Crypto Gainers Today: Cronos, Numeraire and Hyperliquid rally as bullish news fuels momentum

- Cronos hits a new yearly high of $0.21 as Trump Media announced plans to establish a CRO treasury company.

- Numeraire rallies sharply as it secures a commitment of up to $500 million from JPMorgan Asset Management.

- Hyperliquid price surpasses its previous record high of $49.88, entering a new phase of price discovery.

Cronos (CRO), Numeraire (NMR), and Hyperliquid (HYPE) emerged as the top crypto gainers on Wednesday, rallying strongly on the back of bullish news and market momentum. Cronos price surges to a new yearly high following Trump Media's plans for a CRO treasury company. At the same time, Numeraire soared after securing a massive $500 million commitment from JPMorgan Asset Management. Meanwhile, Hyperliquid (HYPE) extended its upward run, breaking past its record high and entering price discovery mode.

Cronos price hits a yearly high as Trump Media announces plans to establish a CRO treasury company

Trump Media Group announced on Tuesday that it has agreed with Crypto.com to establish a CRO treasury company. The companies will jointly establish Trump Media Group CRO Strategy Inc., with an expected funding of $6.42 billion at launch. The initial investment will comprise $1 billion in CRO (approximately 6.3 billion CRO), $200 million in cash, $220 million in warrants, and an additional $5 billion line of credit from an affiliate of Yorkville.

This news announcement triggered a sharp rally in CRO's price, reaching a new yearly high of $0.21 that day.

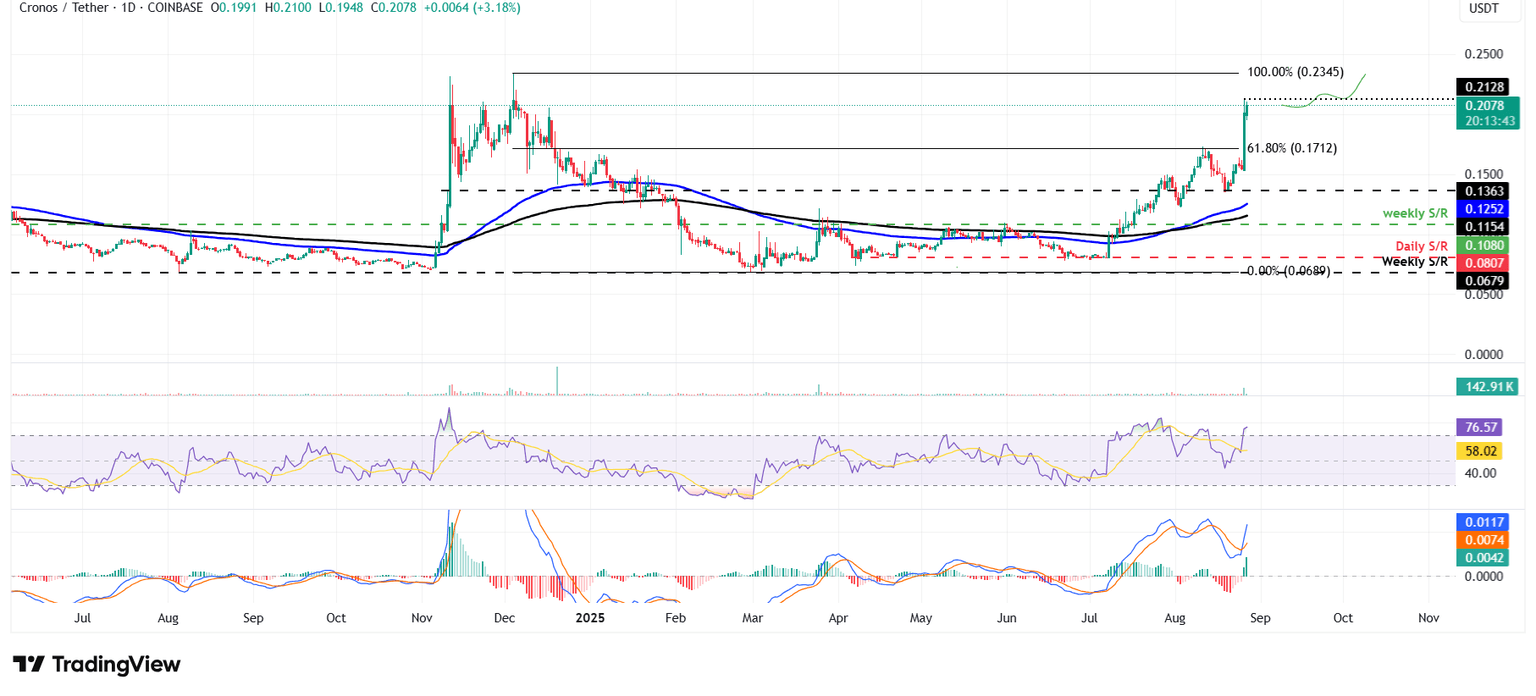

CRO's daily chart, as shown below, highlights that the upward trend continues, trading higher by 3.57% at the time of writing on Wednesday, around $0.20.

