Litecoin buyers are piling up before LTC’s massive pump to $250

- Litecoin price readies for a breakout above $250.

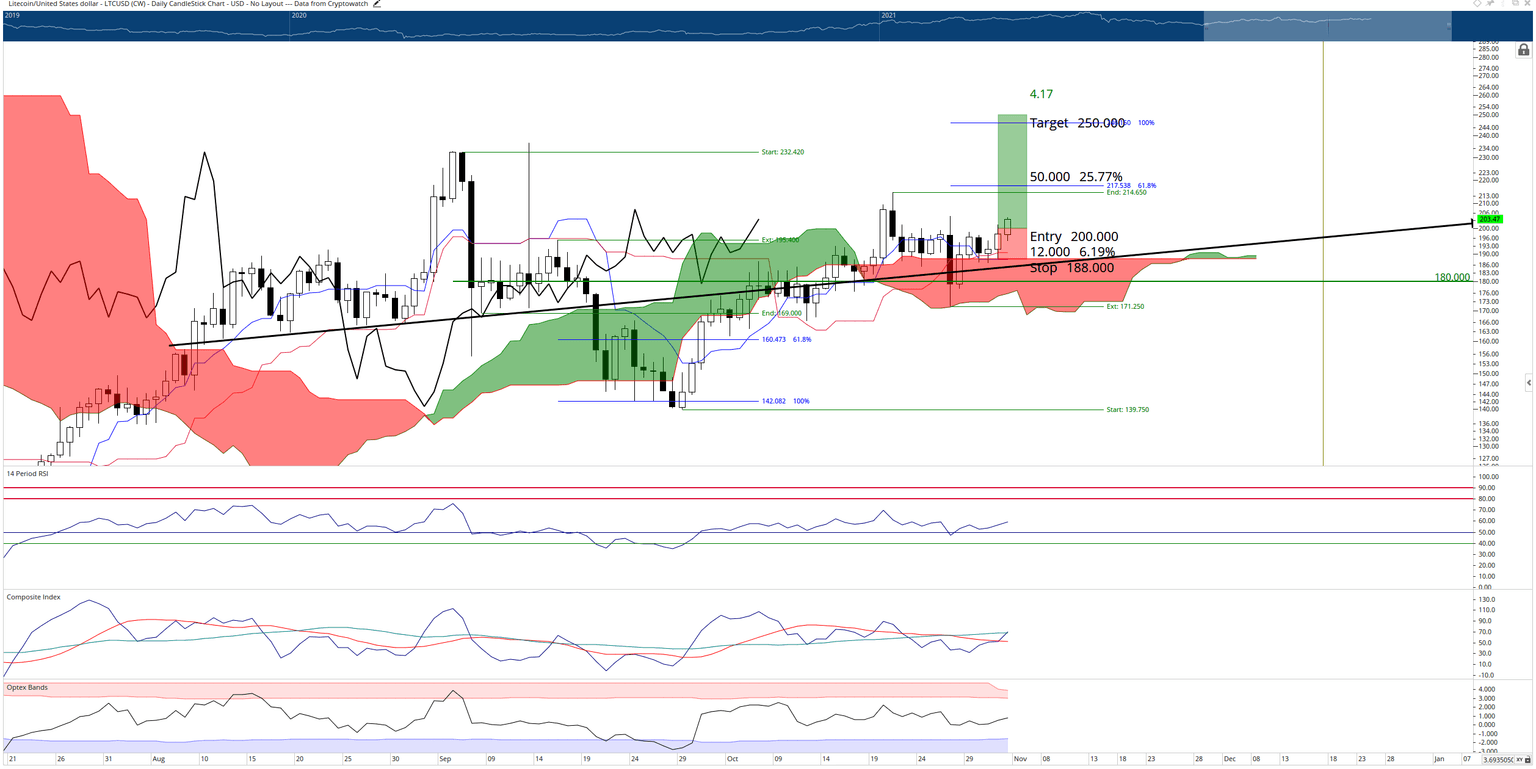

- The daily Ichimoku chart has a textbook example of an Ideal Bullish Ichimoku Breakout entry setup.

- Short sellers could get trapped.

Litecoin price action, like many altcoins, has been relatively stagnant over the past two weeks. Except for the big spike higher on October 20th and the subsequent spike lower on October 27th, little movement worth note has occurred. But that is about to change.

Litecoin price fulfills all requirements for a bullish Ichimoku breakout entry

Litecoin price is at one of its most favorable entry opportunities since early April 2021. All of the required conditions for an Ideal Ichimoku Bullish Breakout entry are fulfilled. Those conditions are:

- The close above the Cloud.

- The close above the Tenkan-Sen and Kijun-Sen.

- Chikou Span above the candlesticks and in open space (won’t intercept the body of a candlestick over the next five to ten periods).

- Futures Senkou Span A is greater than Future Senkou Span B.

When all four of those entry conditions are met, instruments generally experience a significant expansion move. The oscillators help support Litecoin price extending higher as well. The first oversold level of 50 in the Relative Strenght Index has held as support, while the Composite Index has now crossed above both of its moving averages. Most important is the Optex Bands sitting at relatively neutral levels.

LTC/USD Daily Ichimoku Chart

Litecoin would need to move to a price level where a daily close is below the Cloud, and the Chikou Span is below the candlesticks for the bullish outlook to be invalidated. For that to occur, Litecoin would need to close at or below $170.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.