Here's how Bitcoin options traders might prepare for a BTC ETF approval

Bloomberg analysts expect a BTC ETF approval in the next few months, and clever options traders might use this strategy to profit from the possibility.

Very few events can shake the cryptocurrency markets in a sustainable manner that really sends Bitcoin and altcoin prices into a sharp directional move. One example is when Xi Jinping, China's President, called for the development of blockchain technology throughout the country in October 2019.

The unexpected news caused a 42% pump in Bitcoin (BTC), but the movement completely faded away as investors realized China was not altering its negative stance on cryptocurrencies. As a result, only a handful of tokens focused on China's FinTech industry, blockchain tracing, and industry automation saw their prices consolidate at higher levels.

Some 'crypto news' and regulatory development have a lasting impact on investors' perceptions and willingness to interact with the crypto market. Not every one of these is positive. Take, for example, the launch of Chicago Mercantile Exchange (CME) Bitcoin futures in Dec. 2017, which experts say popped the 'bubble' and led to a nearly 3-year long bear market. Despite this outcome, a positive was institutional investors finally had a regulated instrument for betting against cryptos.

Tesla's February 2021 announcement that it had invested $1.5 billion in Bitcoin effectively changed the perception of reluctant corporate and institutional investors, and it validated the "digital gold" thesis. Even if the price spiked to a $65,000 all-time-high and retracted all the way to $29,000, it helped to establish a support level price-wise.

Believe it or not, investors have been expecting the United States Securities and Exchange Commission to approve a Bitcoin futures exchange-traded instrument since July 2013, when the Winklevoss brothers filed for their "Bitcoin Trust."

Grayscale's Bitcoin Trust (GBTC) was finally able to list it on OTC markets in March 2015, but numerous restrictions are applied to these instruments, limiting investor access.

A potentially positive price trigger is coming up

With that in mind, the effective approval of a U.S. listed ETF from the SEC will likely be one of those events that will alter Bitcoin's price forever. By expanding the field of potential buyers to the underlying asset, the event could be the trigger that drives BTC to become a multi-billion dollar asset.

Bloomberg ETF analysts Eric Balchunas and James Seyffart issued an investor note on Aug. 24 that suggested that the SEC approval could come as soon as October. Even though one could use futures contracts to leverage their long positions, they would risk being liquidated if a sudden negative price move occurs ahead of the approval.

Consequently, pro traders will likely opt for an options trading strategy like the 'Long Butterfly.'

By trading multiple call (buy) options for the same expiry date, one can achieve gains that are 3.5 times higher than the potential loss. The 'long butterfly' strategy allows a trader to profit from the upside while limiting losses.

It is important to remember that all options have a set expiry date, and as a result, the asset's price appreciation must happen during the defined period.

Using call options to limit the downside

Below are the expected returns using Bitcoin options for the October 29 expiry, but this methodology can also be applied using different time frames. While the costs will vary, the general efficiency will not be affected.

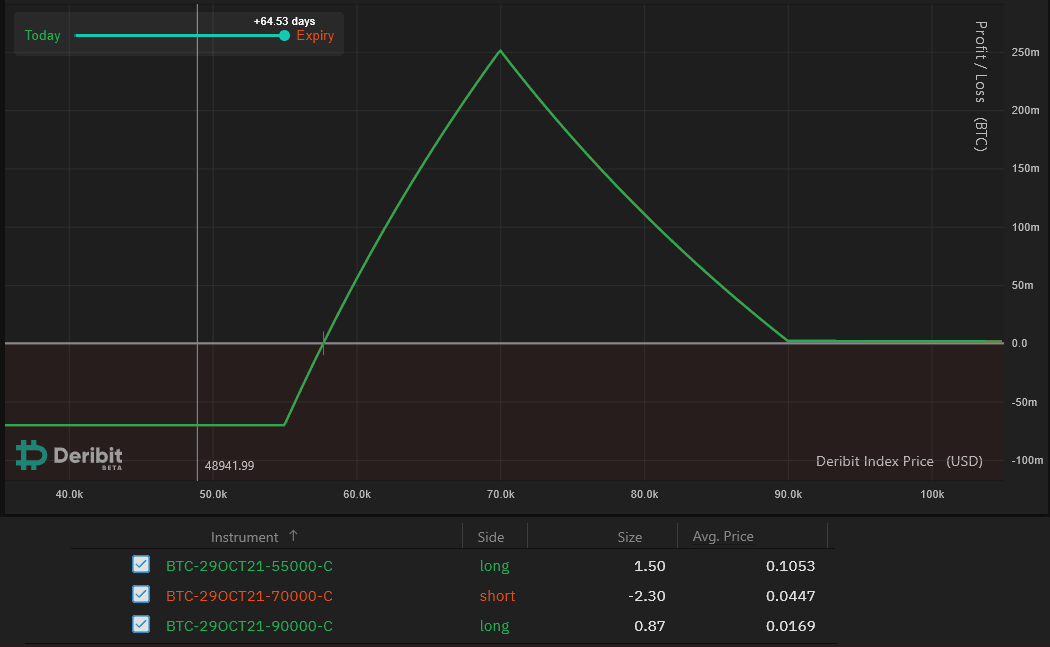

Profit / Loss estimate. Source: Deribit Position Builder

This call option gives the buyer the right to acquire an asset, but the contract seller receives (potential) negative exposure. The Long Butterfly strategy requires a short position using the $70,000 call option.

To initiate the execution, the investor buys 1.5 Bitcoin call options with a $55,000 strike while simultaneously selling 2.3 contracts of the $70,000 call. To finalize the trade, one should buy 0.87 BTC contracts of the $90,000 call options to avoid losses above such a level.

Derivatives exchanges price contracts in Bitcoin terms, and $48,942 was the price when this strategy was quoted.

The trade ensures limited downside with a possi 0.25 BTC gain

In this situation, any outcome between $57,600 (up 17.7%) and $90,000 (up 83.9%) yields a net profit. For example, a 30% price increase to $63,700 results in a 0.135 BTC gain.

Meanwhile, the maximum loss is 0.07 BTC if the price is below $55,000 on October 29. Thus, the 'long butterfly' appeal is a potential gain of 3.5 times larger than the maximum loss.

Overall, the trade yields a better risk-to-reward outcome than leveraged futures trading, especially when considering the limited downside. It certainly looks like an attractive bet for those expecting the ETF approval sometime over the next couple of months. The only upfront fee required is 0.07 Bitcoin, which is enough to cover the maximum loss.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.