Litecoin price to revisit $100 as LTC bulls gear up for third halving event

- Litecoin price coils up as it prepares for a quick uptrend to $101.41.

- The backing from momentum indicators combined with the third halving event makes a compelling case for LTC to rally.

- Invalidation of the bullish thesis will occur on the breakdown of the $86.29 support level.

Litecoin price shows signs of an emerging uptrend on the four-hour chart. While a minor retracement might be likely, the larger trend is bullish for LTC. Additionally, the altcoin will undergo the third halving event on August 5, which will split its block rewards from 25 to 12.5 LTC.

Also read: Litecoin price and LTC holders stuck in dilemma as third halving nears

Litecoin halving and its effects

Typically, halving creates a negative supply shock - where the supply declines but the demand either remains the same or increases. The result of this change can be seen in the underlying asset’s price. In LTC’s case, Litecoin price will likely note a stark increase.

In practice, things are a bit different since the anticipation of the negative supply shock and the subsequent increase in Litecoin price created a sense of urgency. As a result, investors jump on the bandwagon before the halving event to capture maximum upside potential. Soon, this idea manifests, triggering a pre-halving rally for Litecoin price.

The same effect was seen in Bitcoin price before its halving.

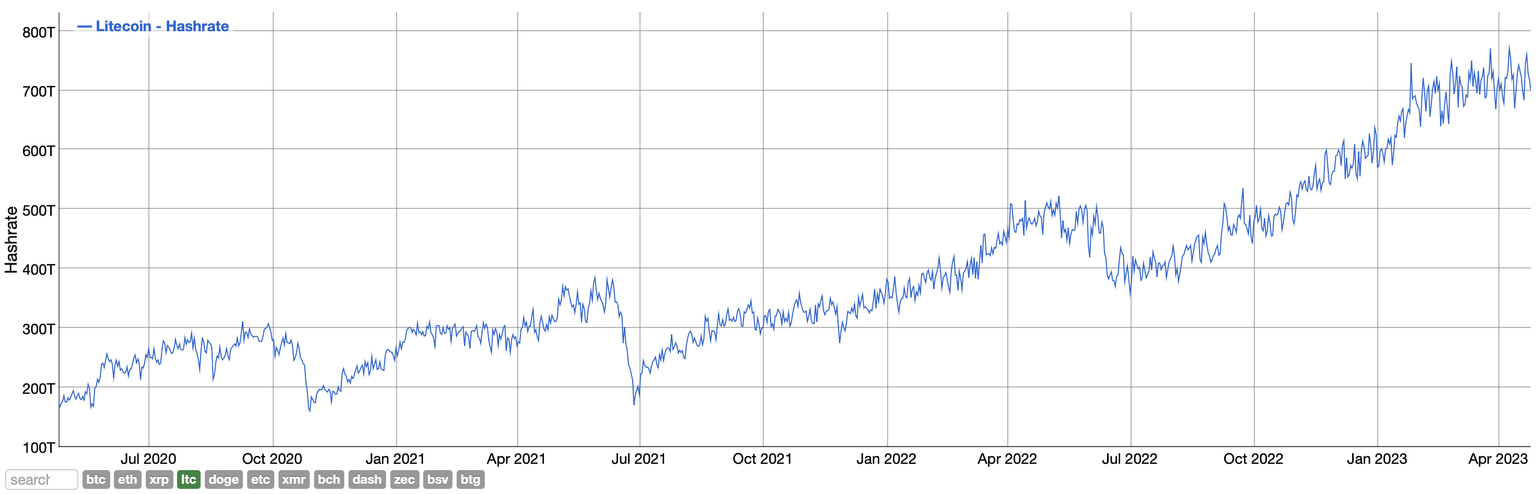

Additionally, investors can note that the hash rate for Litecoin is also increasing. From January 2023 to April 2023, the LTC hash rate has increased from 580 Terra hash per sec (TH/s) to 701 TH/s.

Typically, a rise in hash rate is often followed by a rise in the underlying asset’s price due to network effects.

LTC hash rate

Litecoin price ready to take off

Litecoin price shows clear signs of an uptrend as it rallied 6.70% in the last 24 hours. This bullish move came despite a market-wide range formation, suggesting an interest in LTC. As mentioned above, the demand could be driven by the halving event.

Regardless, Litecoin price is at a crucial point, where it could retrace to $88.99 before taking off. As long as LTC manages to flip the four-hour bullish breaker, extending from $87.60 to $90.88, the trend will remain in favor of buyers.

Additionally, both the Relative Strength Index (RSI) and the Awesome Oscillator (AO) have flipped above the 50 and the zero line, respectively, suggesting that the bulls are in control.

A continued northbound move for Litecoin price will send it to its first target, which is the midpoint of the recent crash at $93.72 that lies just below another hurdle at $95.71. Overcoming this blockade will allow Litecoin price to tag the $101.41 resistance level.

LTC/USDT 4-hour chart

On the other hand, if Litecoin price fails to stay above the $87.60 to $90.88 bullish breaker but produces a four-hour candlestick close below, the bullish thesis will face invalidation.

In such a case, Litecoin price will likely slide lower to collect the sell-stop liquidity below $83.90 before giving the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.