Institutional traders split between Bitcoin, Ether: Bybit research

Institutional traders are bullish on Bitcoin, mixed on ether and skeptical of altcoins, a new report from Bybit Research shows.

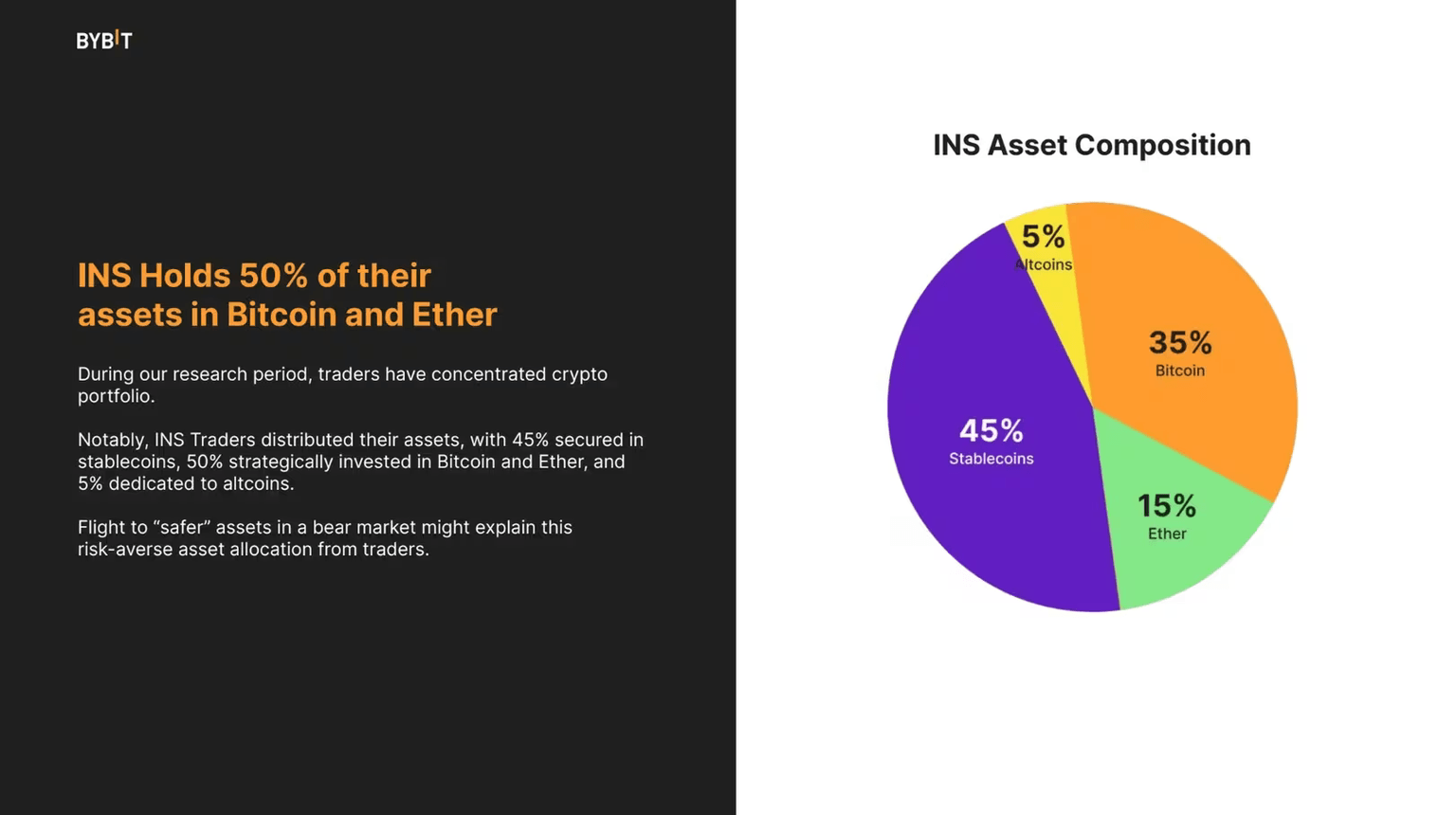

(Bybit Research)

During the first three quarters of 2023, institutional traders nearly doubled their holdings of Bitcoin (BTC). As of Setpember, half their assets were denominated in the largest cryptocurrency, driven by positive market sentiment and anticipation of the Securities and Exchange Commission (SEC) approving a spot BTC exchange-traded fund (ETF) in the U.S. Their stance contrasts with the lower BTC holdings of retail traders, possibly due to their higher leverage levels, Bybit's research shows.

(Bybit Research)

Institutional traders and whales, or large holders of bitcoin, were skeptical about altcoins, the report says, with the data showing a general decline in altcoin holdings among traders despite a brief rise in May. A notable decrease started in August, particularly among institutions, reflecting a cautious stance towards these more volatile assets.

Ether (ETH) holdings have generally declined since the Ethereum blockchain's Shapella upgrade, data shows, except for a surge among institutional traders in September amid a positive crypto outlook as ETF news excited markets.

The bitcoin price is up about 140% year-to-date, while ether has risen 87%.

In a report from October, K33 Research wrote that it was shifting stance on asset allocation, advising a pivot back to bitcoin due to ether's prolonged slump against BTC since July 2022, and a muted response to the newly launched futures-based ETH ETFs.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.