How this fakeout could trigger ApeCoin price to rally 60%

- ApeCoin price is trying to recover after a breakdown from the bull pennant formation.

- Investors can expect a 60% ascent to $12.80 if bulls make a serious comeback.

- A decisive close below $7.19 will create a lower low and invalidate the bullish thesis.

ApeCoin price is preparing for an upswing but the recent breakdown has caused many buyers to go to the sidelines. The breakdown from a bullish pattern, however, could be a tactic used by smart money to collect liquidity before an explosive ascent.

ApeCoin price ready to take off

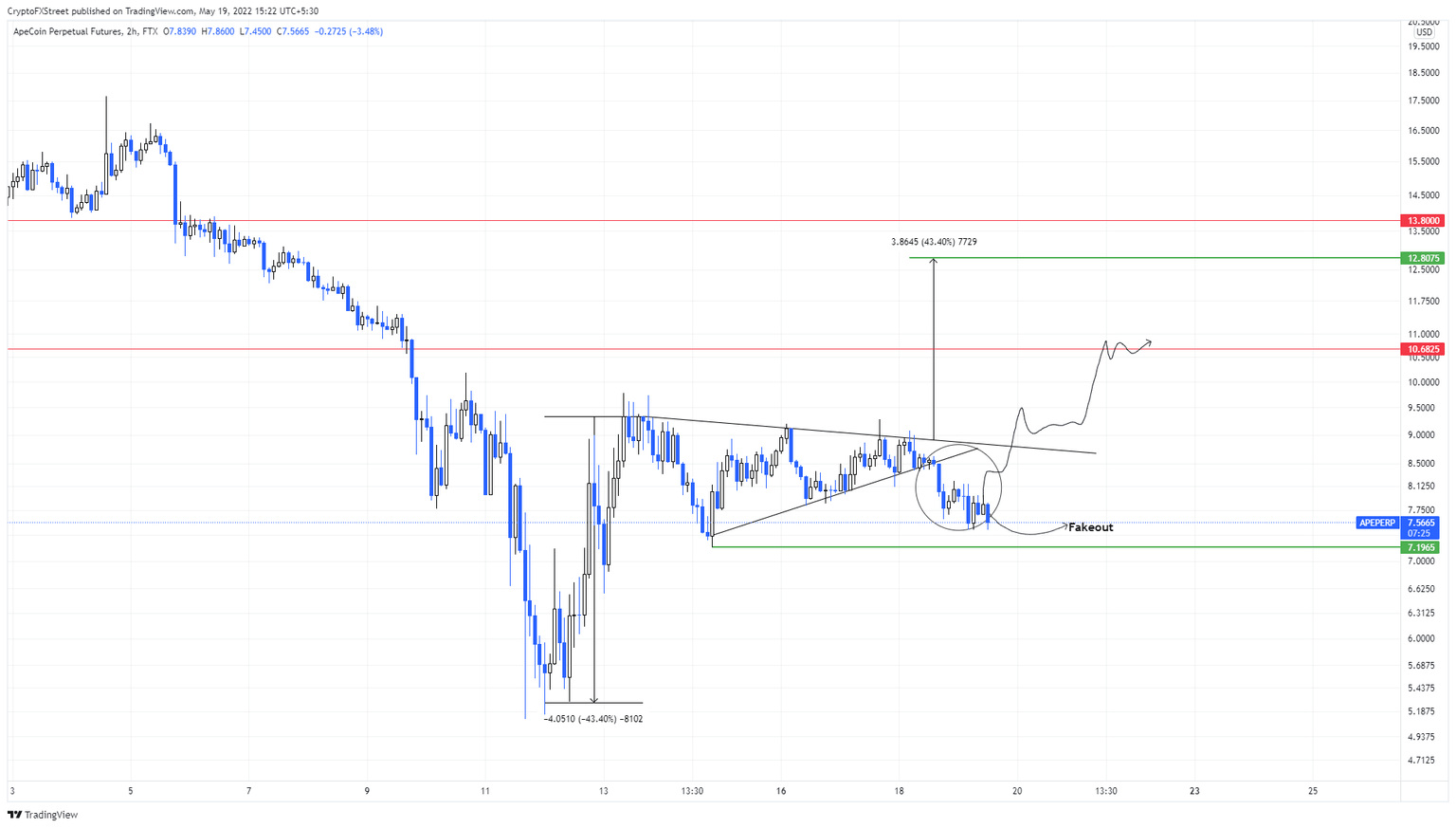

ApeCoin price is showing an optimistic outlook due to the formation of a bull pennant. The 76% surge that took place between May 12 and 13 after the LUNA-induced crash created the “flagpole.” The consolidation in the form of lower highs and higher lows that followed created the “pennant.”

This continuation pattern signals a 43% upswing to $12.80, determined by measuring the flag pole’s height and adding to the breakout point at $8.90. While the theoretical forecasts are bullish, the actual price action pushed APE to breakdown from the pennant.

Although this move technically invalidates the setup, it is a manipulation tactic by smart money done to collect the stop-losses below the swing lows. Once the liquidity is collected, ApeCoin price will reverse its trend and move higher.

For this scenario to play out, APE needs to climb above the declining trend line aka pennant’s upper trend line. Such a development will indicate that ApeCoin price is ready for a retest of the $10.68 hurdle. This rally would constitute a 35% ascent but is not where the upside is capped. If bulls manage to overcome this blockade, APE could revisit the $12.80 ceiling, bringing the total gain to 62%.

APE/USDT 2-hour chart

Regardless of the optimism, a downward breakout has invalidated the bull pennant. Additionally, a decisive move that produces a lower low below $7.19 will invalidate the bullish thesis for ApeCoin price and trigger a crash to $5.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.