Here's why Polkadot price likely to fall to $6.90

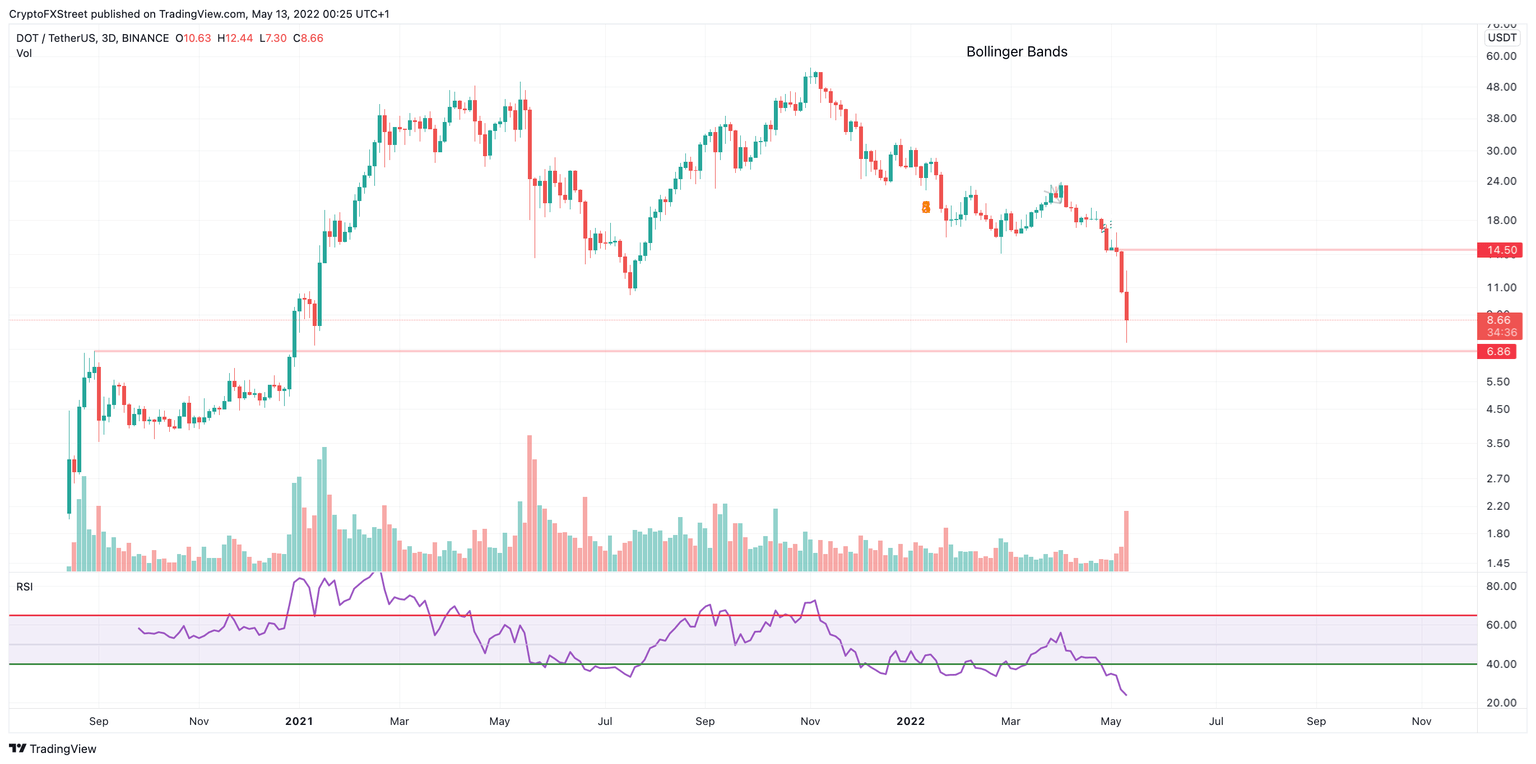

- Polkadot price printing a bearish engulfing on the 3-day chart.

- DOT price has ramping volume pattern signaling bearish control.

- Invalidation of the bearish downtrend is a breach at $14.50.

Polkadot price could continue the steep decline, and a short opportunity could present itself, but the technicals need more time to establish a clear entry.

Polkadot price is impulsively headed south.

Polkadot price, like most cryptocurrencies in the space, is under considerable bearish pressure. Today, the bears are moments away from printing a bearish engulfing candlestick on the 3-day chart. Such a bearish presence warrants the idea of additional drops. Analyzing the technicals, there could be significant liquidity at the $6.90 level for market makers to aim for next.

Polkadot price also displays bearish confluence on the volume profile indicator. The bears have established a classic ramping pattern in which professional traders claim to forecast moves in advance. Thus, an additional price drop will likely occur, but at the current time, forecasting an imminent bottom will need more chart evidence.

DOT/USDT 3-Day Chart

Invalidation of the bearish downtrend is a breach at $14.50. If the bulls can establish a price spike at this level, the entire downtrend could halt. The bulls could then reclaim the $ 16 price level resulting in a 100% increase from the current Polkadot price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.