If the upward momentum continues, CRO could extend the rally toward its December $0.23.

The Relative Strength Index (RSI) on the daily chart reads 76, above its overbought territory, pointing upward and indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) also showed a bullish crossover on Tuesday, providing a buy signal and reinforcing the bullish thesis.

CRO/USDT daily chart

Numeraire jumps on $500 million JPMorgan backing

Bloomberg report on Tuesday highlighted that crowdsourced quantitative fund Numerai has secured a commitment of up to $500 million from JPMorgan Chase & Co.'s asset-management arm, to be deployed over the next year. The quantitative firm currently operates with approximately $450 million. This news triggered a sharp rally in the NMR token price, with gains of over 100% that day.

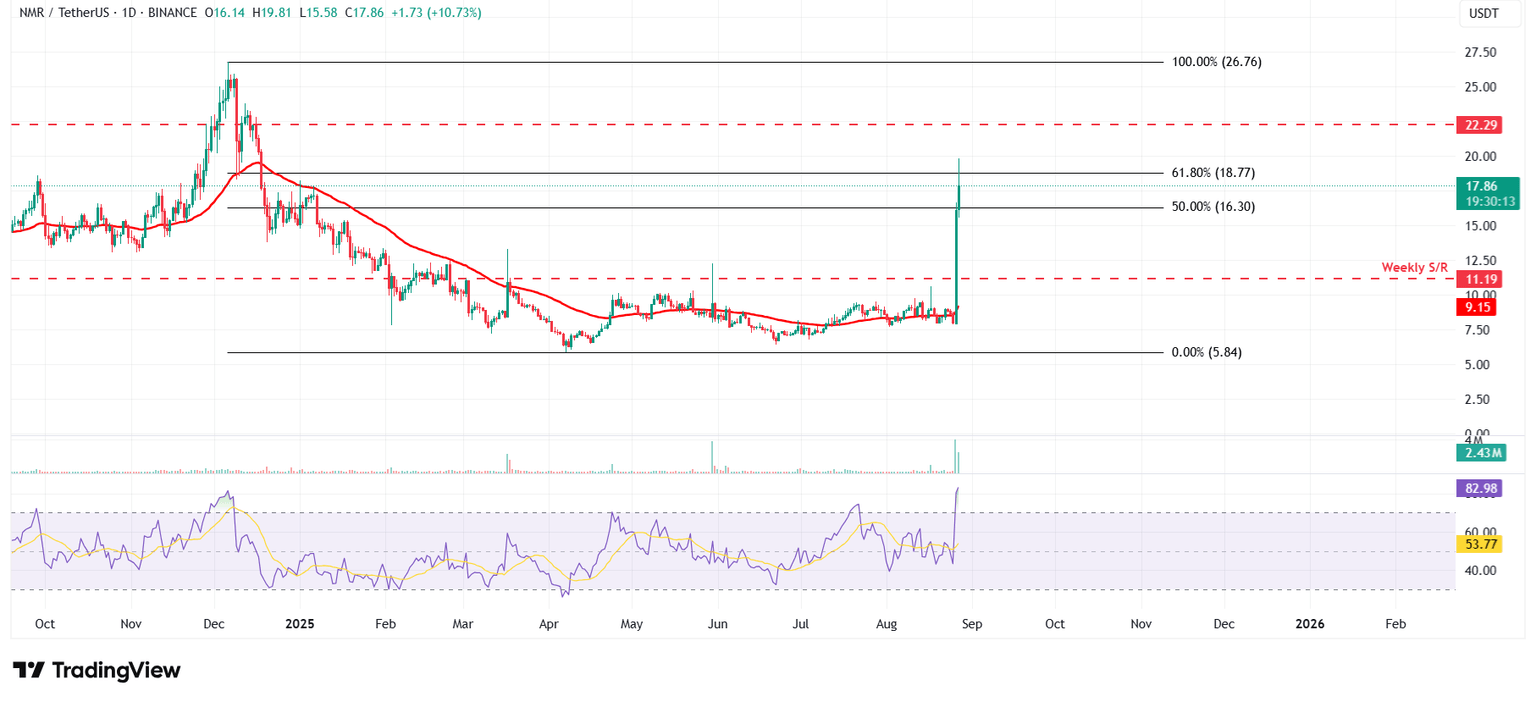

The daily chart below shows that the NMR price extends its gains by 10% at the time of writing on Wednesday, trading above $17.80.

