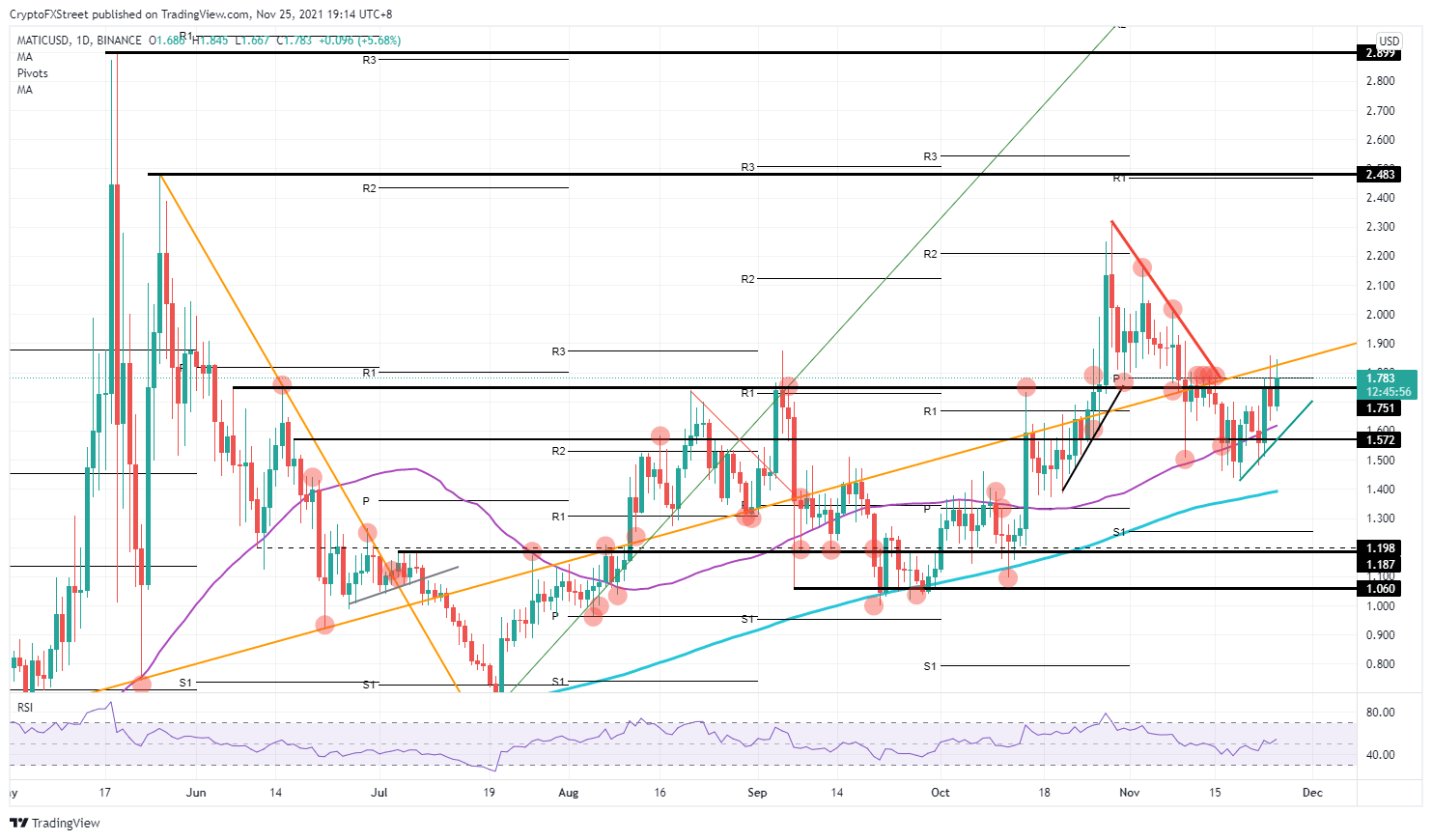

MATIC price shows a continuation of further bullish price action with a slight acceleration. The uptrend started a week earlier in quite challenging circumstances related to headwinds in global cryptocurrencies. The Relative Strength Index (RSI) already signals bullish action since November 19. In the meantime, investors have recovered the historical $1.57 level and added the 55-day Simple Moving Average (SMA) to their support arsenal.

MATIC price shows a slight slow down for the moment as bulls are trying to regain control of the monthly pivot, but seeing the price action between November 11 and November 15, this level was in the past very well defended by bears, suggesting they may have difficulty breaking above it. Those same bears are putting up a fight at the moment, preventing bulls from regaining control of $1.80. Hence it will be essential to see bulls making a daily close above the pivot, which would then prove bears had capitulated Following that, further downside, would likely be limited..

MATIC/USD daily chart

As both Bitcoin and Ethereum see some bullish price action, expect more tailwinds to start to emerge while headwinds fade, giving bulls a hand at gaining control of the monthly pivot at $1.80. Once through there, it is quite an easy road towards $2.48, which is next to a historical level and the monthly R1 resistance level. Further upside potential will by then depend on the sentiment and mood in the global cryptocurrency space but will probably see a halt in the rally as the RSI will have entered overbought territory.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.