How traders might position themselves if the ATOM price moves up this weekend

- Atom price has rebounded 12% since establishing the $11.39 pivot point.on January 19.

- Cosmos could rally by 25% to tag the $15 liquidity zone.

- The uptrend trade idea depends on the $11 zone remaining untagged.

Atom price continues to show strength in the market as the Bulls have risen by 12% in the last two days. Still, as the uptrend move unfolds, traders should remember to follow healthy risk management practices as the strength of the bulls could be waning.

Cosmos price shows a two-sided scenario

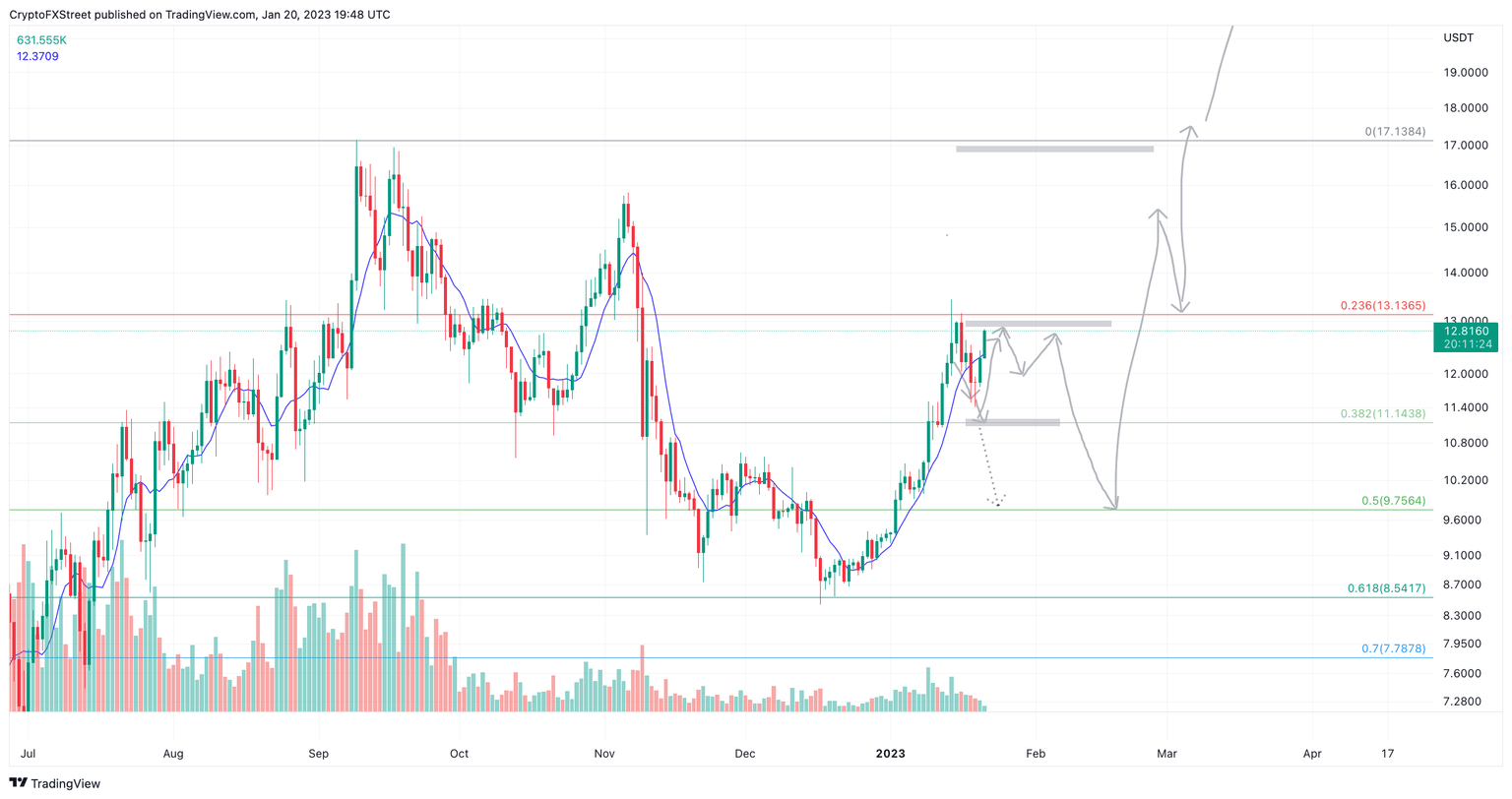

Cosmos price currently auctions at $12.75. On smaller time frames, the bulls have successfully hurdled the eight-day exponential moving average, which is an optimistic signal for the short term. However, when looking at the volume indicator, the current surge is reducing in transactions while the price ascends. This is a common signal when uptrends are near a reversal point.

According to the Binance exchange API, which tracks the volume data on the largest crypto Exchange, The 6% move witnessed on January 20 only accounts for $1.24 million dollars worth of transactions. This is more than 50% less than the strongest green day within the 40% rally, which occurred on January 9. The cosmos price rose by 9% accumulating $3.8 million dollars worth of transactions and settled 6% net positive after a brief profit-taking event occurred.

The relative strength index, an indicator used to gauge market momentum by comparing and contrasting swing points, shows the current uptrend moving directly beneath a key resistance level. Combining all of these factors, an uptrend is still possible, but traders should be careful not to get too overzealous.

ATOM USDT 1-Day Chart

The next level bullish target zone to aim for would be the November 5th swing high at $15.81. The cosmos price would rally by 25% if the bulls were successful. Invalidation of the uptrend idea would be a breach of the recent swing low established on January 19 at $11.39

On the contrary, if the trend is indeed waning, the Bears could induce a much steeper decline to test previous resistance levels as support. Key levels of Interest would be the psychological $10 boundary and the order blocks near $9.50. The bearish idea would become void if the psychological $14 zone were breached.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.