Hyperliquid Price Forecast: HYPE recovery strengthens as network adoption, revenues hit record highs

- Hyperliquid price extends its recovery on Wednesday after a brief dip following last week’s record high.

- USDC stablecoin goes live on the Hyperliquid network, while HYPE’s 24-hour fees surpass those of ETH and SOL.

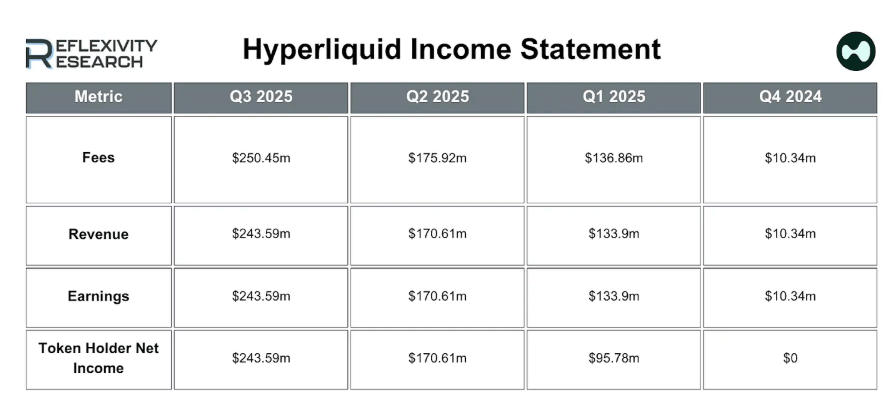

- Financial performance in Q3 marks a record, with fees hitting $250.45 million and Token Holder Net Income at $243.59 million.

Hyperliquid (HYPE) price is regaining momentum midweek, trading above $55 at the time of writing on Wednesday after a pullback from last week’s record highs of $57.40. The recovery is fueled by growing network activity, with the USDC stablecoin now live on the network, and fee collection outpacing Ethereum (ETH) and Solana (SOL) over the past 24 hours. Moreover, Q3 financials show record-breaking performance, hinting at new record highs for HYPE in the near term.

USDC goes live on the Hyperliquid network

USDC stablecoin announced on Tuesday that its native USDC and (Cross-Chain Transfer Protocol) CCTP V2 will be deployed on Hyperliquid’s Ethereum Virtual Machine (EVM), enabling USDC deposits to HyperCore and any HyperEVM application, making deposits, trading, and Decentralized Finance (DeFi) use cases smoother and safer.

This presents a bullish outlook for HYPE in the long term, as the native USDC stablecoin on HyperEVM serves as a liquidity magnet that could boost Hyperliquid’s adoption, revenue, and HYPE token value.

Growing revenue and fee collection

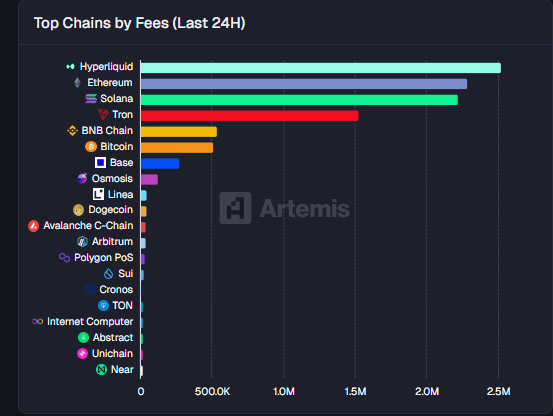

According to Artemis Terminal data, Hyperliquid’s 24-hour chain fees collection is $2.5 million, topping the list of other networks such as Ethereum and Solana, indicating a growing interest among traders and liquidity in the HYPE chain.

Moreover, the Reflexivity weekly report highlighted that in Q3, Hyperliquid achieved its strongest financial performance to date, with fees reaching $250.45 million and Token Holder Net Income climbing to $243.59 million, all with a team of just 11 people.

Hyperliquid Price Forecast: Will HYPE hit a new all-time high?

