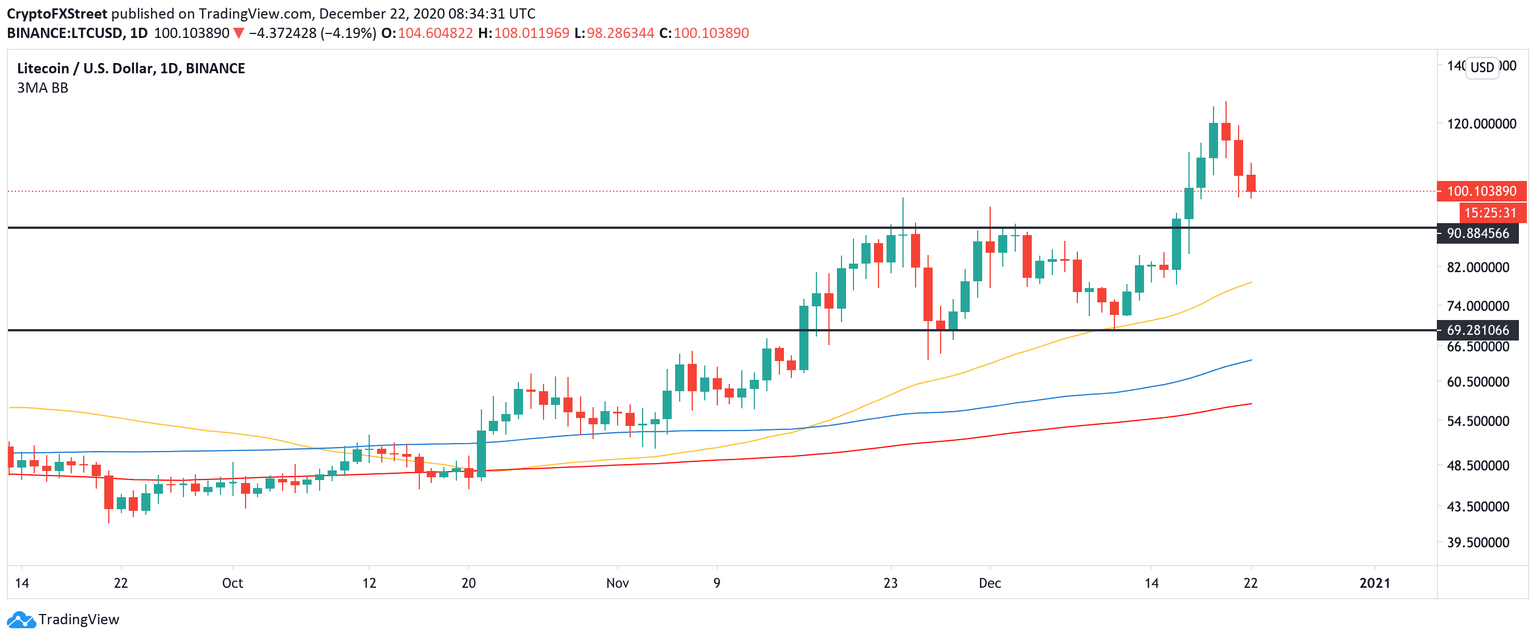

Litecoin Price Prediction: LTC may extend correction to $90 before another growth attempt

- Litecoin is poised to retest $90 amid the technical correction.

- On the upside, the local barrier is seen on approach to $110.

Litecoin retreated from the recent high of hitting $124 on Saturday, December 19, to trade at $100 by the time of writing. The fifth-largest asset lost over $100 million of value in less than 24 hours amid a significant sell-off on the cryptocurrency market; the con has lost over 14% on a day-to-day basis, though it is still 22% high on a weekly basis.

Litecoin's trading volume exceeded $10 billion amid snowballing profit-taking.

Litecoin extends the correction

As FXStreet previously reported, LTC has started a correction from overbought territory. Currently, the coin struggles to stay above the psychological support of $100. If it gives way, the sell-off may be extended.

LTC, In/Out of the Money Around Price

The In/Out of the Money Around Price (IOMAP) data shows that over 18,000 addresses previously purchased 2.3 million LTC tokens between $96 and $93, meaning that this area has the potential to slow down the bears. Once it is broken, the price will retest a stronger barrier of $90 that served as a resistance at the end of November and December. It can be verified as support and trigger another bullish wave that will take LTC above $100.

LTC, daily chart

A sustainable move below $90 will worsen the short-term technical picture and allow for a deeper decline towards $78. This support is reinforced by the daily EMA50 and followed by the previous channel support at $69.

On the other hand, LTC will need to clear the $110 barrier for the upside gain traction and bring the recent high of $124 back into focus.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637442233351512695.png&w=1536&q=95)