ApeCoin price positioned to retest at $11.50

- ApeCoin price is struggling to maintain the gains it had over the weekend.

- APE is up against some critical resistance zones that have proven difficult to break.

- The path to higher prices is more difficult than moving lower.

ApeCoin price action, like the rest of the cryptocurrency market, is still reeling and adjusting from the massive selloff last week. However, compared to the broader altcoin market, APE’s response to last week’s crash was much more dramatic.

ApeCoin price faces an uphill battle and could slip lower

ApeCoin price has performed admirably since last week. After reaching a new 45-day low at $4.99, APE rallied over 96% to $9.81. However, APE is showing signs of exhaustion and moving lower.

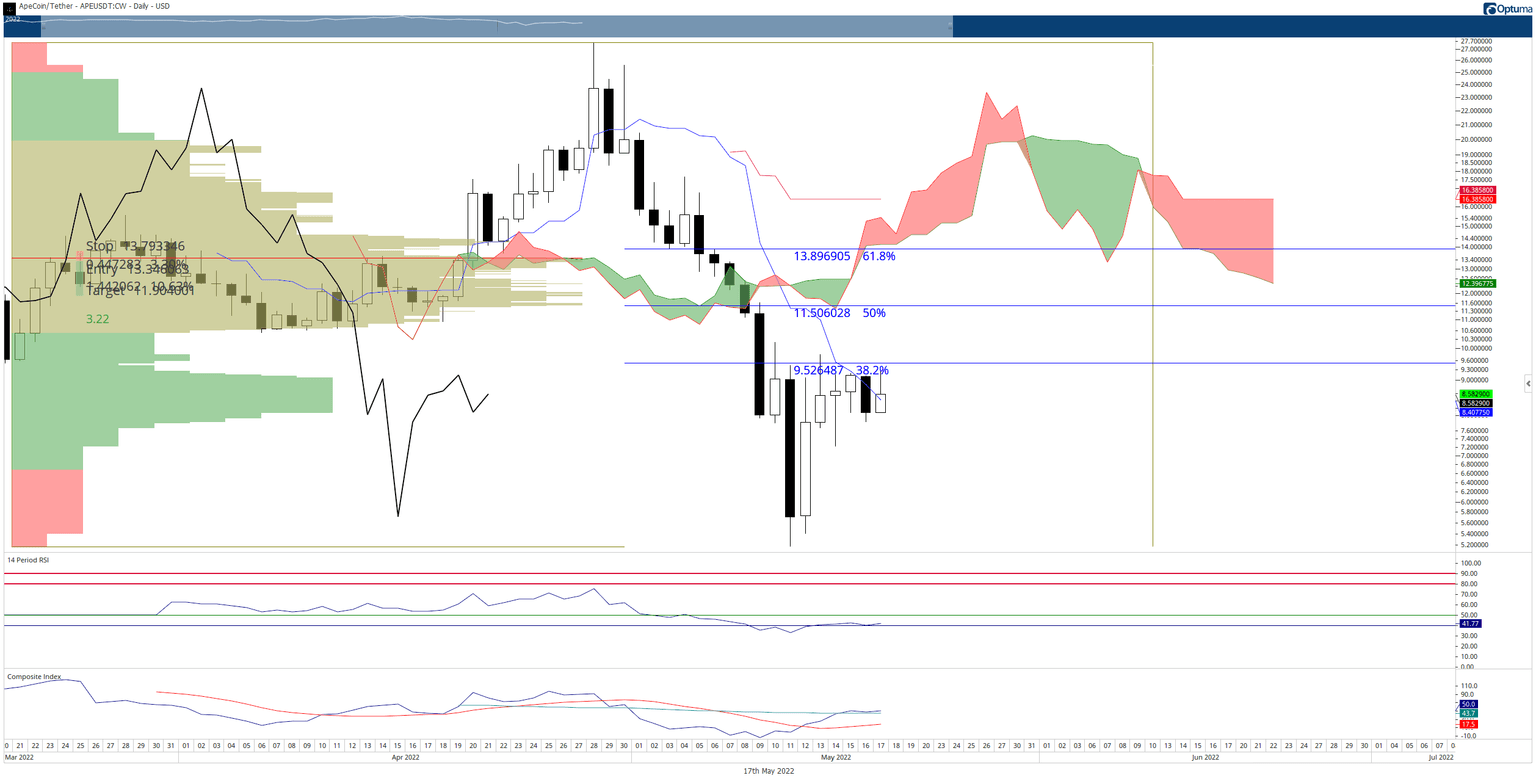

The daily Tenkan-Sen has acted as the primary resistance level for ApeCoin price. Bulls have been unable to complete a daily close above the Tenkan-Sen since April 28, 2022.

The overall daily volume continues to drop at an alarming rate. Despite Monday being a normal trading day, it could not break the volume from Sunday or Saturday. However, a high volume node in the Volume Profile has formed in the $8.15 value area, creating a strong future support or resistance level.

APE/USDT Daily Ichimoku Kinko Hyo Chart

The $7.50 price level is the lower of the new high volume node. Therefore, if there is a daily close below $7.50, then ApeCoin price has a wide-open path to the $5.50 lows.

If bulls want to prevent any near-term downside pressure, first, they’ll need to close ApeCoin price above the Tenkan-Sen at or above $8.50. If that occurs, then APE should have an easy time moving to $11.25 due to a near-total absence of traded volume in the Volume Profile between $$8.50 and $11.25.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.