Litecoin price could explode to $100 due to this LTC accumulation pattern

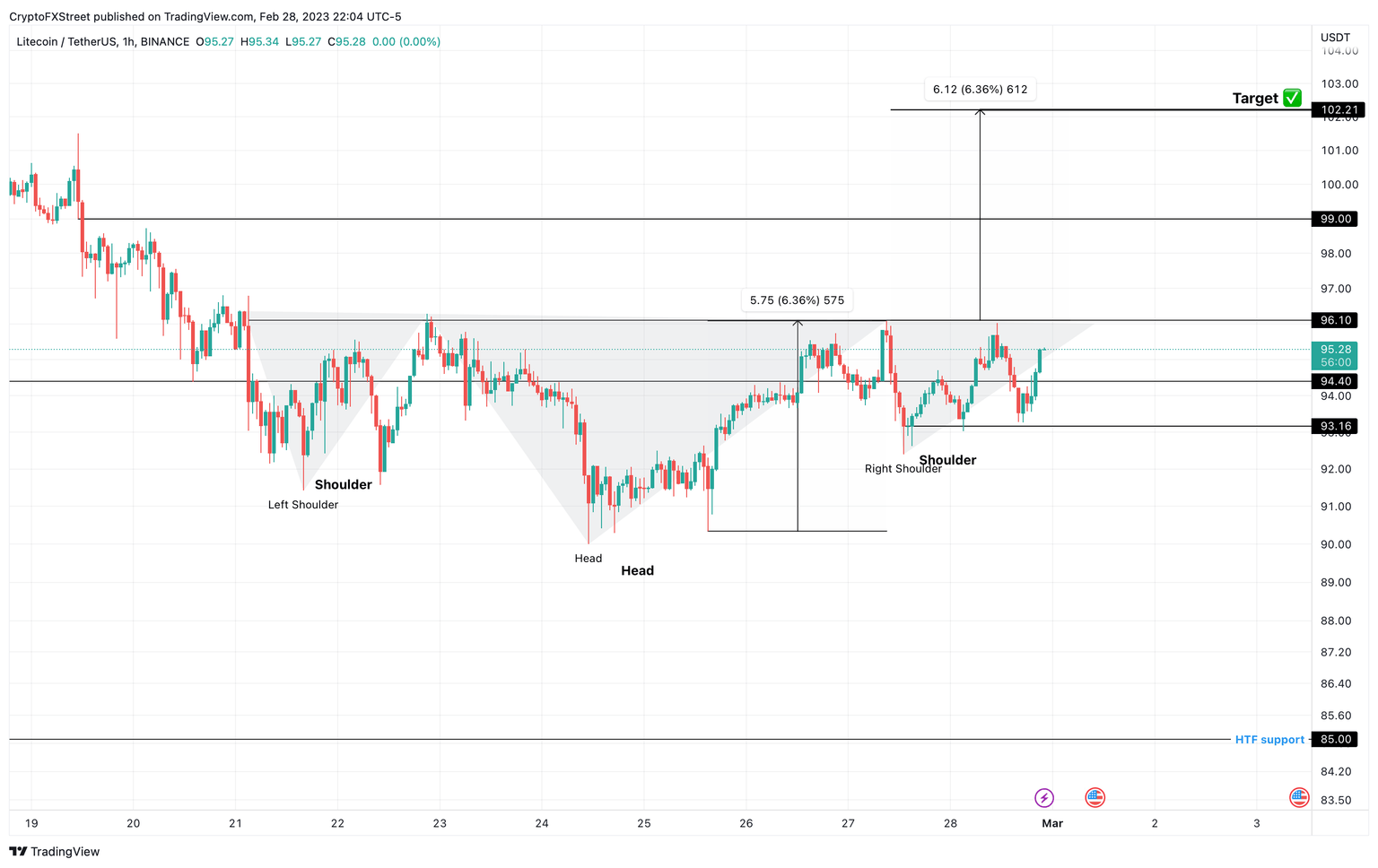

- Litecoin price has set up an inverse head-and-shoulders pattern on the one-hour timeframe.

- This technical formation forecasts a 6% upswing to $102 upon a decisive break of $96.10.

- Invalidation of this setup will occur if LTC flips the $93.16 support structure into a hurdle.

Litecoin price shows a bullish setup on the one-hour timeframe, which is getting ready for a breakout. If played correctly with leverage and risk, this outlook could yield LTC futures traders a neat little chunk of profit.

Litecoin price readies for a breakout

Litecoin price action set up an inverse head-and-shoulders in the last week. The altcoin established three distinctive swing lows; the central variant is deeper than the other two, known as the head, while the sides are termed shoulders. Hence the namesake head-and-shoulders.

Since this setup horizontally mirrors the original pattern, it is an inverse head-and-shoulders. The swing highs of the head and shoulders can be connected using a horizontal trendline to form a resistance level known as the neckline.

The target for this setup is obtained by measuring the distance between the lowest part of the head and the right shoulder’s peak or the neckline and adding it to the breakout point. Theoretically, this technical formation yields a 6.36% upswing should Litecoin price produce a decisive flip of the neckline at $96.10 on the one-hour timeframe or higher.

Interested investors can open a long position here with managed risk and leverage to get a good deal out of this small 6.36% move Litecoin price.

LTC/USDT 1-hour chart

The inverse head-and-shoulders pattern will face invalidation if Litecoin price produces a one-hour candlestick close below $93.16. Such a move would create a lower and low and trigger sidelined sellers.

In such a case, Litecoin price could further trigger a 9% correction to a higher timeframe support level at $85.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.