Is Shiba Inu price setting up an opportunity to recoup this year's losses?

- Shiba Inu price coils in a consolidative manner that will likely resolve in a sharp rally.

- SHIB price trades above both the 8- and 21-day simple moving averages.

- Invalidation of the uptrend is a breach below $0.00000938.

Shiba Inu price presents a bullish trade setup with a conservative entry that equates to a 4-1 reward-to-risk ratio.

Shiba Inu price to the moon?

Shiba Inu price has been trading in a triangular fashion since the out-of-nowhere rally that occurred on the first day of summer 2021. The rally on June 21 pulled off a 68% increase in price, followed by the sideways profit-taking range the notorious dog coin finds itself entangled in.

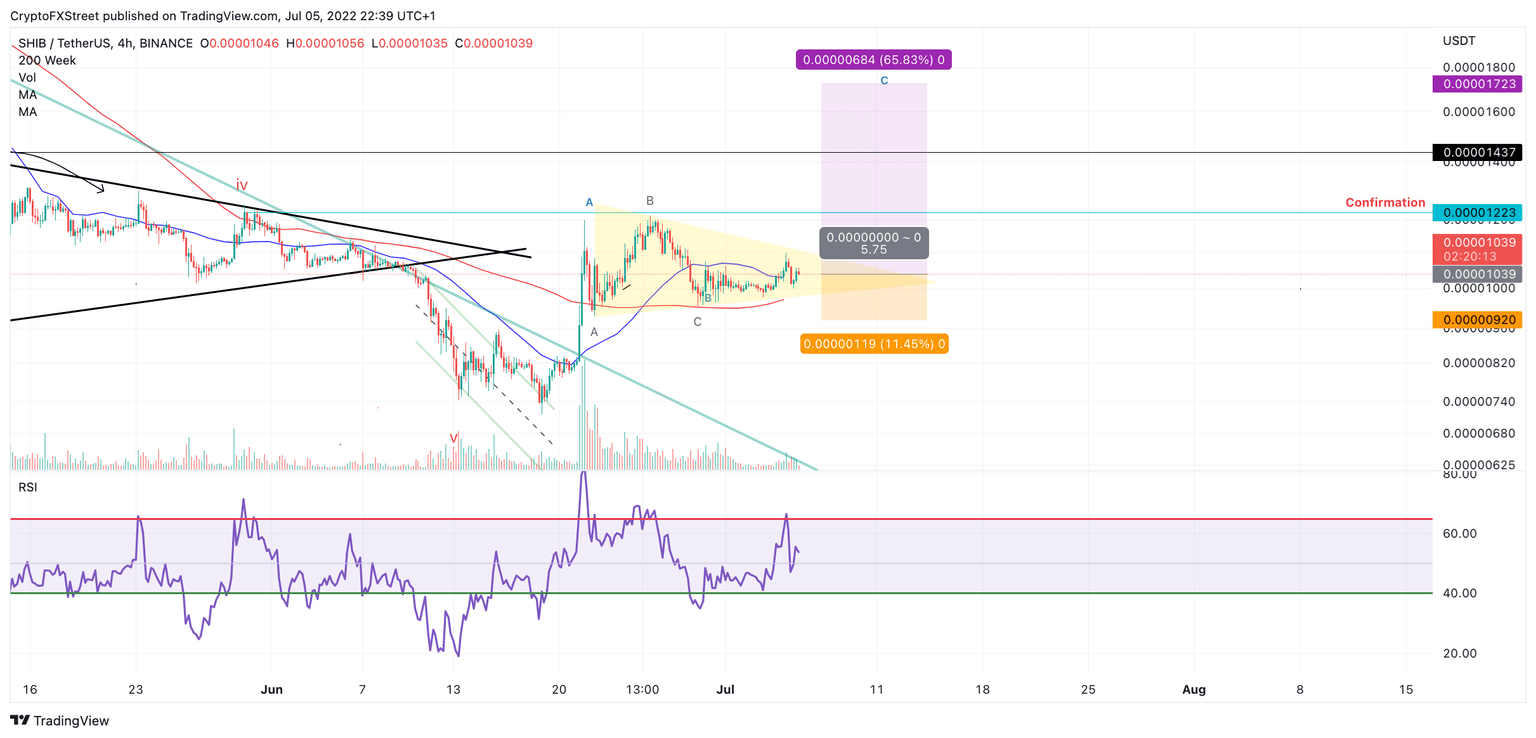

Shiba Inu price experienced a brief rejection around $0.00001100 on July 5. Shortly after a steep retracement occurred and the bulls managed to hurdle over the 21-day simple moving average (SMA). SHIB price currently trades at $0.000001038, above both the 8- and 21-day SMAs, enabling analysts to believe that the triangular consolidation may soon resolve with an additional 70% bull rally in the coming days.