If NMR continues its upward momentum, it could extend the rally toward its next weekly resistance at $22.29.

The RSI on the daily chart reads 82 above its overbought conditions, suggesting strong bullish momentum.

NMR/USDT daily chart

Hyperliquid hits a new all-time high

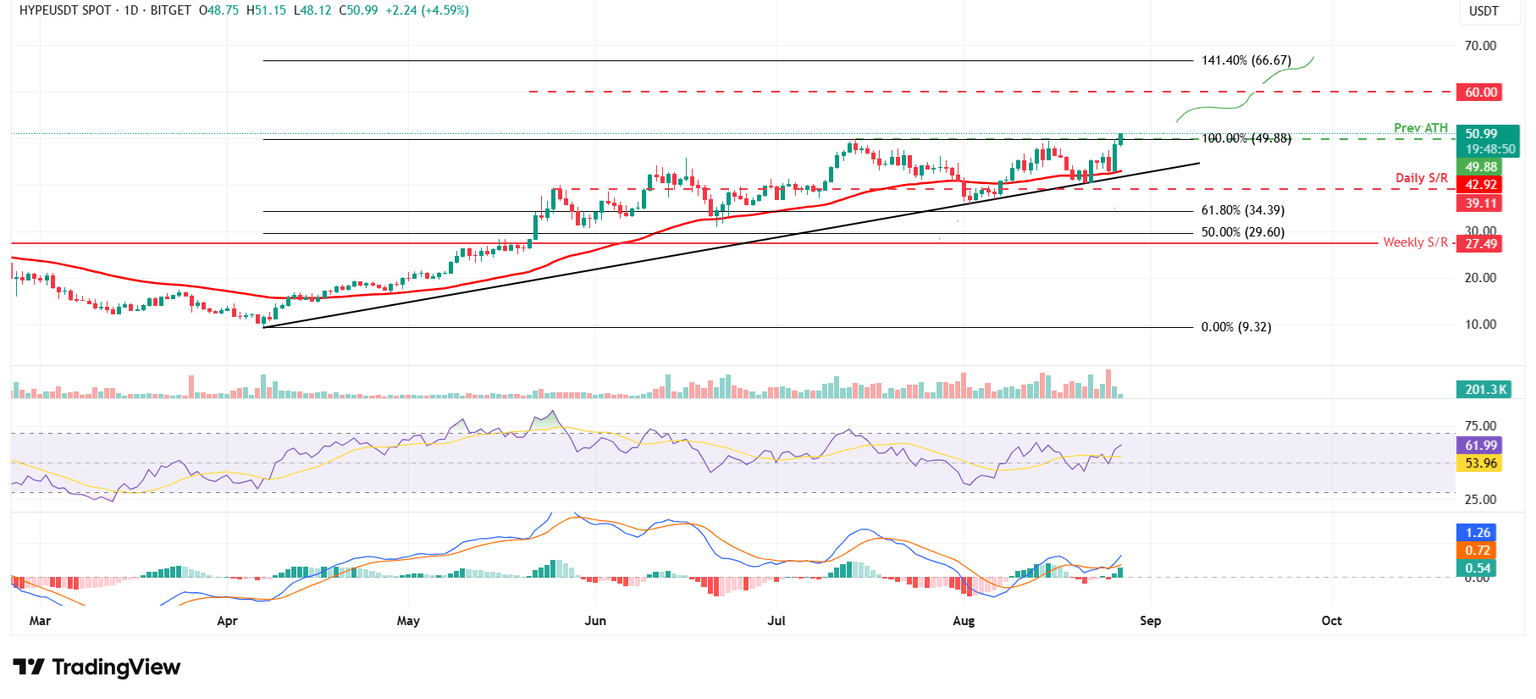

Hyperliquid price found support around the ascending trendline (drawn by connecting multiple lows since early April) on Thursday and rose 13.88% over the next three days, closing above its 50-day Exponential Moving Average (EMA) at $42.44. However, on Monday, it faced a 6.6% correction, retesting the 50-day EMA and finding support, rallying by over 13% the next day. At the time of writing on Wednesday, it continues its rally, surpassing its previous record high at $49.88.

HYPE enters a price discovery mode, and if it continues its rally, it could extend gains to test its key psychological level at $60.

The RSI on the daily chart reads 61 above its neutral level of 50, indicating bullish momentum. The MACD also showed a bullish crossover on Tuesday, further supporting the bullish thesis.

HYPE/USDT daily chart

However, if HYPE faces a correction, it could extend the decline toward its 50-day EMA at $42.92.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.