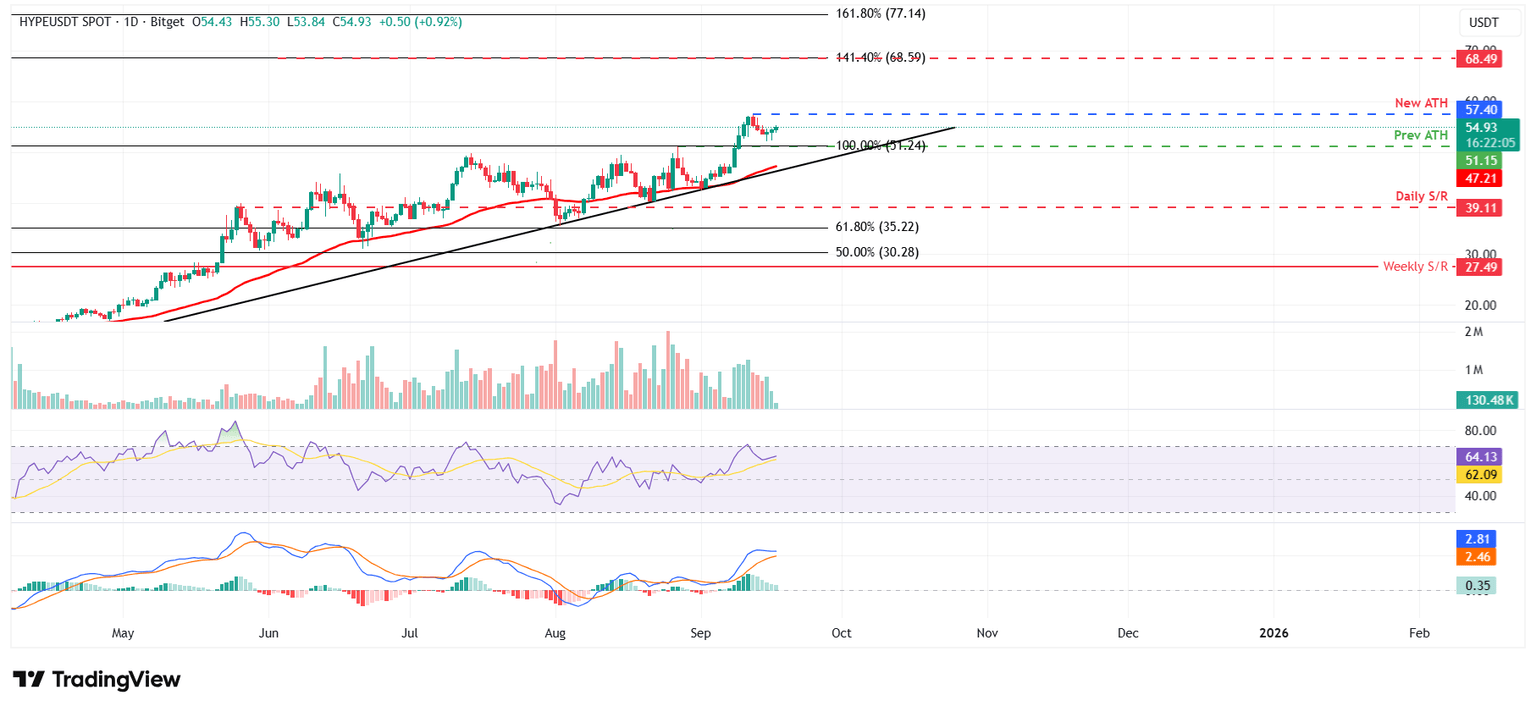

Hyperliquid price reached a new all-time high of $57.40 on Friday but failed to maintain the upward momentum, declining 5.81% by Sunday. At the start of the week on Monday, HYPE recovered slightly, closing above $54.43 the next day. At the time of writing on Wednesday, HYPE continues its recovery, trading above $54.93.

If HYPE continues its upward momentum, it could extend the rally toward its record high at $57.40. A successful close above this level would trigger a price discovery mode, allowing HYPE to extend gains and test its key psychological level at $60.

The Relative Strength Index (RSI) on the daily chart reads 64, above its neutral level of 50 and well below its overbought conditions, indicating that bulls still have momentum to continue the rally. The Moving Average Convergence Divergence (MACD) displayed a bullish crossover in early September that remains in effect, reinforcing the bullish outlook.

HYPE/USDT daily chart

However, if HYPE faces a correction, it could extend the decline to retest its previous all-time high at $51.15.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.