Toshi memecoin soars over 40% after Upbit listing sparks buying frenzy

- Toshi price rallies more than 40% on Wednesday following its listing on South Korea’s largest crypto exchange, Upbit.

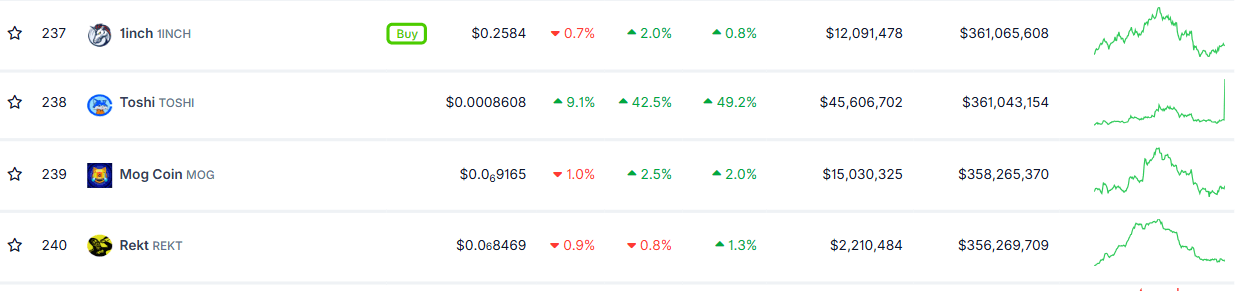

- Market capitalization jumps above $361 million, surpassing meme coins like MOG and REKT.

- The technical outlook suggests a continuation of the rally, with bulls targeting the $0.000996 mark.

Toshi (TOSHI) memecoin price surged more than 40%, trading above $0.000855 at the time of writing on Wednesday. This rally follows the confirmation of Upbit, South Korea’s largest crypto exchange, for the TOSHI listing. The rally pushed TOSHI’s market cap above $361 million, overtaking rivals like MOG and REKT, while technicals suggest further upside toward the $0.000996 target.

Why is TOSHI rallying today?

Toshi, a meme coin named after Coinbase co-founder Brian Armstrong’s cat, rallied by more than 40% on Wednesday. The main reason for this price surge was that Upbit, a crypto exchange, announced it would list TOSHI with trading pairs against KRW and USDT.

This news triggered a massive surge in TOSHI price as a centralized exchange listing typically signals increased liquidity, accessibility, and investor confidence in the token.

CoinGecko data show that Toshi’s market capitalization reached $361.04 million on Wednesday, surpassing other popular meme coins, such as Mog Coin (MOG) and Rekt (REKT), while aiming to overtake 1inch (INCH) as it secures the 238th spot in the overall crypto market capitalization table.

Toshi Price Forecast: Bulls aiming for $0.000996 mark

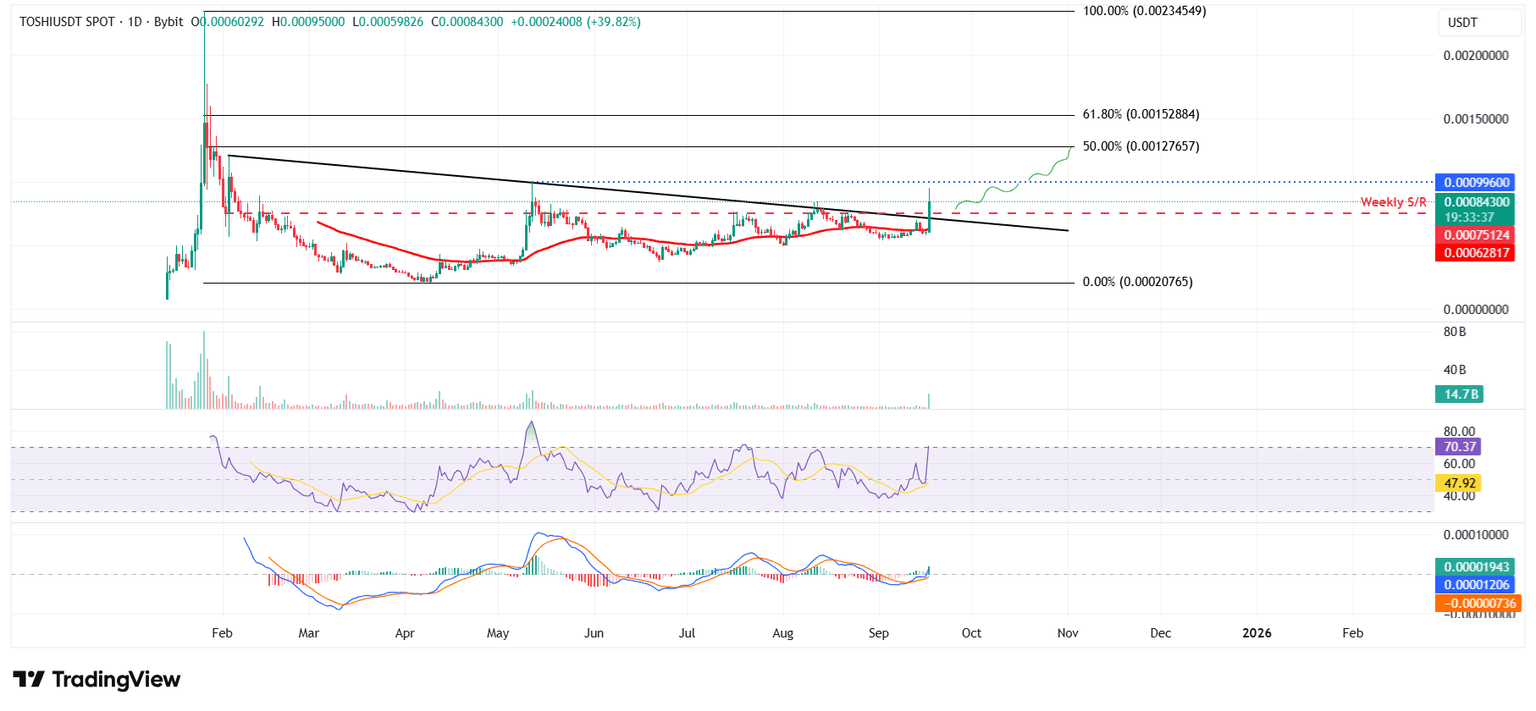

Toshi price is breaking above the descending trendline (drawn by connecting multiple highs since early February) on Wednesday and has rallied nearly 40%, trading around $0.000843.

If TOSHI continues its upward momentum, it could extend the gains toward its May 12 high of $0.000996.

The Relative Strength Index (RSI) on the daily chart reads 70, pointing upward, indicating strong bullish momentum.

TOSHI/USDT daily chart

However, if TOSHI faces a correction, it could find support around its weekly support at $0.000751.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.