From a reward-to-risk perspective, being an early bull could provide a 5.75 to 1 setup targeting the $0.000001700 price level.

SHIB/USDT 4-Hour Chart

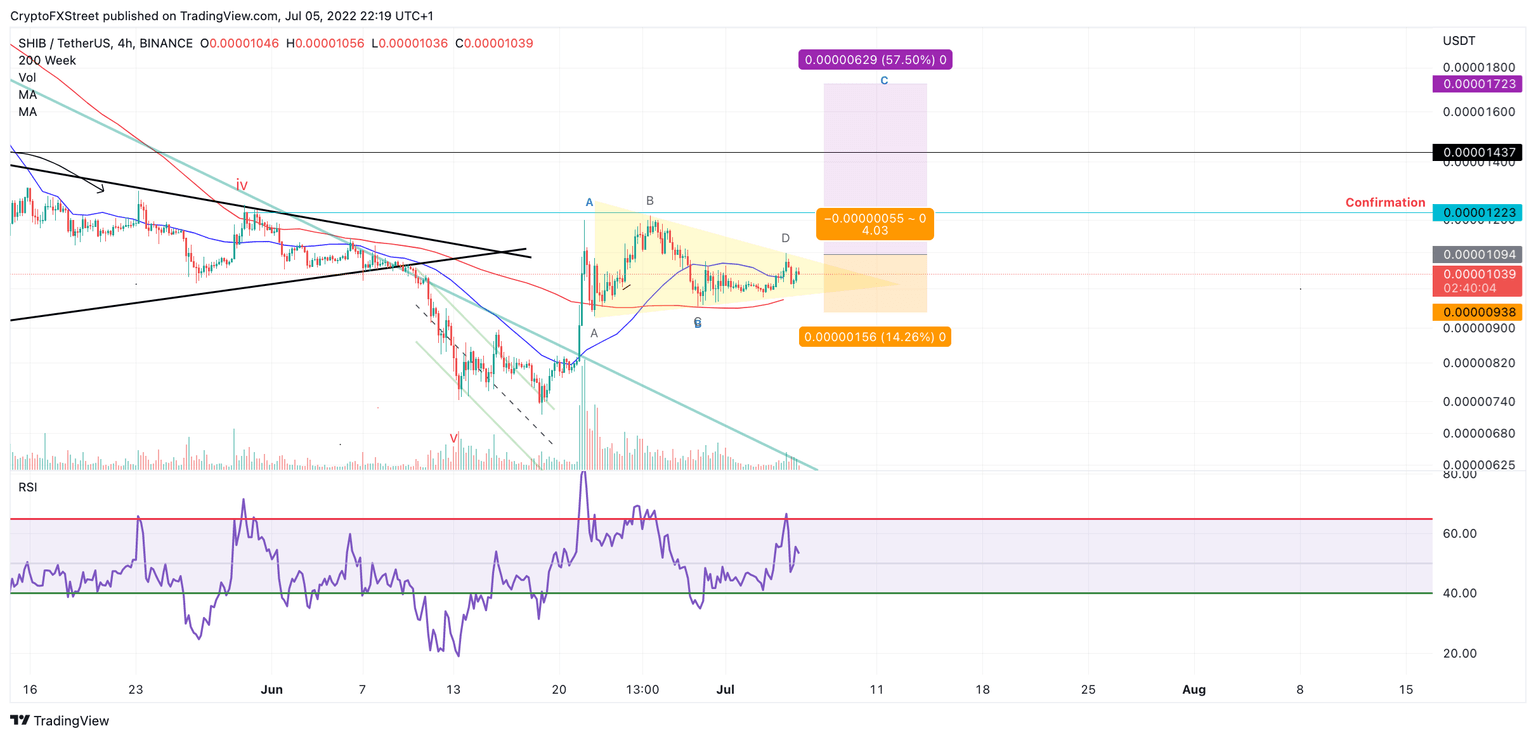

A more conservative approach will be to wait for a second attempt from the bulls to breach and definitively close above the newly established swing high at $0.00001100.

SHIB/USDT 4-Hour Chart

It is worth noting that both the early and the more conservative setup keeps an invalidation level below wave A of the triangle at $0.000001043. This conservative invalidation point is to avoid a smart money-induced liquidity hunt of the $0.00000950 swing low while maintaining the ability to participate in a sharp moving bull-run. Hearty risk-to-reward trade setups come every few months in the cryptocurrency market which could entice many traders to partake in the move to recoup losses from 2022’s bear market. Thus a breach of the $0.00001100 could trigger massive volatility.

Investors should keep in mind that, If the bears breach the $0.00000920, the uptrend thesis will not be entirely invalidated. However the breach would open the possibility of a sharper decline to $0.00000800, resulting in a 23% decrease from the current Shiba Inu price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.