Grayscale fund drops ADA and ATOM after quarterly rebalancing

Grayscale has removed Cardano’s (ADA $0.57) token from its Grayscale Digital Large Cap Fund (GDLC) and Cosmos’ (ATOM $10.74) token from its Grayscale Smart Contract Platform Ex-Ethereum Fund (GSCPxE).

The removal of the tokens was part of Grayscale’s quarterly fund rebalancing, the world’s largest crypto-focused asset manager announced in an April 4 X post. The proceeds generated from selling the tokens were used to buy existing fund components.

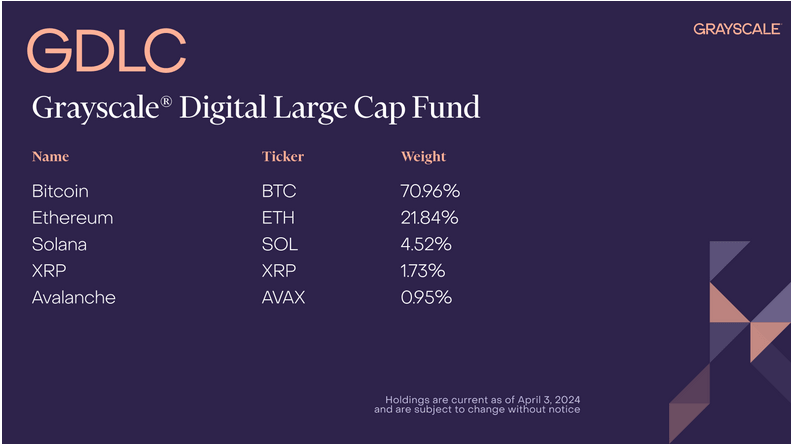

Grayscale Digital Large Cap Fund. Source: Grayscale

Following the removal of the ADA token, Grayscale’s large-cap fund now consists of 70.96% Bitcoin (BTC $66,714), 21.84% Ether (ETH $3,243), 4.52% Solana (SOL $171), 1.73% XRP (XRP $0.57) and 0.95% Avalanche (AVAX $44.43).

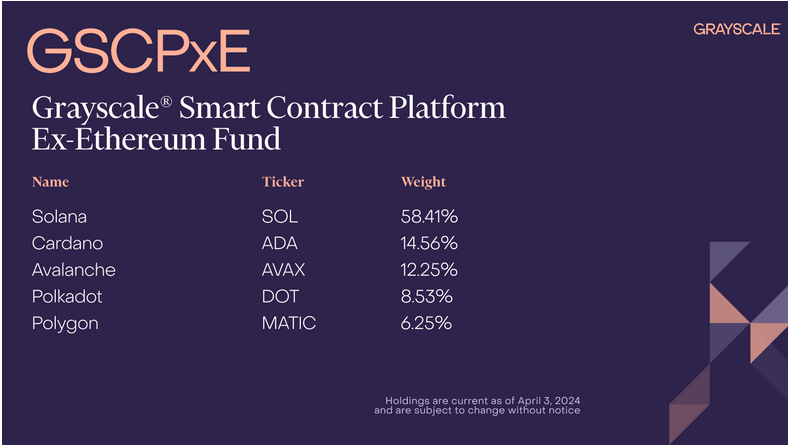

Grayscale Smart Contract Platform Ex-Ethereum Fund. Source: Grayscale

As for Grayscale’s smart contract platform fund, it now holds 58.41% Solana, 14.56% Cardano, 12.25% Avalanche, 8.53% Polkadot (DOT $8.16) and 6.25% Polygon (MATIC $0.8676) tokens, after removing ATOM from the fund.

No new assets have been added or removed from Grayscale’s DeFi Fund, which currently holds 48.74% Uniswap (UNI $10.56), 20.41% Maker (MKR $3,775), 13.17% Lido (LDO $2.39), 9.99% Aave (AAVE $110.55) and 7.69% Synthetix (SNX $3.88) tokens.

Grayscale is the world’s largest crypto-focused asset manager. At the end of March, it announced a crypto investment fund prioritizing cryptocurrencies with staking rewards.

The new Grayscale Dynamic Income Fund is only available to clients with more than $1.1 million assets under management or a net worth of more than $2.2 million.

ADA and ATOM deliver negative returns year-to-date

Cardano’s ADA token fell 8.1% year-to-date (YTD) while ATOM fell over 3.3%, significantly underperforming both Bitcoin — the world’s first cryptocurrency — and Ether.

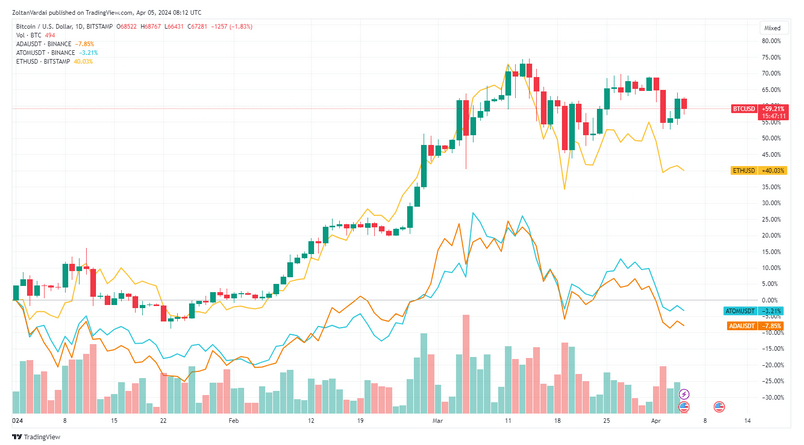

BTC, ADA, ATOM, YTD chart. Source: TradingView

In comparison, Bitcoin is up 59% since the beginning of the year, while Ether has rallied over 40%, TradingView data shows.

ADA is down over 10% on the weekly chart, after falling below the $0.6 psychological mark on April 2, and is currently 81% away from its previous all-time high of $3.10 reached in September 2021.

ATOM is also down over 10% during the past week, trading at the $10.8 mark, 75% away from its record $44.7 reached in September 2021.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.